Answered step by step

Verified Expert Solution

Question

1 Approved Answer

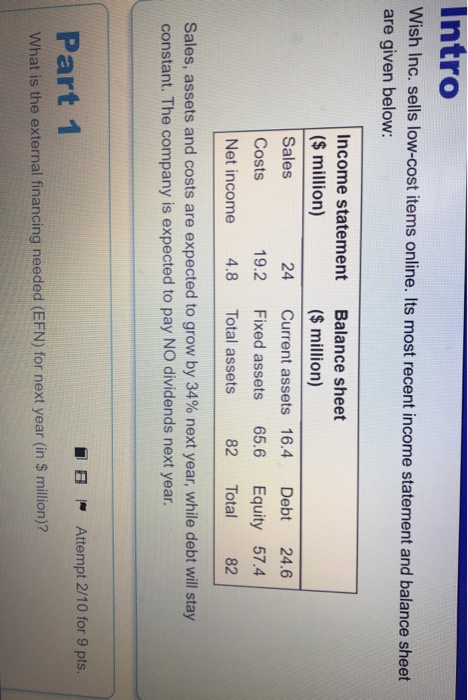

Please answer all questions and show work Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below:

Please answer all questions and show work

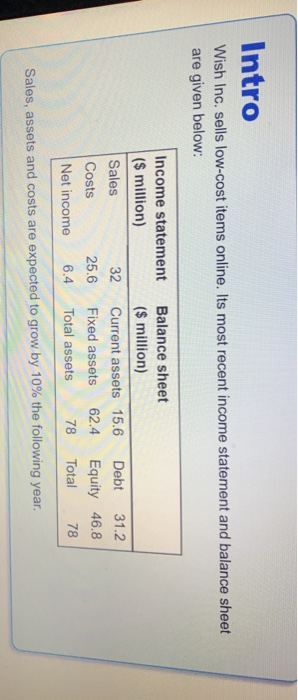

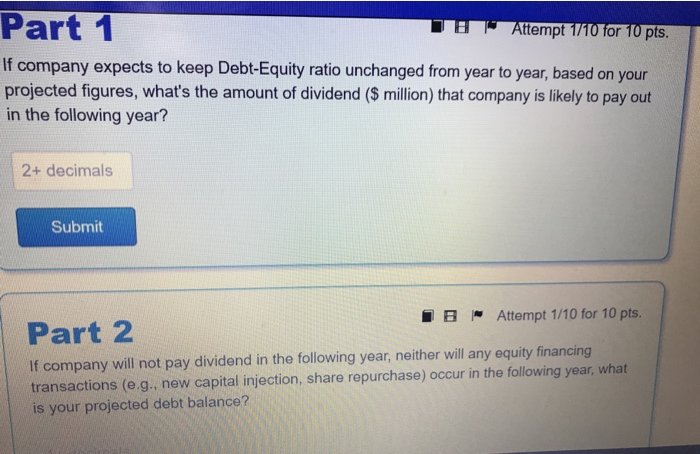

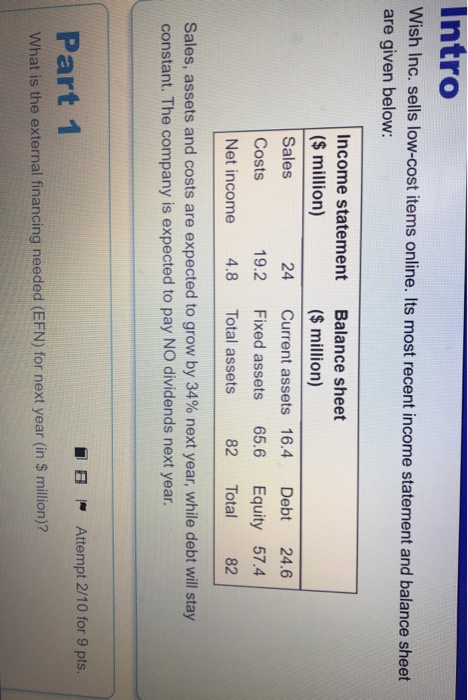

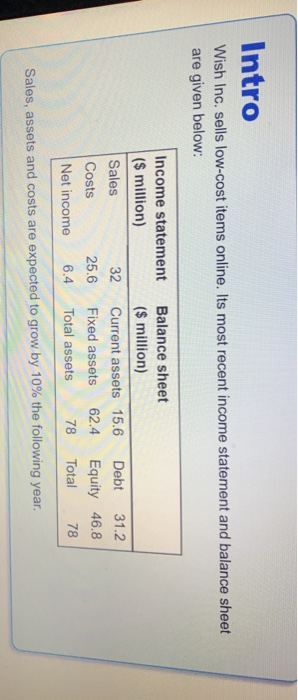

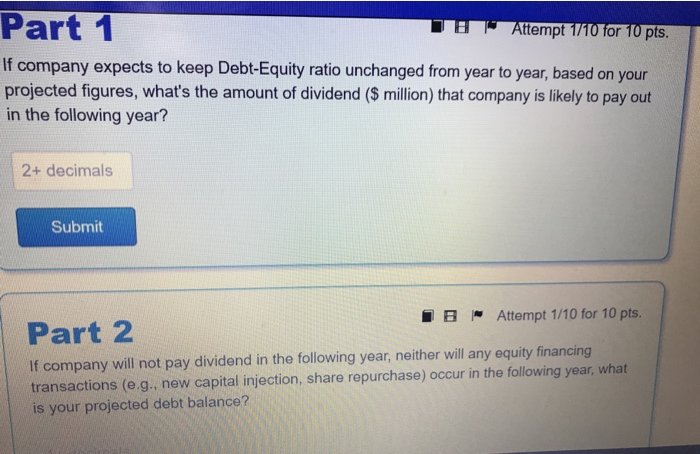

Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement Balance sheet ($ million) ($ million) Sales 32 Current assets 15.6 Debt 31.2 Costs 25.6 Fixed assets 62.4 Equity 46.8 Net income 6.4 Total assets 78 Total 78 Sales, assets and costs are expected to grow by 10% the following year. Part 1 Attempt 1/10 for 10 pts. If company expects to keep Debt-Equity ratio unchanged from year to year, based on your projected figures, what's the amount of dividend ($ million) that company is likely to pay out in the following year? 2+ decimals Submit Attempt 1/10 for 10 pts. B Part 2 If company will not pay dividend in the following year, neither will any equity financing transactions (e.g., new capital injection, share repurchase) occur in the following year, what is your projected debt balance? Intro Wish Inc. sells low-cost items online. Its most recent income statement and balance sheet are given below: Income statement Balance sheet ($ million) ($ million) Sales 24 Current assets 16.4 Debt 24.6 Costs 19.2 Fixed assets 65.6 Equity 57.4 Net income 4.8 Total assets 82 Total 82 Sales, assets and costs are expected to grow by 34% next year, while debt will stay constant. The company is expected to pay NO dividends next year. B Attempt 2/10 for 9 pts. Part 1 What is the external financing needed (EFN) for next year (in $ million)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started