Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all Questions and provide working out The following losses are ranked from highest to lowest for 500 scenarios. What is the 99% expected

Please answer all Questions and provide working out

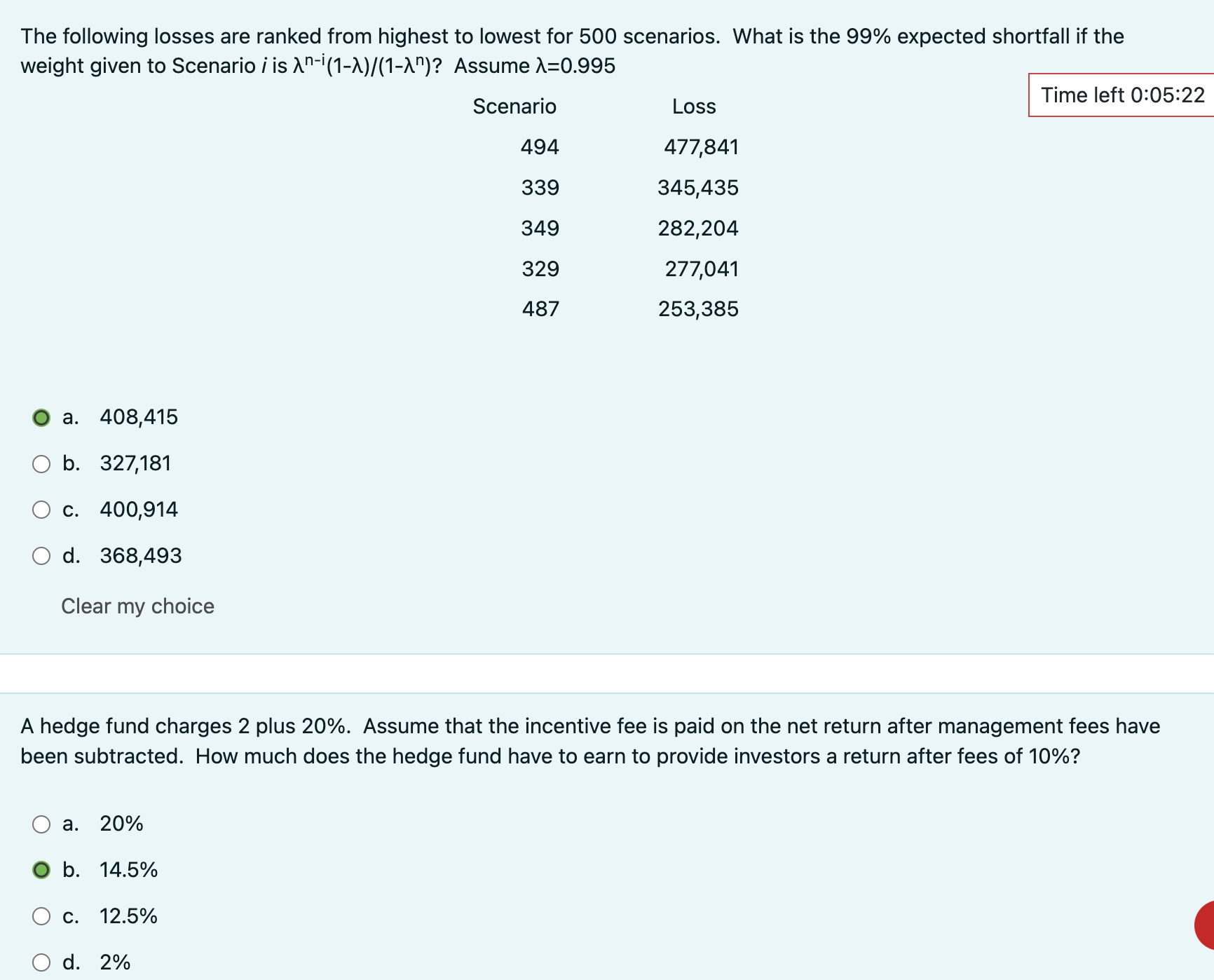

The following losses are ranked from highest to lowest for 500 scenarios. What is the 99% expected shortfall if the weight given to Scenario i is ni(1)/(1n) ? Assume =0.995 a. 408,415 b. 327,181 C. 400,914 d. 368,493 Clear my choice A hedge fund charges 2 plus 20%. Assume that the incentive fee is paid on the net return after management fees have been subtracted. How much does the hedge fund have to earn to provide investors a return after fees of 10% ? a. 20% b. 14.5% c. 12.5% d. 2%

The following losses are ranked from highest to lowest for 500 scenarios. What is the 99% expected shortfall if the weight given to Scenario i is ni(1)/(1n) ? Assume =0.995 a. 408,415 b. 327,181 C. 400,914 d. 368,493 Clear my choice A hedge fund charges 2 plus 20%. Assume that the incentive fee is paid on the net return after management fees have been subtracted. How much does the hedge fund have to earn to provide investors a return after fees of 10% ? a. 20% b. 14.5% c. 12.5% d. 2% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started