Please answer all questions and show work. Thank you very much, I appreciate it.

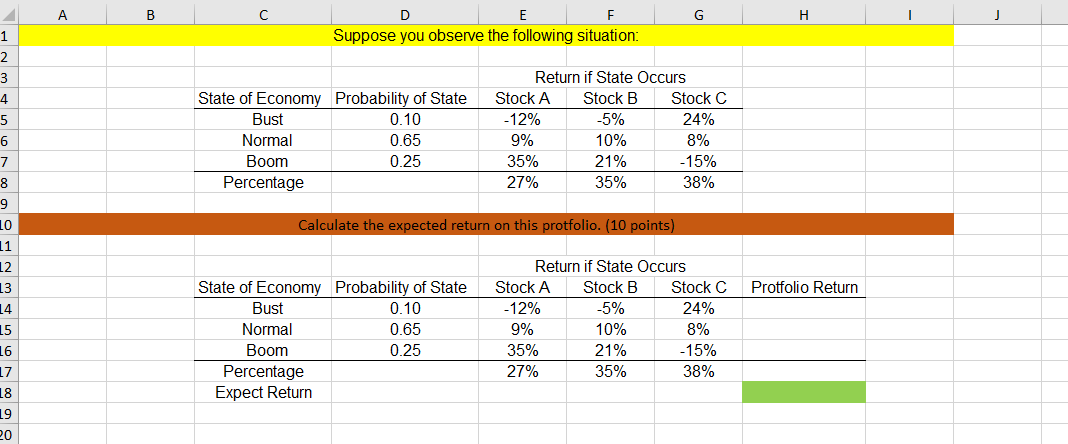

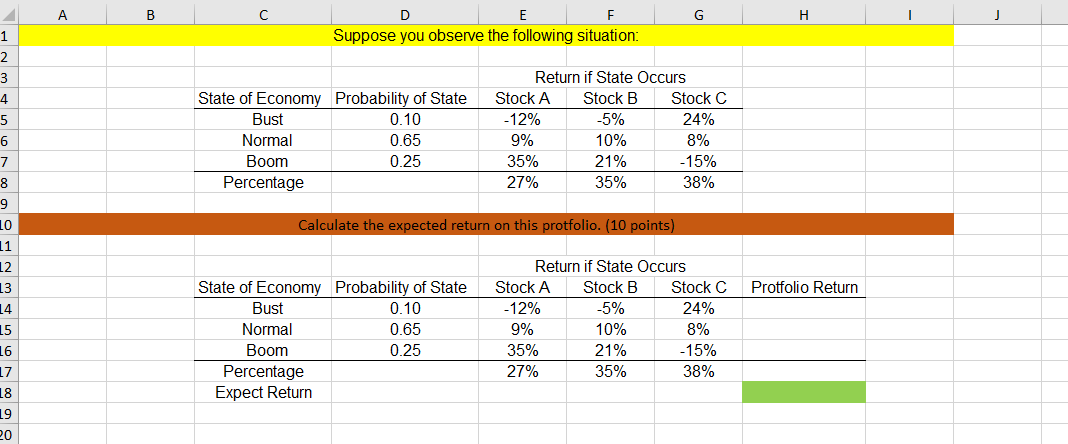

Part A )

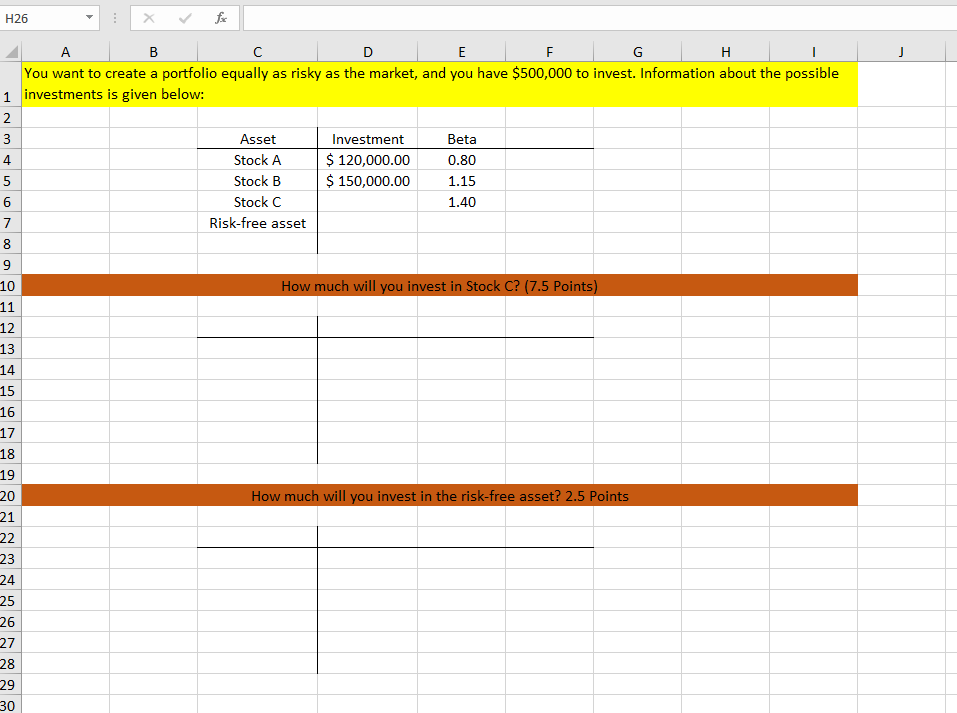

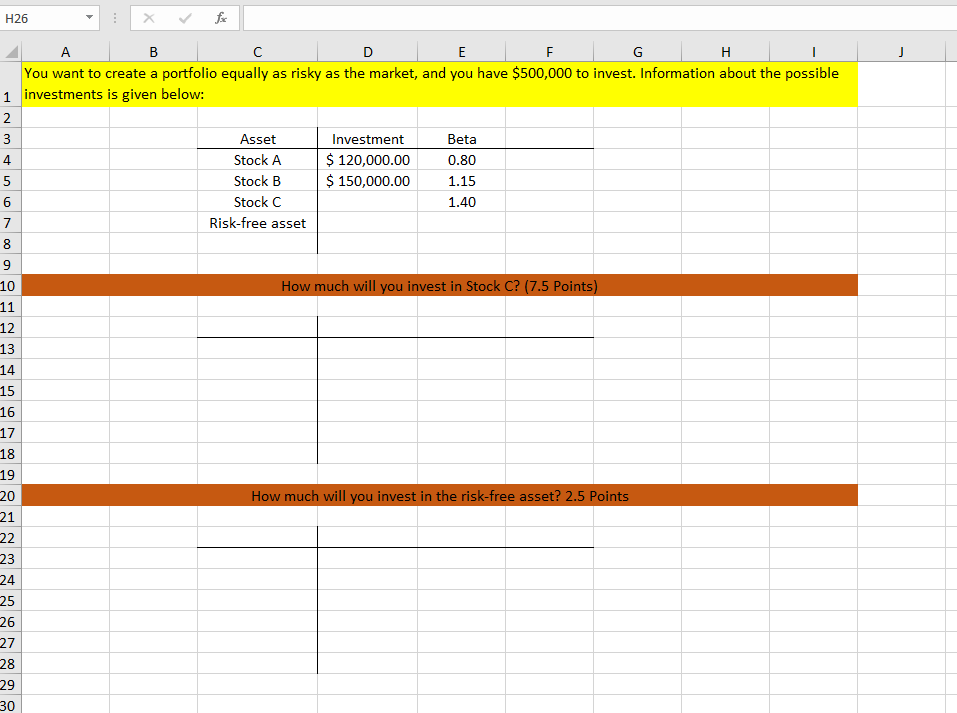

Part B )

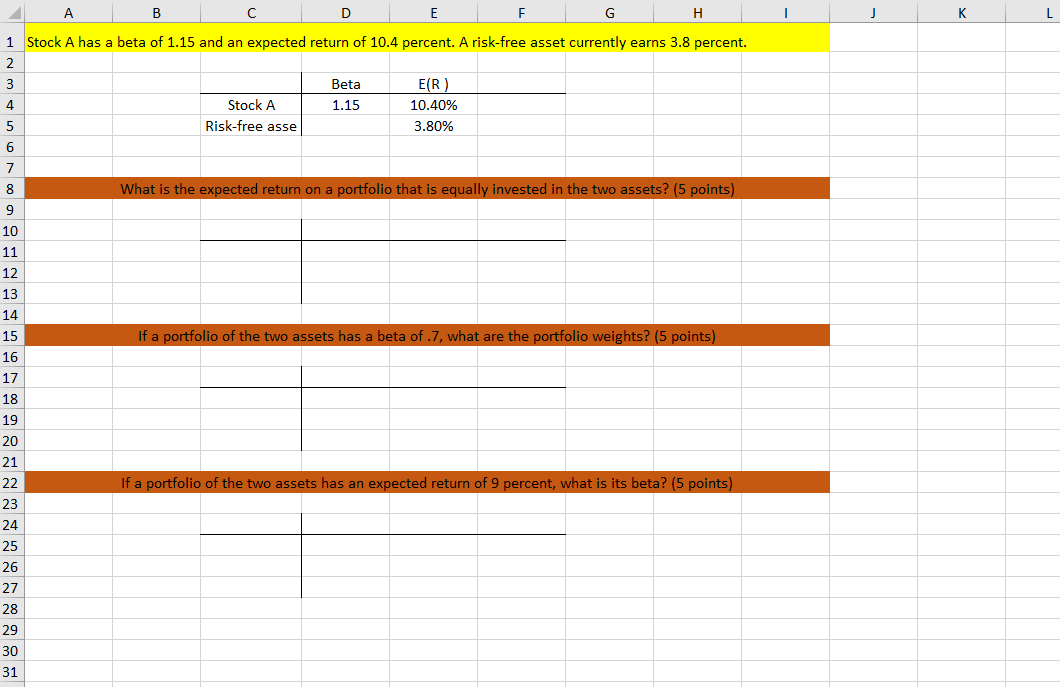

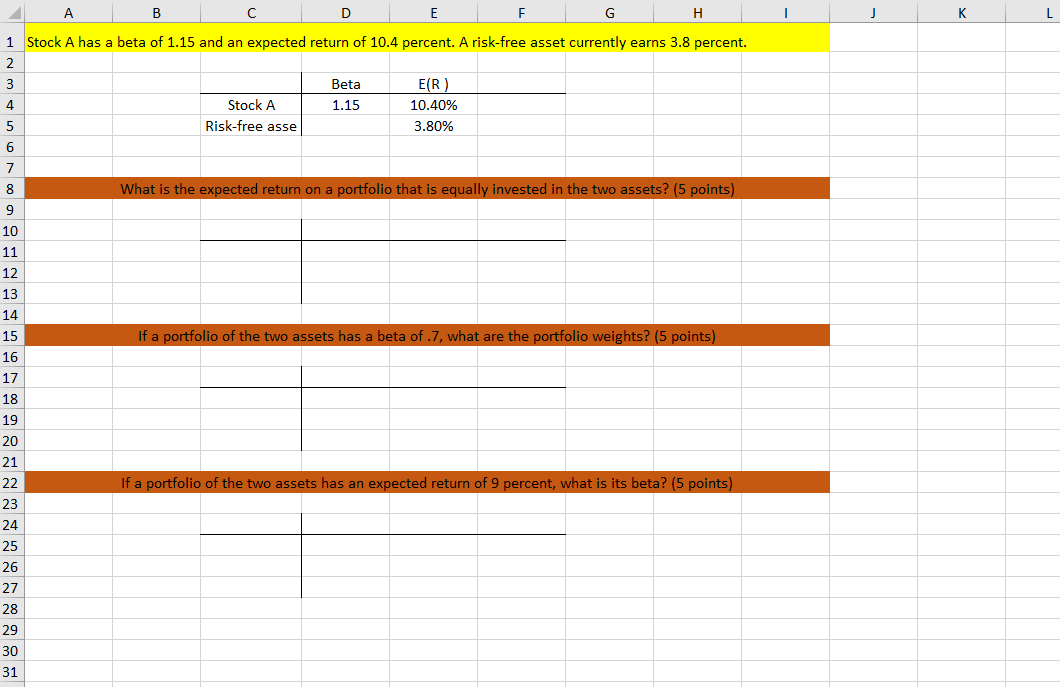

Part C )

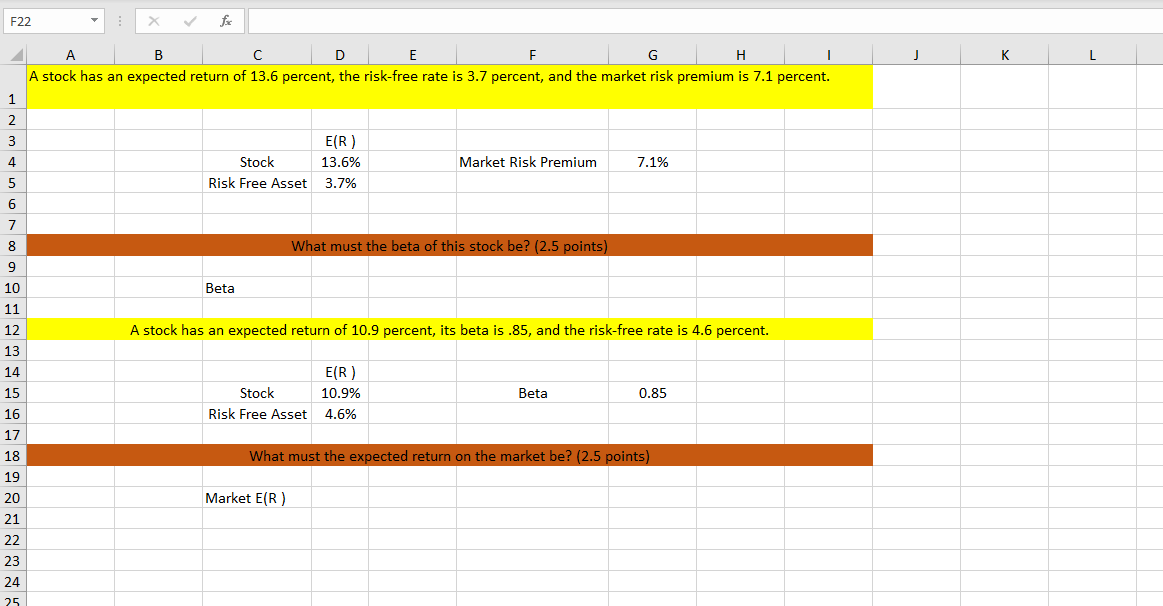

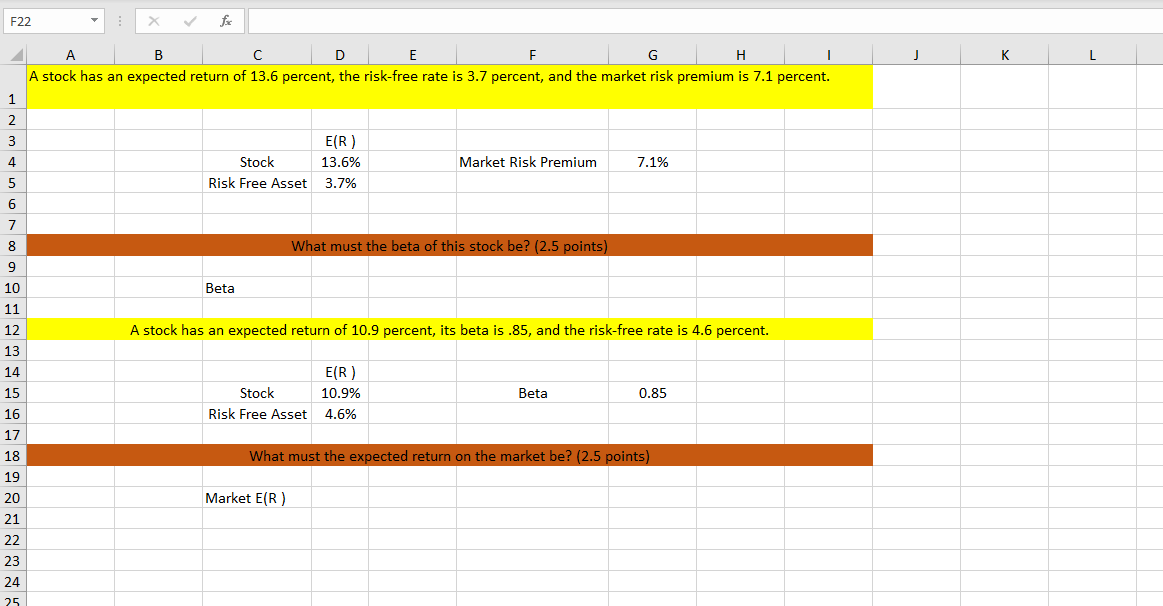

Part D )

A B G H I J D E F Suppose you observe the following situation: 1 2 3 State of Economy Probability of State Bust 0.10 Normal 0.65 Boom 0.25 Percentage Return if State Occurs Stock A Stock B Stock C -12% -5% 24% 9% 10% 8% 35% 21% -15% 27% 35% 38% Calculate the expected return on this protfolio. (10 points) 4 5 6 7 8 9 LO 11 12 13 14 15 16 17 18 19 20 Protfolio Return State of Economy Probability of State Bust 0.10 Normal 0.65 Boom 0.25 Percentage Expect Return Return if State Occurs Stock A Stock B Stock C -12% -5% 24% 9% 10% 8% 35% 21% -15% 27% 35% 38% H26 fi Nm + B D E F G H 1 You want to create a portfolio equally as risky as the market, and you have $500,000 to invest. Information about the possible 1 investments is given below: 2 3 Asset Investment Beta 4 Stock A $ 120,000.00 0.80 5 Stock B $ 150,000.00 1.15 6 Stock C 1.40 7 Risk-free asset 8 How much will you invest in Stock C? (7.5 points) 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 How much will you invest in the risk-free asset? 2.5 Points A B D E F H J K L 1 Stock A has a beta of 1.15 and an expected return of 10.4 percent. A risk-free asset currently earns 3.8 percent. 2 3 Beta E(R) 4 Stock A 1.15 10.40% 5 Risk-free asse 3.80% 6 What is the expected return on a portfolio that is equally invested in the two assets? (5 points) If a portfolio of the two assets has a beta of.7, what are the portfolio weights? (5 points) 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 If a portfolio of the two assets has an expected return of 9 percent, what is its beta? (5 points) F22 J K 1 A B D E G H 1 A stock has an expected return of 13.6 percent, the risk-free rate is 3.7 percent, and the market risk premium is 7.1 percent. 1 2 3 4. E(R) 13.6% 3.7% Market Risk Premium Stock Risk Free Asset 7.1% 5 6 7 8 What must the beta of this stock be? (2.5 points) 9 10 11 Beta A stock has an expected return of 10.9 percent, its beta is.85, and the risk-free rate is 4.6 percent. 12 13 14 15 E(R) 10.9% 4.6% Beta Stock Risk Free Asset 0.85 16 What must the expected return on the market be? (2.5 points) 17 18 19 20 Market E(R) 21 22 23 24 25