please answer all questions

All answers rounded to the nearest $10

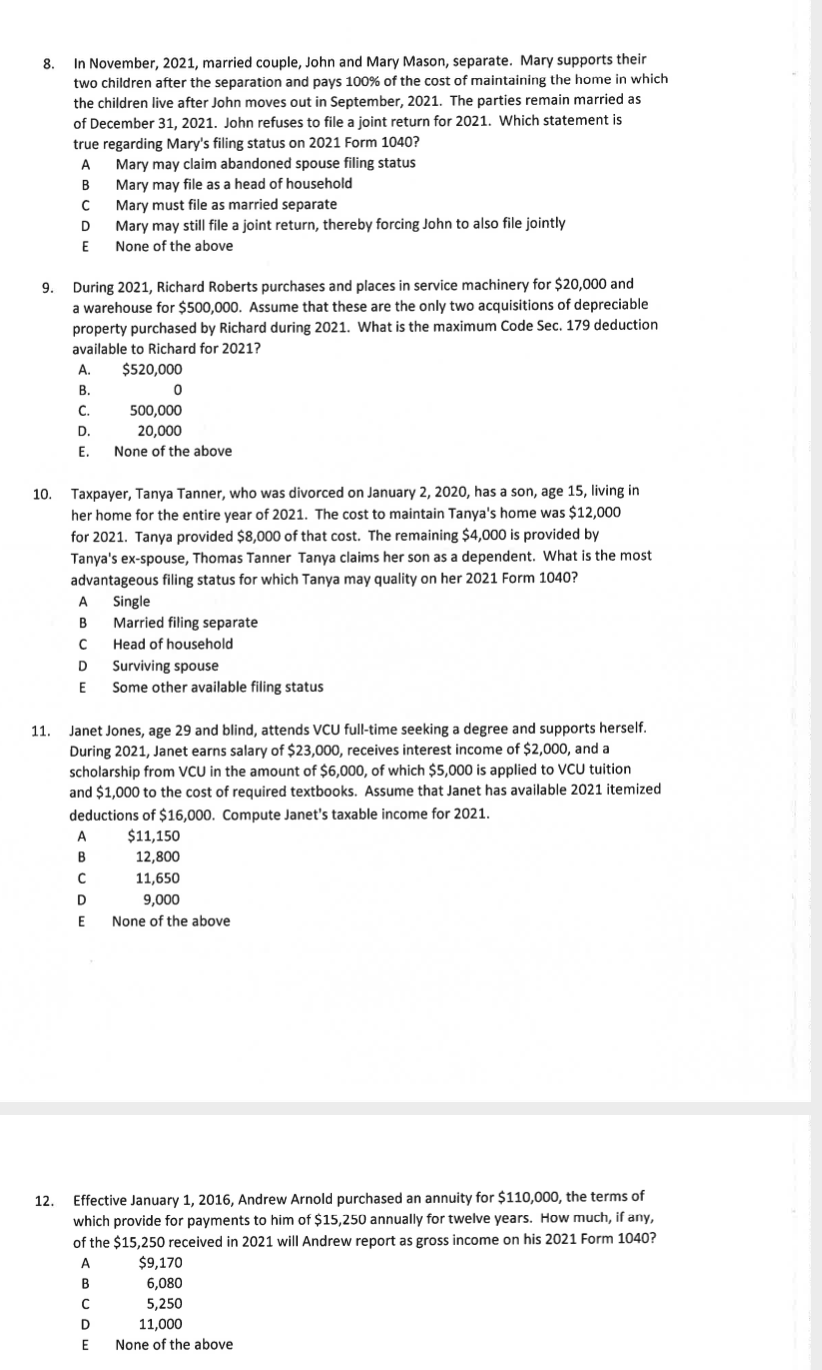

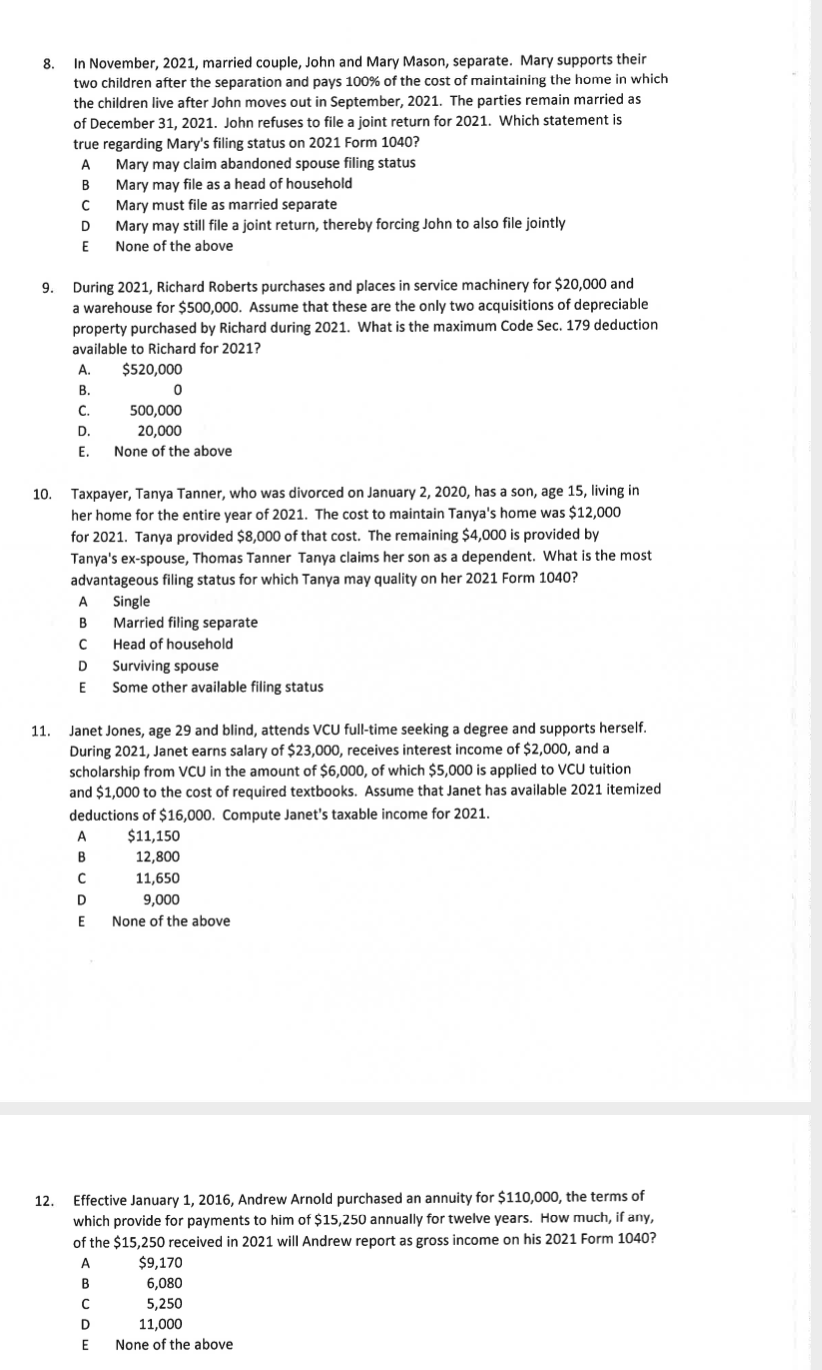

8. In November, 2021, married couple, John and Mary Mason, separate. Mary supports their two children after the separation and pays 100% of the cost of maintaining the home in which the children live after John moves out in September, 2021. The parties remain married as of December 31, 2021. John refuses to file a joint return for 2021. Which statement is true regarding Mary's filing status on 2021 Form 1040? A A Mary may claim abandoned spouse filing status B Mary may file as a head of household Mary must file as married separate D Mary may still file a joint return, thereby forcing John to also file jointly E None of the above 9. During 2021, Richard Roberts purchases and places in service machinery for $20,000 and a warehouse for $500,000. Assume that these are the only two acquisitions of depreciable property purchased by Richard during 2021. What is the maximum Code Sec. 179 deduction available to Richard for 2021? A. $520,000 B. 0 C. 500,000 D. 20,000 E. None of the above 10. Taxpayer, Tanya Tanner, who was divorced on January 2, 2020, has a son, age 15, living in her home for the entire year of 2021. The cost to maintain Tanya's home was $12,000 for 2021. Tanya provided $8,000 of that cost. The remaining $4,000 is provided by Tanya's ex-spouse, Thomas Tanner Tanya claims her son as a dependent. What is the most advantageous filing status for which Tanya may quality on her 2021 Form 1040? A Single B Married filing separate Head of household D Surviving spouse E Some other available filing status 11. Janet Jones, age 29 and blind, attends VCU full-time seeking a degree and supports herself. , . During 2021, Janet earns salary of $23,000, receives interest income of $2,000, and a scholarship from VCU in the amount of $6,000, of which $5,000 is applied to VCU tuition and $1,000 to the cost of required textbooks. Assume that Janet has available 2021 itemized deductions of $16,000. Compute Janet's taxable income for 2021. A $11,150 B 12,800 11,650 D 9,000 E None of the above 12. . Effective January 1, 2016, Andrew Arnold purchased an annuity for $110,000, the terms of which provide for payments to him of $15,250 annually for twelve years. How much, if any, . , of the $15,250 received in 2021 will Andrew report as gross income on his 2021 Form 1040? A $9,170 B 6,080 5,250 D 11,000 E E None of the above 8. In November, 2021, married couple, John and Mary Mason, separate. Mary supports their two children after the separation and pays 100% of the cost of maintaining the home in which the children live after John moves out in September, 2021. The parties remain married as of December 31, 2021. John refuses to file a joint return for 2021. Which statement is true regarding Mary's filing status on 2021 Form 1040? A A Mary may claim abandoned spouse filing status B Mary may file as a head of household Mary must file as married separate D Mary may still file a joint return, thereby forcing John to also file jointly E None of the above 9. During 2021, Richard Roberts purchases and places in service machinery for $20,000 and a warehouse for $500,000. Assume that these are the only two acquisitions of depreciable property purchased by Richard during 2021. What is the maximum Code Sec. 179 deduction available to Richard for 2021? A. $520,000 B. 0 C. 500,000 D. 20,000 E. None of the above 10. Taxpayer, Tanya Tanner, who was divorced on January 2, 2020, has a son, age 15, living in her home for the entire year of 2021. The cost to maintain Tanya's home was $12,000 for 2021. Tanya provided $8,000 of that cost. The remaining $4,000 is provided by Tanya's ex-spouse, Thomas Tanner Tanya claims her son as a dependent. What is the most advantageous filing status for which Tanya may quality on her 2021 Form 1040? A Single B Married filing separate Head of household D Surviving spouse E Some other available filing status 11. Janet Jones, age 29 and blind, attends VCU full-time seeking a degree and supports herself. , . During 2021, Janet earns salary of $23,000, receives interest income of $2,000, and a scholarship from VCU in the amount of $6,000, of which $5,000 is applied to VCU tuition and $1,000 to the cost of required textbooks. Assume that Janet has available 2021 itemized deductions of $16,000. Compute Janet's taxable income for 2021. A $11,150 B 12,800 11,650 D 9,000 E None of the above 12. . Effective January 1, 2016, Andrew Arnold purchased an annuity for $110,000, the terms of which provide for payments to him of $15,250 annually for twelve years. How much, if any, . , of the $15,250 received in 2021 will Andrew report as gross income on his 2021 Form 1040? A $9,170 B 6,080 5,250 D 11,000 E E None of the above