Please answer all questions.

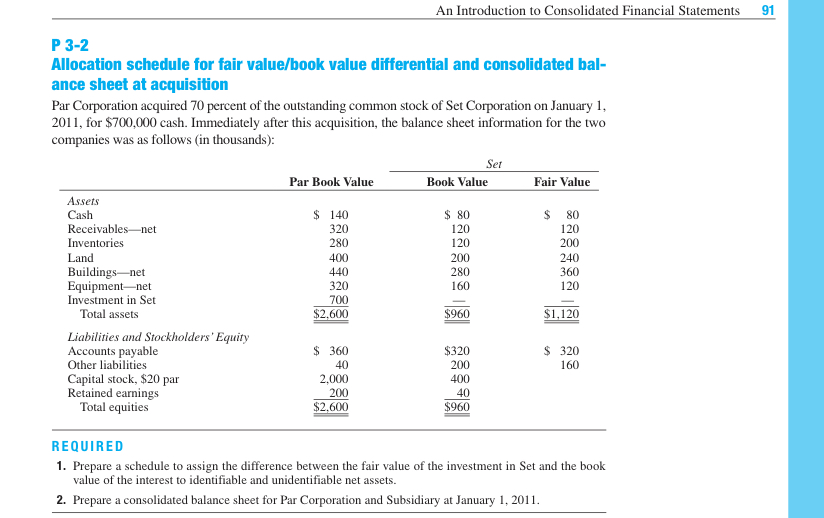

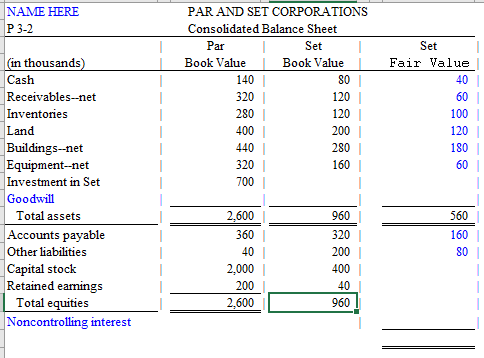

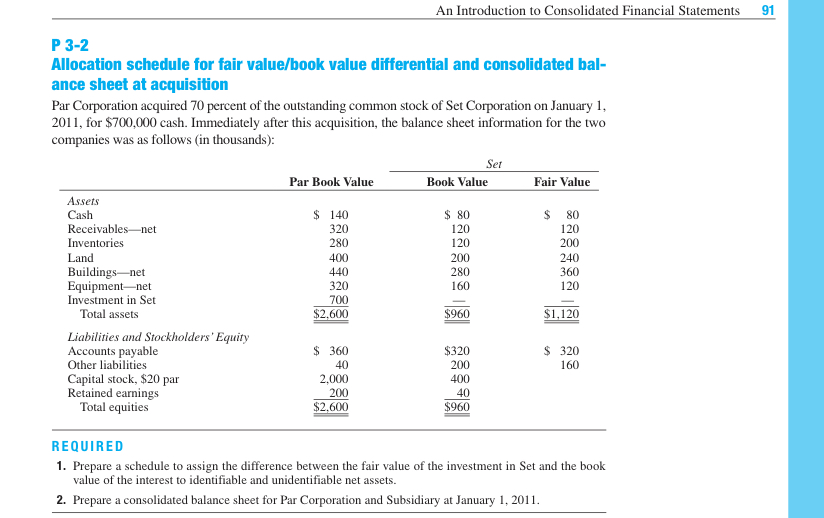

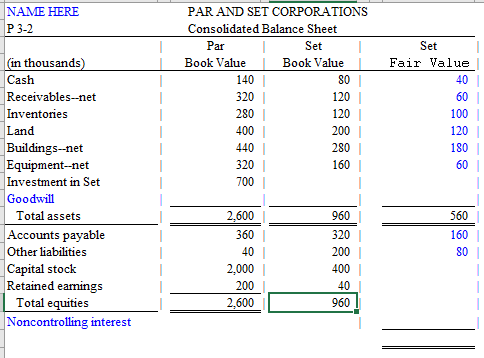

91 An Introduction to Consolidated Financial Statements P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the two companies was as follows (in thousands): Ser Par Book Value Book Value Fair Value Assets Cash $ 140 $ 80 $ 80 Receivables-net 320 120 120 Inventories 280 120 200 Land 400 200 240 Buildings-net 440 280 360 Equipment-net 320 160 120 Investment in Set 700 Total assets $2.600 $960 Liabilities and Stockholders' Equity Accounts payable $ 360 $320 $ 320 Other liabilities 40 200 160 Capital stock, $20 par 2,000 400 Retained earnings 200 40 Total equities $2,600 $960 $1,120 REQUIRED 1. Prepare a schedule to assign the difference between the fair value of the investment in Set and the book value of the interest to identifiable and unidentifiable net assets. 2. Prepare a consolidated balance sheet for Par Corporation and Subsidiary at January 1, 2011. NAME HERE P 3-2 PAR AND SET CORPORATIONS Consolidated Balance Sheet Par Set Book Value Book Value 140 80 320 120 Set Fair Value 40 60 100 120 180 60 280 400 440 120 200 280 160 320 700 (in thousands) Cash Receivables--net Inventories Land Buildings--net Equipment--net Investment in Set Goodwill Total assets Accounts payable Other liabilities Capital stock Retained earings Total equities Noncontrolling interest 960 320 560 160 80 2,600 360 40 2,000 200 2,600 200 400 40 960 91 An Introduction to Consolidated Financial Statements P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the two companies was as follows (in thousands): Ser Par Book Value Book Value Fair Value Assets Cash $ 140 $ 80 $ 80 Receivables-net 320 120 120 Inventories 280 120 200 Land 400 200 240 Buildings-net 440 280 360 Equipment-net 320 160 120 Investment in Set 700 Total assets $2.600 $960 Liabilities and Stockholders' Equity Accounts payable $ 360 $320 $ 320 Other liabilities 40 200 160 Capital stock, $20 par 2,000 400 Retained earnings 200 40 Total equities $2,600 $960 $1,120 REQUIRED 1. Prepare a schedule to assign the difference between the fair value of the investment in Set and the book value of the interest to identifiable and unidentifiable net assets. 2. Prepare a consolidated balance sheet for Par Corporation and Subsidiary at January 1, 2011. NAME HERE P 3-2 PAR AND SET CORPORATIONS Consolidated Balance Sheet Par Set Book Value Book Value 140 80 320 120 Set Fair Value 40 60 100 120 180 60 280 400 440 120 200 280 160 320 700 (in thousands) Cash Receivables--net Inventories Land Buildings--net Equipment--net Investment in Set Goodwill Total assets Accounts payable Other liabilities Capital stock Retained earings Total equities Noncontrolling interest 960 320 560 160 80 2,600 360 40 2,000 200 2,600 200 400 40 960