Answered step by step

Verified Expert Solution

Question

1 Approved Answer

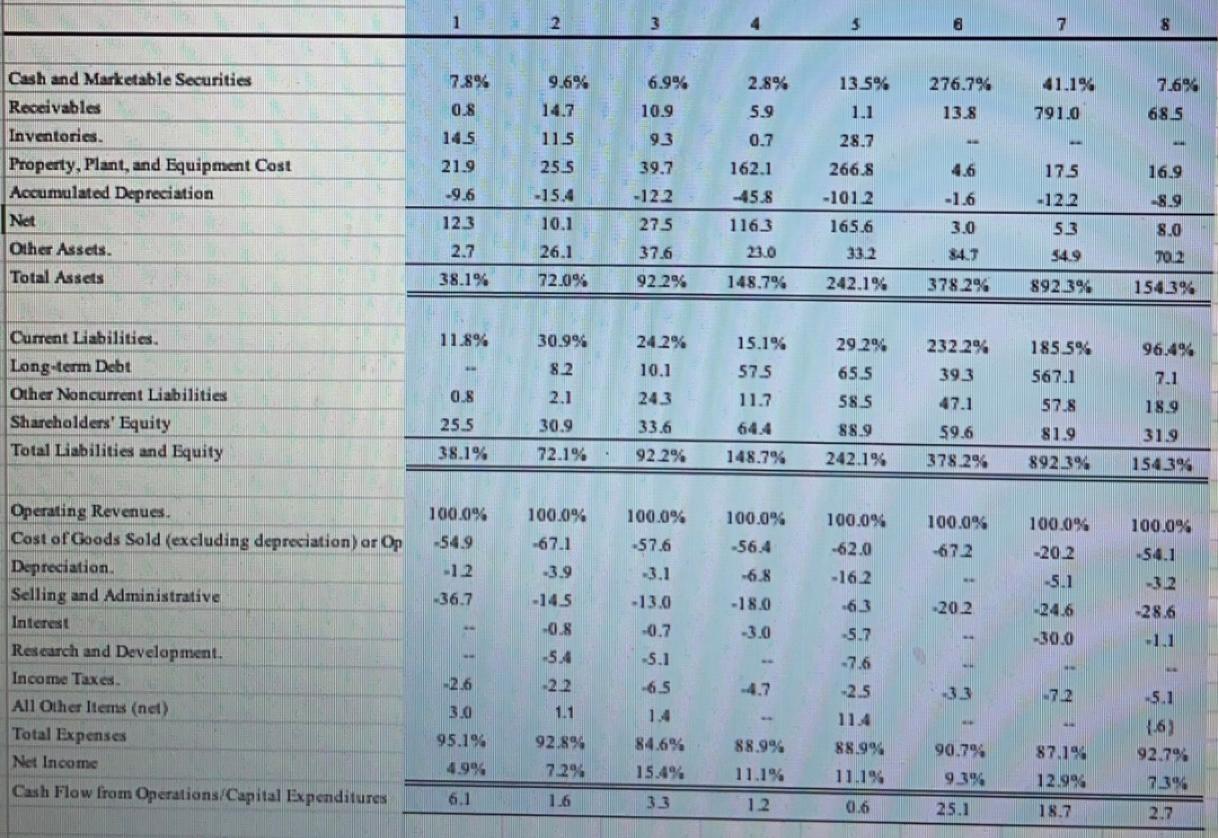

Please answer all questions Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums collected or due from

Please answer all questions

- Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums collected or due from customers and revenues earned from investments made with cash received from customers prior to the time that Allstate pays customers' claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year.

- Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources many of its computer components.

- Household International: Lends money to consumers for periods ranging from several months to several years. Operating expenses represent estimated uncollectible loans.

- Lands' End: Sells apparel through catalogs, primarily through third-party credit cards.

- McDonald's: Operates fast food restaurants worldwide. A large percentage of McDonald's' restaurants are owned and operated by franchisees. McDonald's frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases.

- Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products (primarily ethical drugs) to improve human and animal health, directly and through its joint ventures.

- Newmont Mining: Mines for gold and other minerals. Research and development expense includes exploration costs for Newmont.

- Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Purchases advertising time and space from various media and sells it to clients. Operating revenues represent the commission or fee earned by Omnicom for advertising copy created and media time and space sold. Operating expenses include compensation paid to employees. Omnicom acquired a large number of marketing services firms in recent years.

| Question 1 Company 1 is

|

| Question 2 Company 2 is

|

| Question 3 Company 3 is

|

| Question 4 Company 4 is

|

| Question 5 Company 5 is

|

| Question 6 Company 6 is

|

| Question 7 Company 7 is

|

| Question 8 Give seven reasons for your selections. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started