Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions because this is my last question remaining. Thank you Next quarter a stock will pay a dividend of $2.2 and currently

Please answer all questions because this is my last question remaining. Thank you

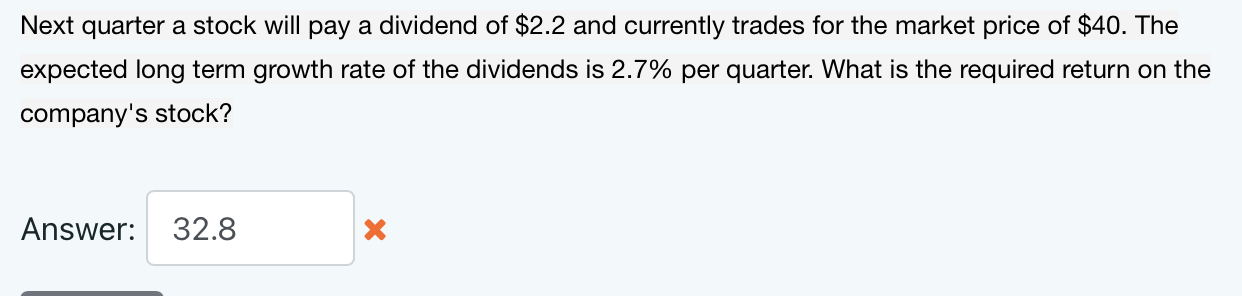

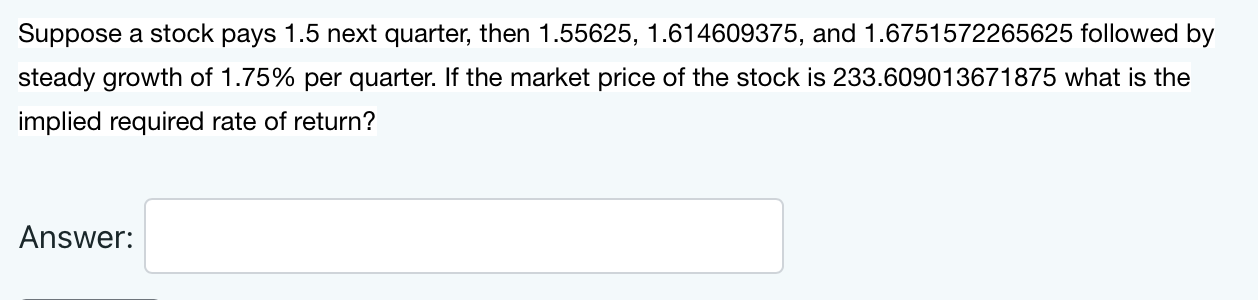

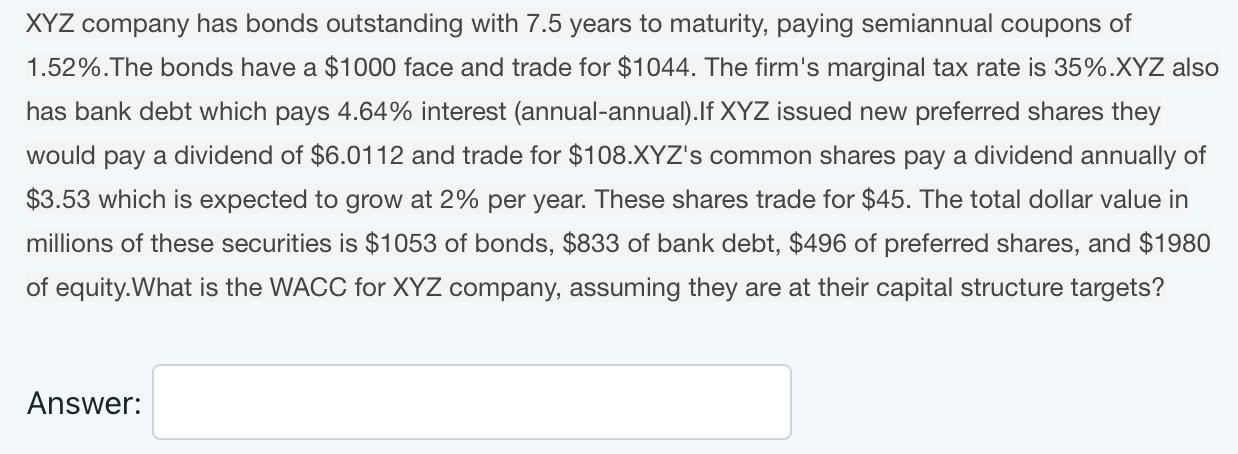

Next quarter a stock will pay a dividend of $2.2 and currently trades for the market price of $40. The expected long term growth rate of the dividends is 2.7% per quarter. What is the required return on the company's stock? Answer: 32.8 X Suppose a stock pays 1.5 next quarter, then 1.55625, 1.614609375, and 1.6751572265625 followed by steady growth of 1.75% per quarter. If the market price of the stock is 233.609013671875 what is the implied required rate of return? Answer: XYZ company has bonds outstanding with 7.5 years to maturity, paying semiannual coupons of 1.52%.The bonds have a $1000 face and trade for $1044. The firm's marginal tax rate is 35%.XYZ also has bank debt which pays 4.64% interest (annual-annual).If XYZ issued new preferred shares they would pay a dividend of $6.0112 and trade for $108.XYZ's common shares pay a dividend annually of $3.53 which is expected to grow at 2% per year. These shares trade for $45. The total dollar value in millions of these securities is $1053 of bonds, $833 of bank debt, $496 of preferred shares, and $1980 of equity.What is the WACC for XYZ company, assuming they are at their capital structure targetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started