Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions.. chegg policy allows 4 questions per post. if you cant answer all of then please leave it for someone else. Question

please answer all questions..

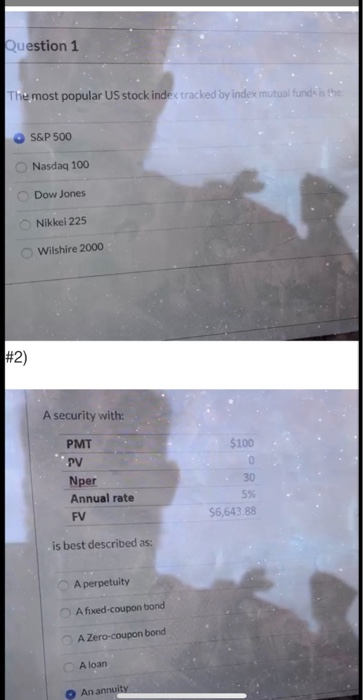

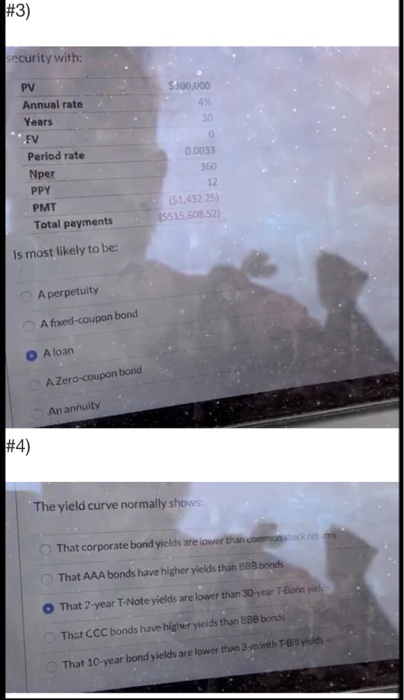

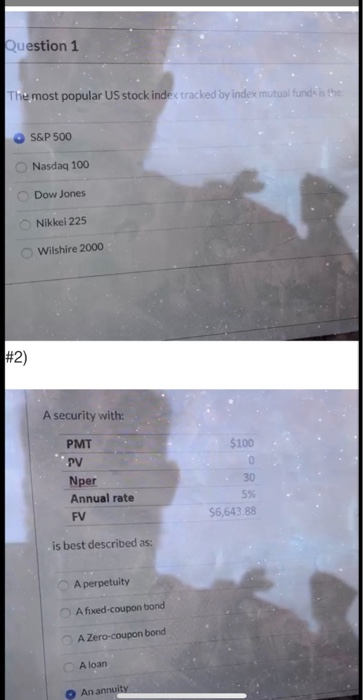

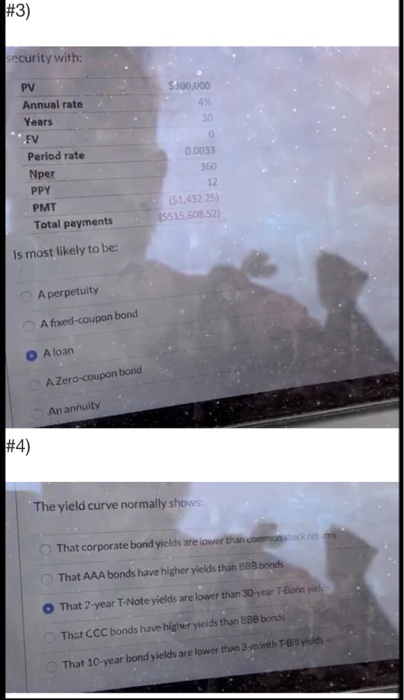

Question 1 The most popular US stock index tracked by index mutual funds is the S&P 500 Nasdaq 100 Dow Jones Nikkei 225 Wilshire 2000 #2) A security with: PMT PV Nper Annual rate FV $100 0 30 5% $6,643.88 is best described as: A perpetuity A fixed-coupon bond A Zero-coupon bond A loan An annuity #3) security with: $300,000 4 30 PV Annual rate Years FV Period rate Nper PPY PMT Total payments 0.0033 360 12 (51,43225) 15515,60852) Is most likely to be: A perpetuity A fixed-coupon bond A loan A Zero-coupon bond An annuity #4) The yield curve normally shows: That corporate bond yields are lower than common stockret That AAA bonds have higher yields than BBB bonds That 2-year T-Note yields are lower than 30-year T-Bond yieks That CCC bonds have higher yields than BBB bonds That 10-year bond yields are lower than 3-month T-Balletes chegg policy allows 4 questions per post. if you cant answer all of then please leave it for someone else.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started