Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions and show all accurate calculations.You're only providing solutions per the spreadsheets below. Ques 1: Ques 2: All information provided. PROBLEMS P

Please answer all questions and show all accurate calculations.You're only providing solutions per the spreadsheets below.

Ques 1:

Ques 2:

All information provided.

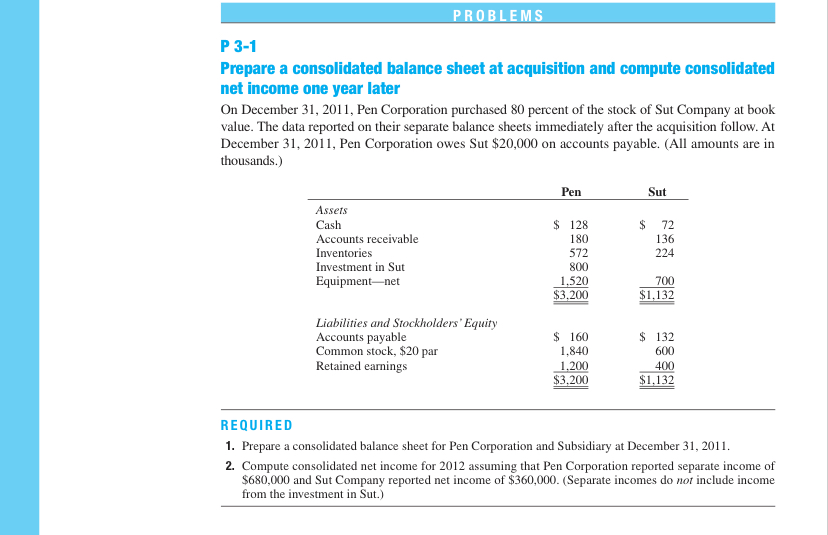

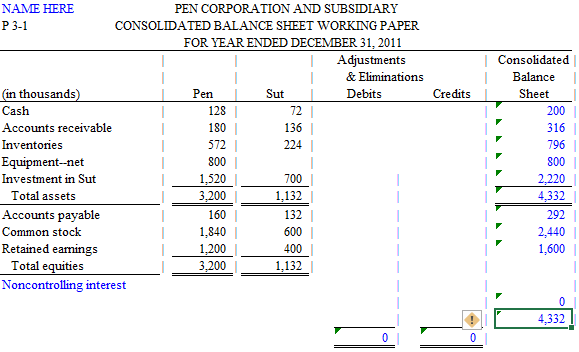

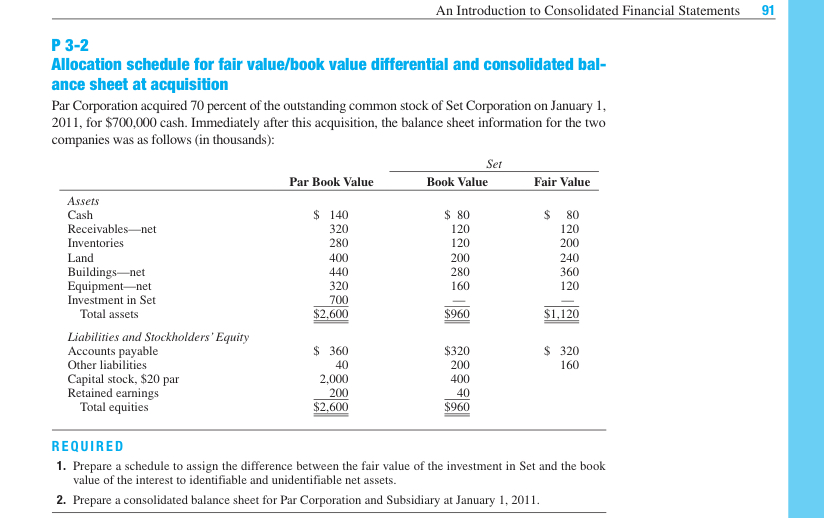

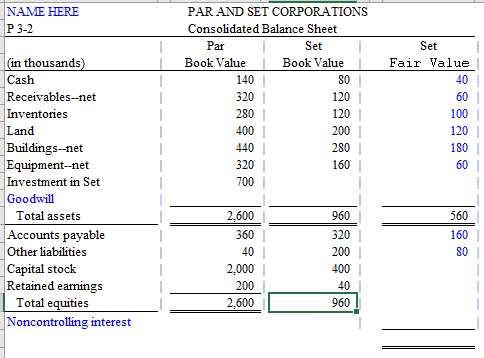

PROBLEMS P 3-1 Prepare a consolidated balance sheet at acquisition and compute consolidated net income one year later On December 31, 2011, Pen Corporation purchased 80 percent of the stock of Sut Company at book value. The data reported on their separate balance sheets immediately after the acquisition follow. At December 31, 2011, Pen Corporation owes Sut $20,000 on accounts payable. (All amounts are in thousands.) Pen Sut $ Assets Cash Accounts receivable Inventories Investment in Sut Equipment-net 72 136 224 $ 128 180 572 800 1.520 $3,200 700 $1.132 Liabilities and Stockholders' Equity Accounts payable Common stock, $20 par Retained earnings $ 160 1.840 1.200 $3.200 $ 132 600 400 $1.132 REQUIRED 1. Prepare a consolidated balance sheet for Pen Corporation and Subsidiary at December 31, 2011. 2. Compute consolidated net income for 2012 assuming that Pen Corporation reported separate income of $680,000 and Sut Company reported net income of $360,000. (Separate incomes do not include income from the investment in Sut.) I NAME HERE PEN CORPORATION AND SUBSIDIARY P 3-1 CONSOLIDATED BALANCE SHEET WORKING PAPER FOR YEAR ENDED DECEMBER 31, 2011 Adjustments & Eliminations (in thousands) Pen Sut Debits Credits Cash 128 72 Accounts receivable 180 136 Inventories Equipment--net 800 Investment in Sut 1,520 700 Total assets 3.200 1,132 Accounts payable 160 132 Common stock 1,840 60 Retained earings 1,200 400 Total equities 3,200 1,132 Noncontrolling interest 572 224 Consolidated Balance Sheet 200 316 796 800 2.220 4,332 292 2,440 1,600 0 4.332 91 An Introduction to Consolidated Financial Statements P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the two companies was as follows (in thousands): Ser Par Book Value Book Value Fair Value Assets Cash $ 140 $ 80 $ 80 Receivables-net 320 120 120 Inventories 280 120 200 Land 400 200 240 Buildings-net 440 280 360 Equipment-net 320 160 120 Investment in Set 700 Total assets $2.600 $960 Liabilities and Stockholders' Equity Accounts payable $ 360 $320 $ 320 Other liabilities 40 200 160 Capital stock, $20 par 2,000 400 Retained earnings 200 40 Total equities $2,600 $960 $1,120 REQUIRED 1. Prepare a schedule to assign the difference between the fair value of the investment in Set and the book value of the interest to identifiable and unidentifiable net assets. 2. Prepare a consolidated balance sheet for Par Corporation and Subsidiary at January 1, 2011. NAME HERE P 3-2 PAR AND SET CORPORATIONS Consolidated Balance Sheet Par Set Book Value Book Value 140 80 320 120 Set Fair Value 40 60 100 120 180 60 280 400 440 120 200 280 160 320 700 (in thousands) Cash Receivables--net Inventories Land Buildings--net Equipment--net Investment in Set Goodwill Total assets Accounts payable Other liabilities Capital stock Retained earings Total equities Noncontrolling interest 960 320 560 160 80 2,600 360 40 2,000 200 2,600 200 400 40 960 PROBLEMS P 3-1 Prepare a consolidated balance sheet at acquisition and compute consolidated net income one year later On December 31, 2011, Pen Corporation purchased 80 percent of the stock of Sut Company at book value. The data reported on their separate balance sheets immediately after the acquisition follow. At December 31, 2011, Pen Corporation owes Sut $20,000 on accounts payable. (All amounts are in thousands.) Pen Sut $ Assets Cash Accounts receivable Inventories Investment in Sut Equipment-net 72 136 224 $ 128 180 572 800 1.520 $3,200 700 $1.132 Liabilities and Stockholders' Equity Accounts payable Common stock, $20 par Retained earnings $ 160 1.840 1.200 $3.200 $ 132 600 400 $1.132 REQUIRED 1. Prepare a consolidated balance sheet for Pen Corporation and Subsidiary at December 31, 2011. 2. Compute consolidated net income for 2012 assuming that Pen Corporation reported separate income of $680,000 and Sut Company reported net income of $360,000. (Separate incomes do not include income from the investment in Sut.) I NAME HERE PEN CORPORATION AND SUBSIDIARY P 3-1 CONSOLIDATED BALANCE SHEET WORKING PAPER FOR YEAR ENDED DECEMBER 31, 2011 Adjustments & Eliminations (in thousands) Pen Sut Debits Credits Cash 128 72 Accounts receivable 180 136 Inventories Equipment--net 800 Investment in Sut 1,520 700 Total assets 3.200 1,132 Accounts payable 160 132 Common stock 1,840 60 Retained earings 1,200 400 Total equities 3,200 1,132 Noncontrolling interest 572 224 Consolidated Balance Sheet 200 316 796 800 2.220 4,332 292 2,440 1,600 0 4.332 91 An Introduction to Consolidated Financial Statements P 3-2 Allocation schedule for fair value/book value differential and consolidated bal- ance sheet at acquisition Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the two companies was as follows (in thousands): Ser Par Book Value Book Value Fair Value Assets Cash $ 140 $ 80 $ 80 Receivables-net 320 120 120 Inventories 280 120 200 Land 400 200 240 Buildings-net 440 280 360 Equipment-net 320 160 120 Investment in Set 700 Total assets $2.600 $960 Liabilities and Stockholders' Equity Accounts payable $ 360 $320 $ 320 Other liabilities 40 200 160 Capital stock, $20 par 2,000 400 Retained earnings 200 40 Total equities $2,600 $960 $1,120 REQUIRED 1. Prepare a schedule to assign the difference between the fair value of the investment in Set and the book value of the interest to identifiable and unidentifiable net assets. 2. Prepare a consolidated balance sheet for Par Corporation and Subsidiary at January 1, 2011. NAME HERE P 3-2 PAR AND SET CORPORATIONS Consolidated Balance Sheet Par Set Book Value Book Value 140 80 320 120 Set Fair Value 40 60 100 120 180 60 280 400 440 120 200 280 160 320 700 (in thousands) Cash Receivables--net Inventories Land Buildings--net Equipment--net Investment in Set Goodwill Total assets Accounts payable Other liabilities Capital stock Retained earings Total equities Noncontrolling interest 960 320 560 160 80 2,600 360 40 2,000 200 2,600 200 400 40 960Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started