Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions. Everything is given. No missing info. I will give you an upvote if you provide the correct answer. Mid - year

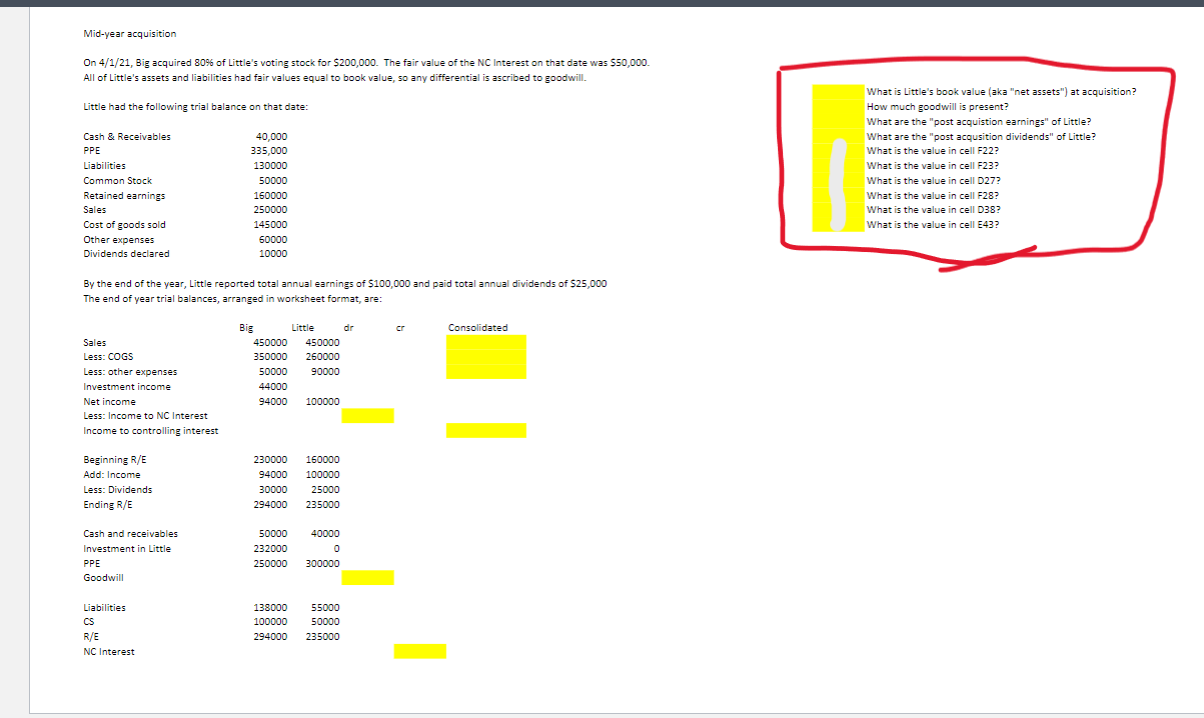

Please answer all questions. Everything is given. No missing info. I will give you an upvote if you provide the correct answer. Midyear acquisition

On Big acquired of Little's voting stock for $ The fair value of the NC Interest on that date was $

All of Little's assets and liabilities had fair values equal to book value, so any differential is ascribed to goodwill.

Little had the following trial balance on that date: Cash & Receivables

PPE

Liabilities

Common Stock

Retained earnings

Sales

Cost of goods sold

Other expenses

Dividends declared

By the end of the year, Little reported total annual earnings of $ and paid total annual dividends of $ The end of year trial balances, arranged in worksheet format, are below info, if not clear look at the picture inserted:

Big Little dr cr Consolidated

Sales

Less: COGS

Less: other expenses

Investment income

Net income

Less: Income to NC Interest

Income to controlling interest

Beginning RE

Add: Income

Less: Dividends

Ending RE

Cash and receivables

Investment in Little

PPE

Goodwill

Liabilities

CS

RE

NC Interest Questions: What is Little's book value aka "net assets" at acquisition?

How much goodwill is present?

What are the "post acquistion earnings" of Little?

What are the "post acqusition dividends" of Little?

What is the value in cell F

What is the value in cell F

What is the value in cell D

What is the value in cell F

What is the value in cell D

What is the value in cell E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started