please answer all questions as they are part of the same problem

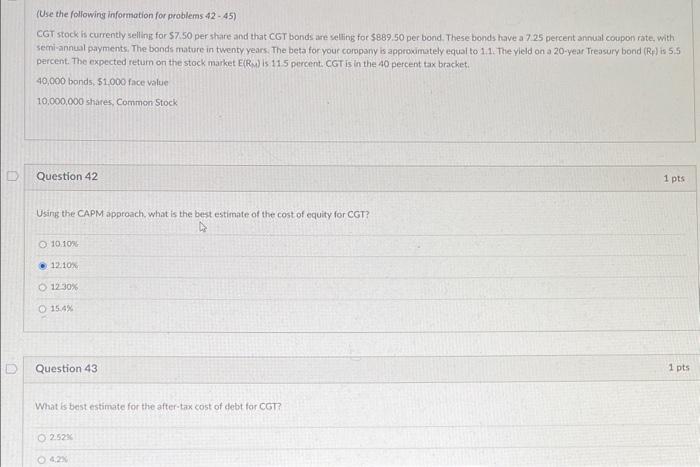

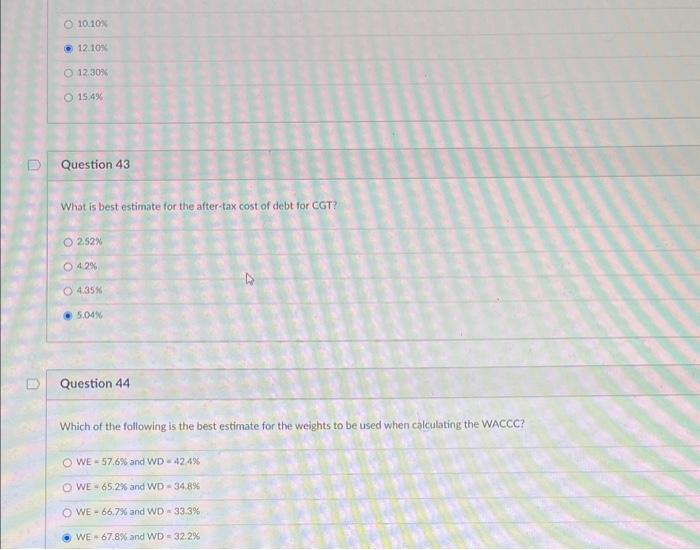

Which of the following is the beit extimate for ithe welghts to be used when calailating the WACCC? WE=57.6%andWo+42.67WE=65.21andWD=34asWr+66TNandWo-33]WC876xdivWo=322K Question 45 What is the best estimate of the WACC for CGT? 8756 8.028 9.18% p83x (Use the following information for problems 42 - 45) CGT stock is currently selling for $7.50 per share and that CGT bonds are selfing for 5889.50 per bond. These bonds have a 7.25 percent anmual coupon rate, with semi-annual payments. The bonds mature in twenty, years. The beta for your company is approwimately equal to 1.1. The yield on a 20 -year Treasury bond (Ri) is 5.5 percent. The expected retum on the stock market E(RM) is 115 percent. CGT is in the 40 percent tax bracket. 40,000 bonds, 51.000 face value 10,000,000 shares, Common Stock Question 42 1 pts Using the CAPM approach. what is the best estimate of the cost of equity for CGT? 10.100s 12.100s 1230%6 15.4% Question 43 1pts What is best estimate for the after-tax cost of debt for CG? 2.5286 4,2Y Question 43 What is best estimate for the after-tax cost of debt for CGT? Question 44 Which of the following is the best estimate for the weights to be used when calculating the WACCC? WE=57.6%andWD=42.4%WE=65.2%andWD=34.8%WE=66.7%andWD=33.3%WE=67.8%andWD=32.2% What is the best estimate of the WACC for CGT? 8,15% 8.92% 9.18% 9.83% Which of the following is the beit extimate for ithe welghts to be used when calailating the WACCC? WE=57.6%andWo+42.67WE=65.21andWD=34asWr+66TNandWo-33]WC876xdivWo=322K Question 45 What is the best estimate of the WACC for CGT? 8756 8.028 9.18% p83x (Use the following information for problems 42 - 45) CGT stock is currently selling for $7.50 per share and that CGT bonds are selfing for 5889.50 per bond. These bonds have a 7.25 percent anmual coupon rate, with semi-annual payments. The bonds mature in twenty, years. The beta for your company is approwimately equal to 1.1. The yield on a 20 -year Treasury bond (Ri) is 5.5 percent. The expected retum on the stock market E(RM) is 115 percent. CGT is in the 40 percent tax bracket. 40,000 bonds, 51.000 face value 10,000,000 shares, Common Stock Question 42 1 pts Using the CAPM approach. what is the best estimate of the cost of equity for CGT? 10.100s 12.100s 1230%6 15.4% Question 43 1pts What is best estimate for the after-tax cost of debt for CG? 2.5286 4,2Y Question 43 What is best estimate for the after-tax cost of debt for CGT? Question 44 Which of the following is the best estimate for the weights to be used when calculating the WACCC? WE=57.6%andWD=42.4%WE=65.2%andWD=34.8%WE=66.7%andWD=33.3%WE=67.8%andWD=32.2% What is the best estimate of the WACC for CGT? 8,15% 8.92% 9.18% 9.83%