Answered step by step

Verified Expert Solution

Question

1 Approved Answer

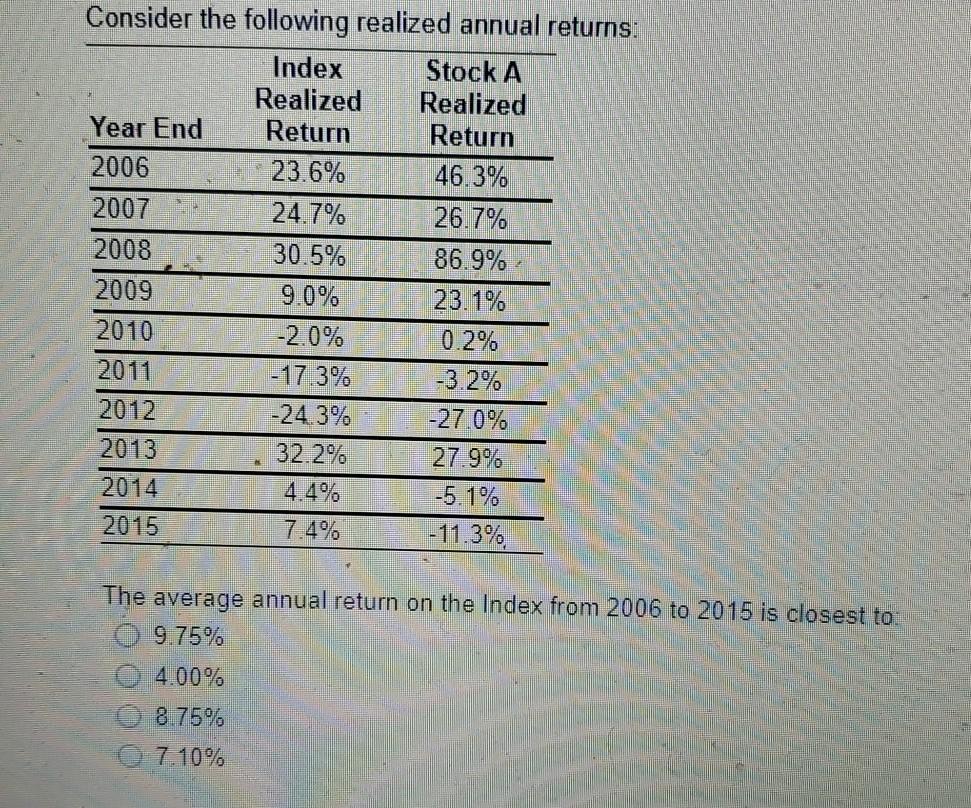

please answer all questions completely using multiple choice Consider the following realized annual returns: Index Stock A Realized Realized Year End Return Return 2006 23.6%

please answer all questions completely using multiple choice

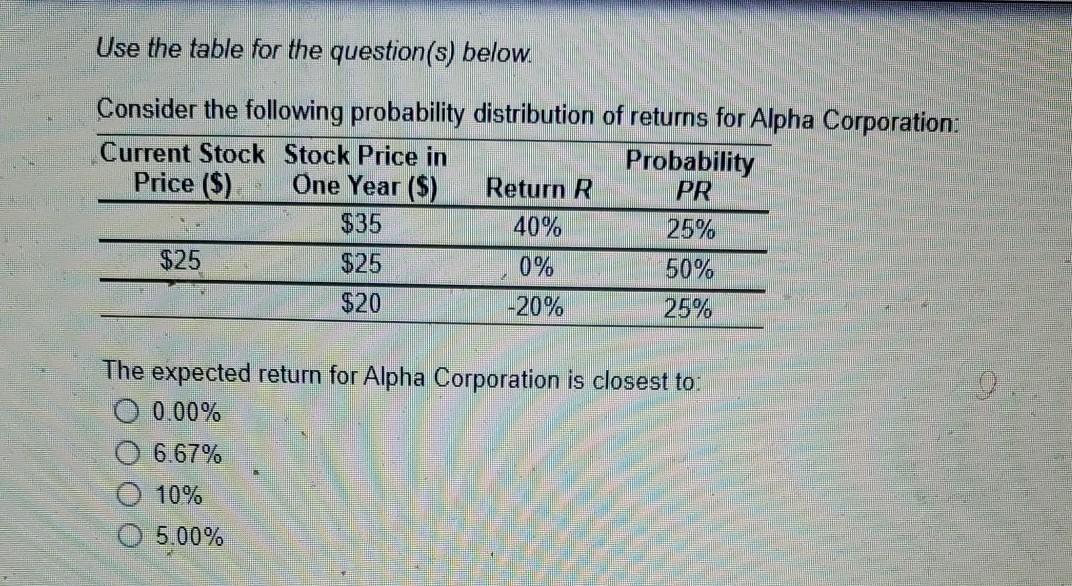

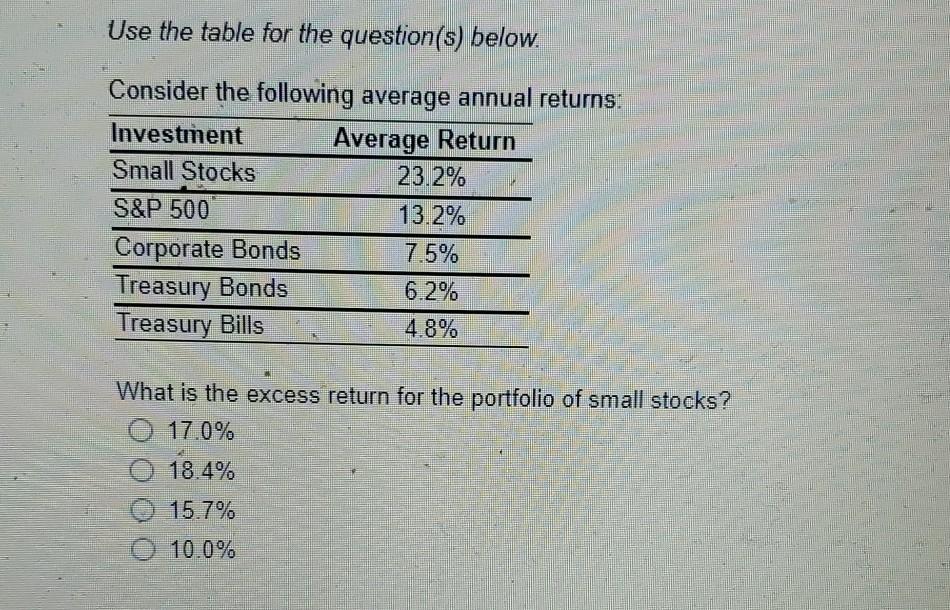

Consider the following realized annual returns: Index Stock A Realized Realized Year End Return Return 2006 23.6% 46.3% 2007 24.7% 26.7% 2008 30.5% 86.9% 2009 9.0% 23.1% 2010 -2.0% 0.2% 2011 -17.3% -3.2% 2012 -24.3% -27.0% 2013 32.2% 27.9% 2014 -5.1% 2015 7.4% - 11.3% The average annual return on the Index from 2006 to 2015 is closest to: 9.75% 4.00% 8.75% 7.10% Use the table for the question(s) below. Consider the following probability distribution of returns for Alpha Corporation: Current Stock Stock Price in Probability Price ($) One Year ($) Return R PR $35 40% 25% $25 $25 0% 50% $20 -20% 25% The expected return for Alpha Corporation is closest to: O 0.00% 6.67% 10% 5.00% Use the table for the question(s) below. Consider the following average annual returns: Investment Average Return Small Stocks 23.2% S&P 500 13.2% Corporate Bonds 7.5% Treasury Bonds 6.2% Treasury Bills 4.8% What is the excess return for the portfolio of small stocks? O 17.0% O 18.4% 15.7% 10.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started