Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions DUPONT ANALYSIS A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's financial position using

please answer all questions

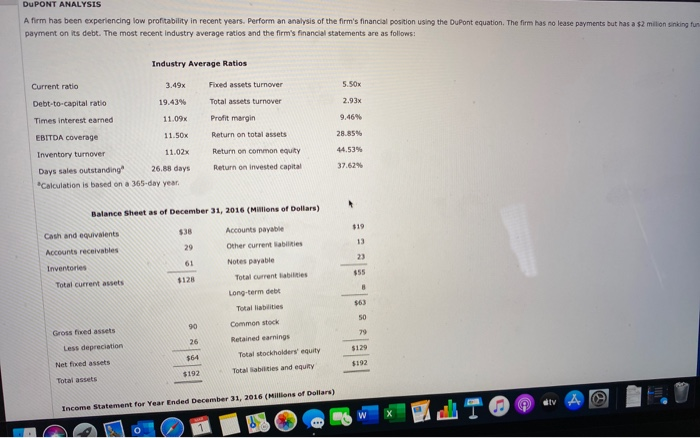

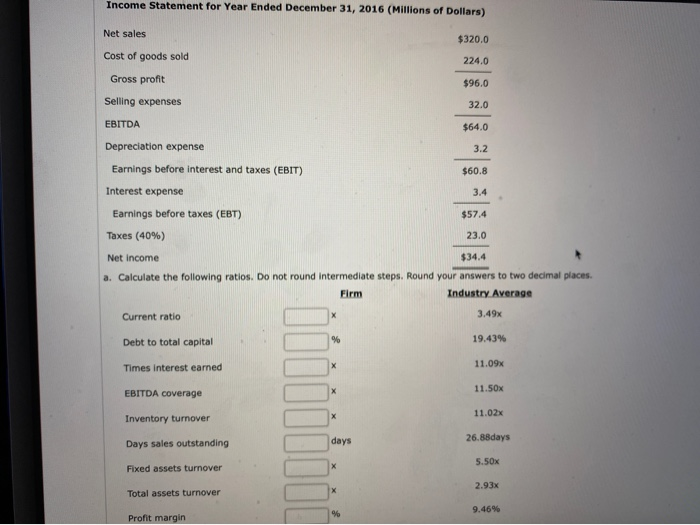

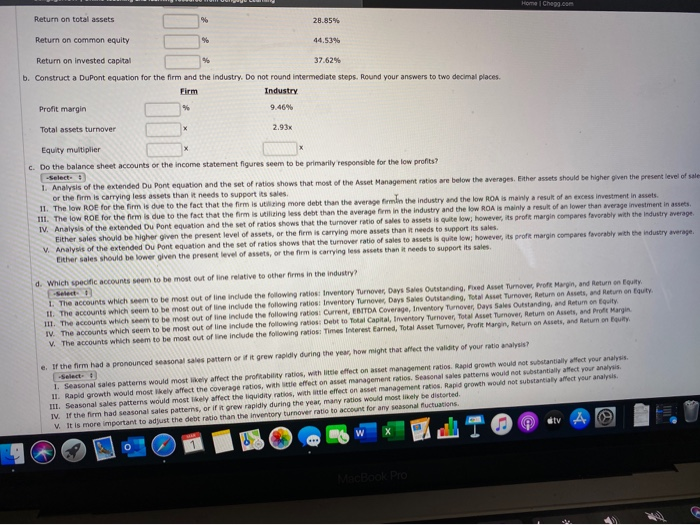

DUPONT ANALYSIS A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's financial position using the DuPont equation. The firm has no lase payments but has a payment on its debt. The most recent industry average ratios and the firm's financial statements are as follows: milioniningu Industry Average Ratios Fixed assets turnover 5.50x 2.93x Total assets turnover Current ratio 3.49 Debt-to-capital ratio 19.43 Times interest earned 11.09% EBITDA Coverage 11.50x Inventory turnover 11.02% Days sales outstanding 26.88 days "Calculation is based on a 365-day year 28.85% Profit margin Return on total assets Return on common equity Return on invested capital 44.53% Balance Sheet as of December 31, 2016 (Millions of Dollars) $38 Accounts payable Other current abilities Cash and equivalents Accounts receivables Inventories Notes payable $128 Total current liabilities Total current assets Long-term debe Total liabilities Grossed assets Less depreciation Common stock Retained earnings Total stockholders' equity Total abilities and equity Net foxed assets Total assets ons of Dollars) Income Statement for Year Ended December 31, 2015 ( M ANADO OSOBWI WAO Income Statement for Year Ended December 31, 2016 (Millions of Dollars) Net sales $320.0 Cost of goods sold 224.0 Gross profit $96.0 Selling expenses 32.0 $64.0 EBITDA Depreciation expense 3.2 Earnings before interest and taxes (EBIT) $60.8 Interest expense 3.4 Earnings before taxes (EBT) $57.4 Taxes (40%) 23.0 Net Income $34.4 a. Calculate the following ratios. Do not round Intermediate steps. Round your answers to two decimal places Firm Industry Average Current ratio 3.49x Debt to total capital 19.43% Times interest earned 11.09x EBITDA coverage 11.50% Inventory turnover 11.02x Days sales outstanding days 26.88days 5.50x Fixed assets turnover 2.93x Total assets turnover 9.46% Profit margin Chegg.com Return on total assets 28.85% Return on common equity 44.53% Return on invested capital 37.625 b. Construct a DuPont equation for the firm and the industry. Do not round intermediate steps. Round your answers to two decimal places Industry Profit margin 9.46 Total assets turnover 2.93 Equity multiplier c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? 1. Analysis of the extended Du Pont equation and the set of ratios shows that most of the Asset Management ratios are below the averages. Either assets should be higher o ven the present level of sale or the term is carrying less assets that needs to support is sales 11. The low ROE for the firm is due to the fact that the firm ring more debt than the overage firm the industry and the low ROA many are of investment in assets. III. The low ROE for the firm is due to the fact that the firm is utilizing less debt than the average firm in the industry and the low ROA is mainly a result of an lower than average investment in a IV. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low however, its profit margin compares favorably with the industry wverage Either sales should be higher given the present level of assets, or the firm is carrying more assets that needs to support its sales V. Analysis of the extended Ou Pont equation and the set of ratios shows that the mover rate of sales to suite ow, however, its profit margin compares tvorably industry average Either sales should be lower given the present level of assets, or the firm is carrying less than it needs to support its sales d. Which specific accounts seem to be most out of line relative to other firms in the industry? y 1. The accounts which seem to be most out of line include the following ratios Inventory Turnover, Days Se Outstanding, ed Asset Turnover Mary, and turn outy II The accounts which seem to be most out of line include the following ratiosi Inventory Turnover, Days Sales Outstanding, Total Asset Turnover, Return on Assets and Return on II. The accounts which seem to be most out of line include the following ratios Current EBITDA Coverage, Inventory Turnover, Days Sales Outstanding, and Return on Equity IV. The accounts which seem to be most out of line include the following : Det to To Capital Inventory Turnover, Total Asset Turnovec Return on Assets, and ProtMargin V. The accounts which seem to be most out of line include the following ratios Times Interest Earned, Asset Tuover, Prof Mary Return on and Return on outy e. If the firm had a pronounced seasonal sales pattern or it grew rapidly during the year, how might that affect the validity of your ratio analysis? 1. Seasonal sales patterns would mostly affect the profitability is, wi e effect on management ratios. Rapid growth would not w antialect your analysis 11. Rapid growth would mostly affect the coverage ratios, with the effect on asset management ratios. Seasonal patterns wou w e e t your ne TL Seasonal sales patterns would mostly affect the liquidity ratios, with the effect on asset management ratio, Rapid growth would not substantly affect your analysis IV. If the firm had seasonal sales patterns, or if grew rapidly during the year many ratios would most likely be distorted. V It is more important to adjust the debt ratio than the inventory turnover rate to account for any luctuations W X di TOO v A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started