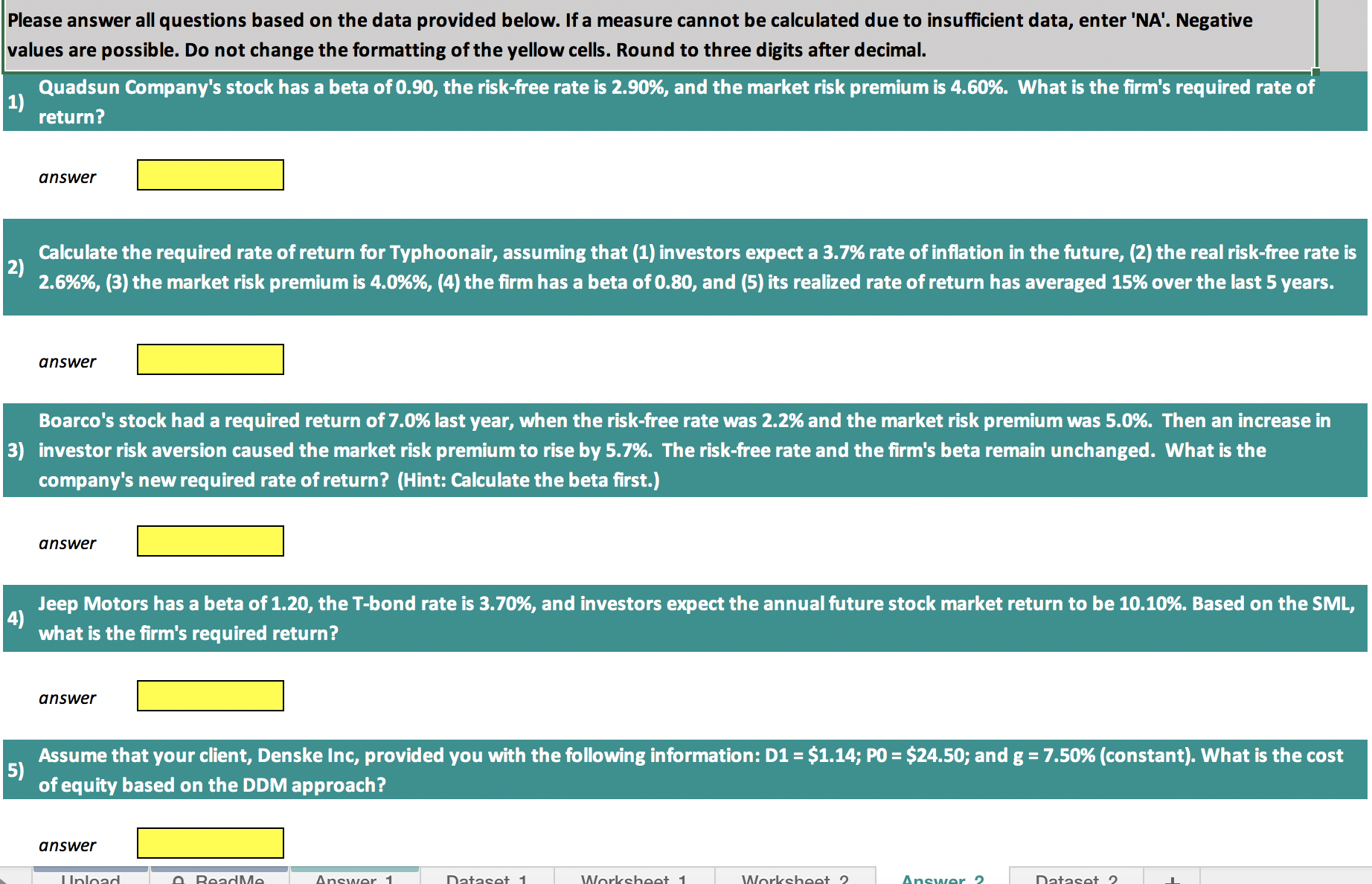

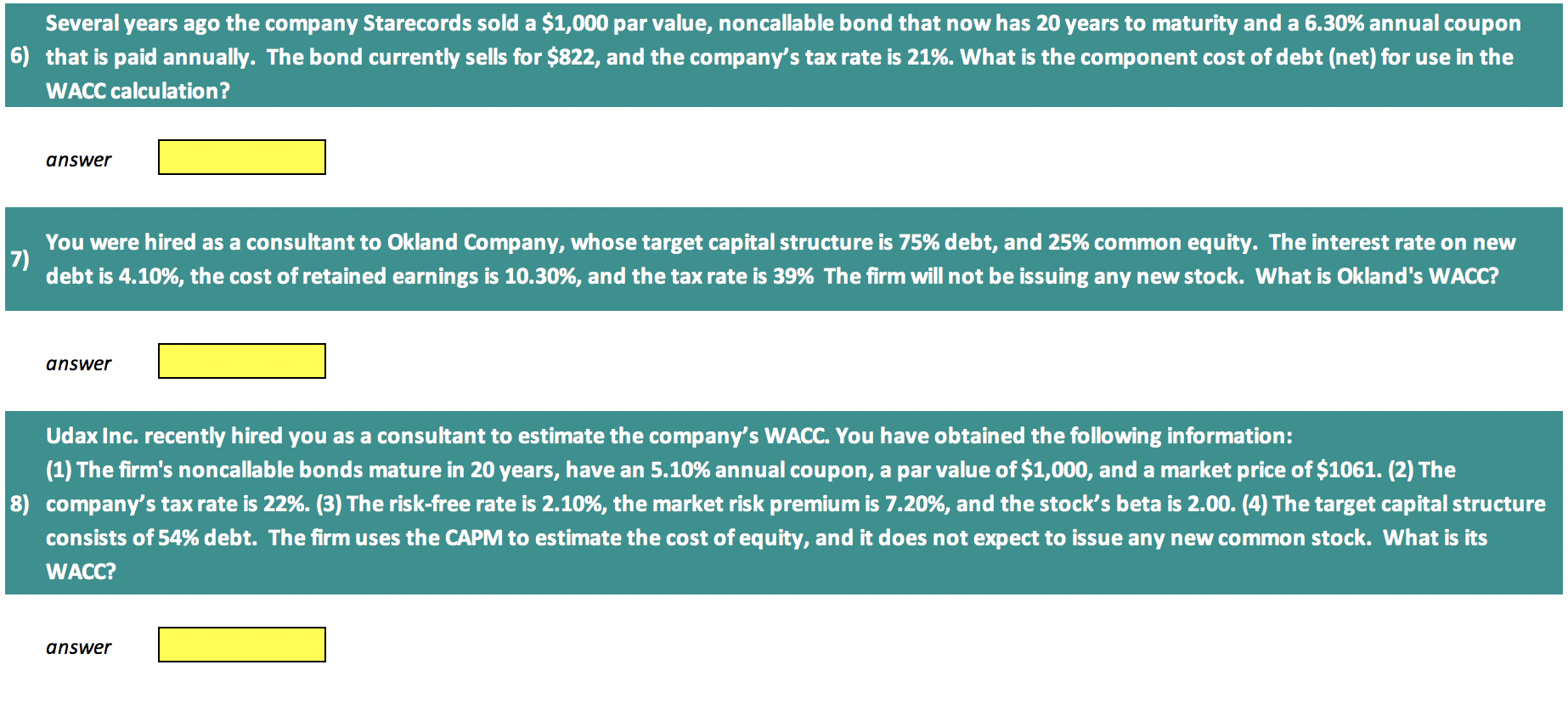

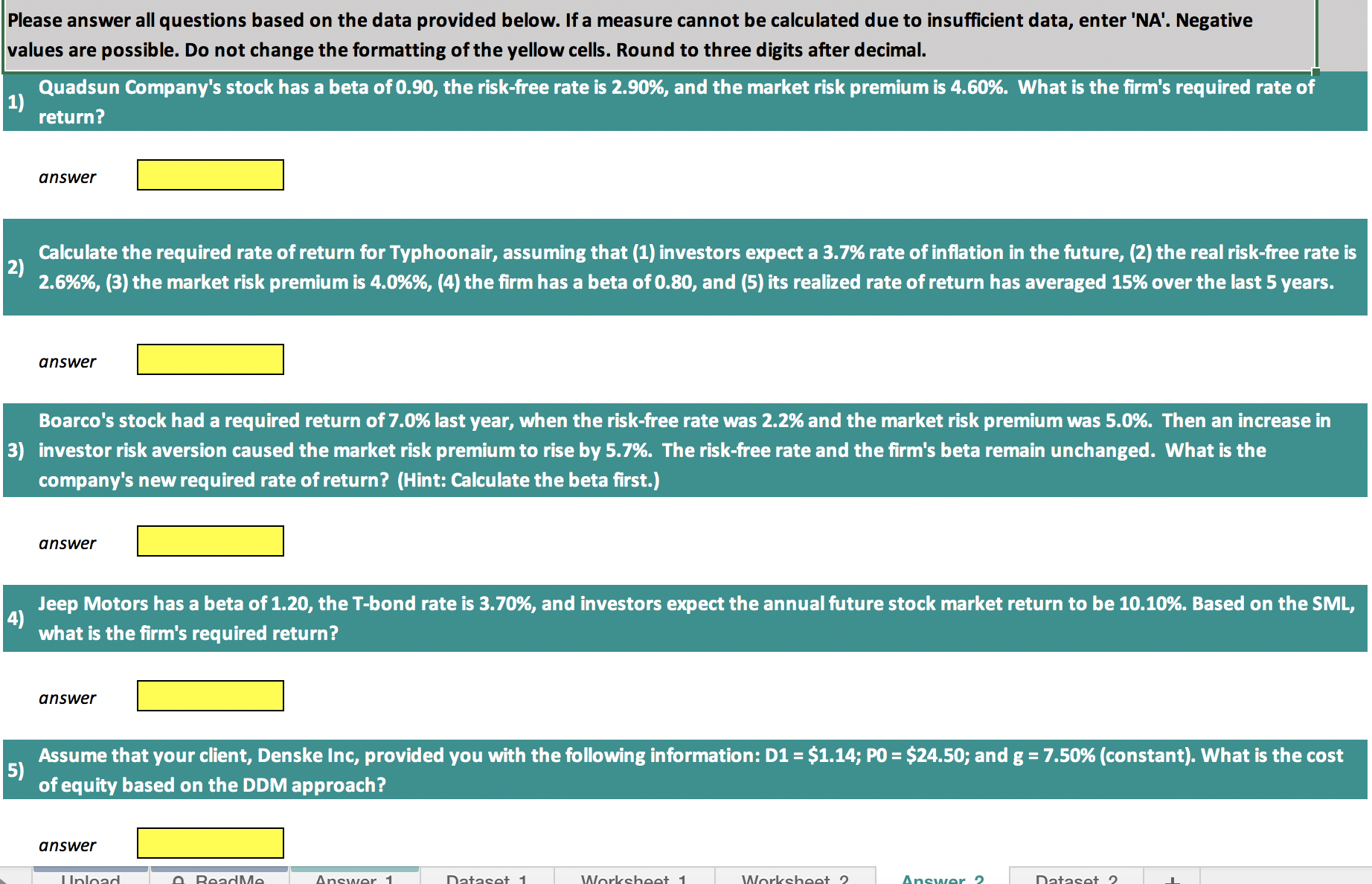

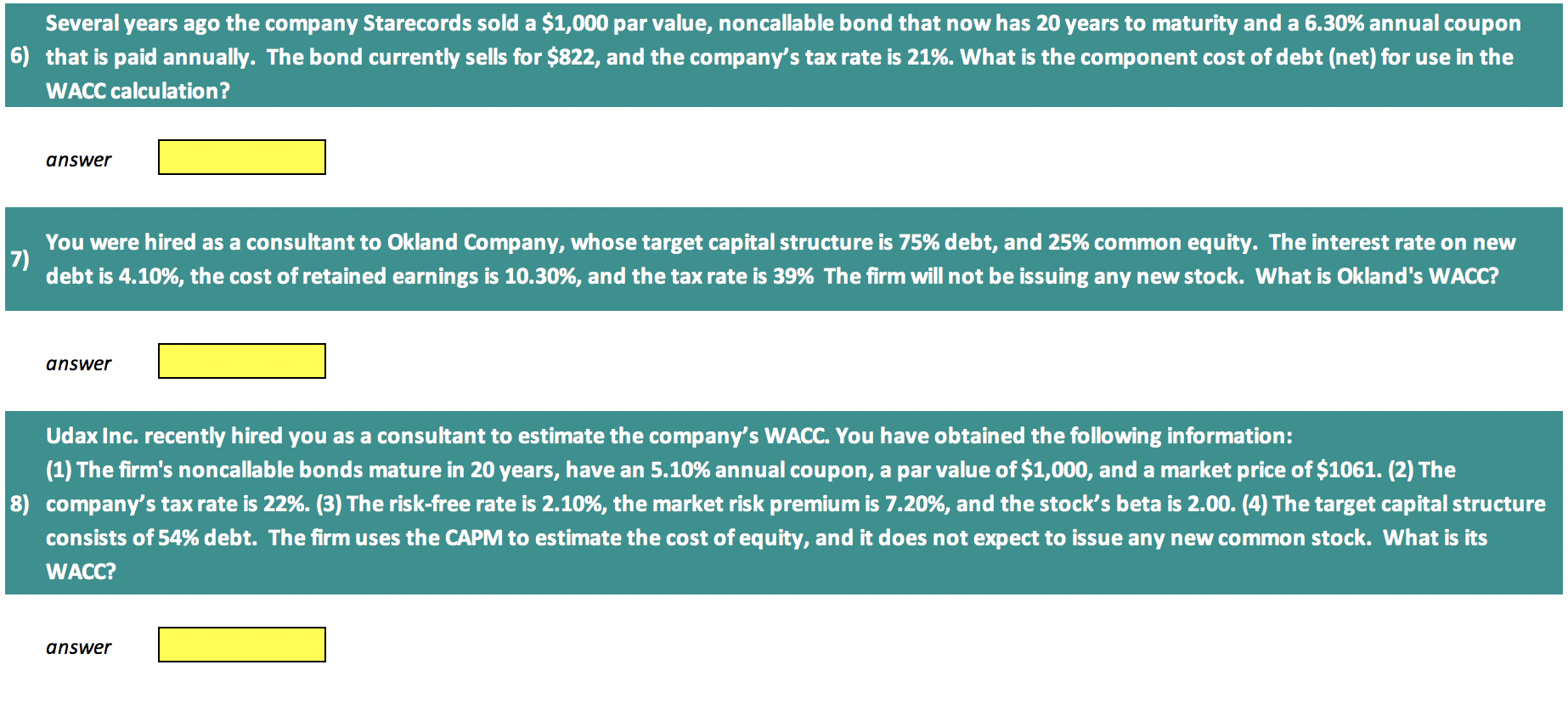

Please answer all questions based on the data provided below. If a measure cannot be calculated due to insufficient data, enter 'NA'. Negative values are possible. Do not change the formatting of the yellow cells. Round to three digits after decimal. 1) Quadsun Company's stock has a beta of 0.90, the risk-free rate is 2.90%, and the market risk premium is 4.60%. What is the firm's required rate of return? answer 2) Calculate the required rate of return for Typhoonair, assuming that (1) investors expect a 3.7% rate of inflation in the future, (2) the real risk-free rate is 2.6%%, (3) the market risk premium is 4.0%%, (4) the firm has a beta of 0.80, and (5) its realized rate of return has averaged 15% over the last 5 years. answer Boarco's stock had a required return of 7.0% last year, when the risk-free rate was 2.2% and the market risk premium was 5.0%. Then an increase in 3) investor risk aversion caused the market risk premium to rise by 5.7%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: Calculate the beta first.) answer 4) Jeep Motors has a beta of 1.20, the T-bond rate is 3.70%, and investors expect the annual future stock market return to be 10.10%. Based on the SML, what is the firm's required return? answer 5) Assume that your client, Denske Inc, provided you with the following information: D1 = $1.14; P0 = $24.50; and g = 7.50% (constant). What is the cost of equity based on the DDM approach? answerSeveral years ago the company Starecords sold a $1,000 par value, noncallable bond that now has 20 years to maturity and a 6.30% annual coupon that is paid annually. The bond currently sells for $822, and the company's tax rate is 21%. What is the component cost of debt (net) for use in the WACC calculation? anserw :l You were hired as a consultant to Okland Company, whose target capital structure is 75% debt, and 25% common equity. The interest rate on new debt is 4.10%, the cost of retained earnings is 10.30%, and the tax rate is 39% The rm will not be issuing any new stock. What is Okland's WACC? sew :l Udax Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the following information: (1)Therm's noncallabie bonds mature in 20 years, have an 5.10% annual coupon, a par value of$1,000, and a market price of51061. (2) The company's tax rate is 22%. (3) The risk-free rate is 2.10%, the market risk premium is 7.20%, and the stock's beta is 2.00. (4) The target capital structure consists of 54% debt. The rm uses the CAPM to estimate the cost of equity, and it does not expect to issue any new common stock. What is its WACC? answer :I