Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL QUESTIONS AND EXPLAIN. WILL LIKE. THANK YOU - A company expects to produce earnings per share of $5.00 at the end of

PLEASE ANSWER ALL QUESTIONS AND EXPLAIN. WILL LIKE. THANK YOU

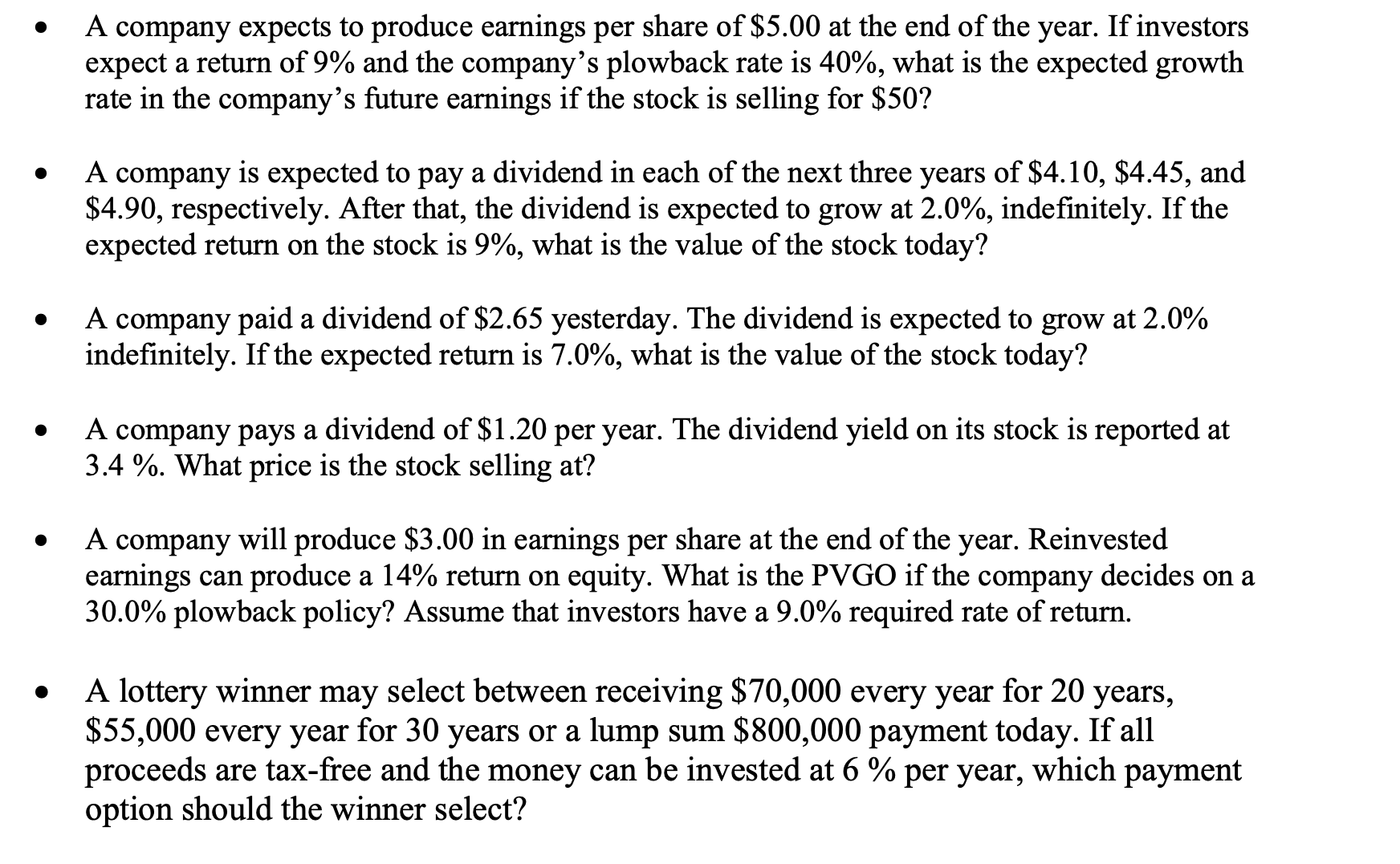

- A company expects to produce earnings per share of $5.00 at the end of the year. If investors expect a return of 9% and the company's plowback rate is 40%, what is the expected growth rate in the company's future earnings if the stock is selling for $50 ? - A company is expected to pay a dividend in each of the next three years of $4.10,$4.45, and $4.90, respectively. After that, the dividend is expected to grow at 2.0%, indefinitely. If the expected return on the stock is 9%, what is the value of the stock today? - A company paid a dividend of $2.65 yesterday. The dividend is expected to grow at 2.0% indefinitely. If the expected return is 7.0%, what is the value of the stock today? - A company pays a dividend of $1.20 per year. The dividend yield on its stock is reported at 3.4%. What price is the stock selling at? - A company will produce $3.00 in earnings per share at the end of the year. Reinvested earnings can produce a 14% return on equity. What is the PVGO if the company decides on a 30.0% plowback policy? Assume that investors have a 9.0% required rate of return. - A lottery winner may select between receiving $70,000 every year for 20 years, $55,000 every year for 30 years or a lump sum $800,000 payment today. If all proceeds are tax-free and the money can be invested at 6% per year, which payment option should the winner selectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started