Answered step by step

Verified Expert Solution

Question

1 Approved Answer

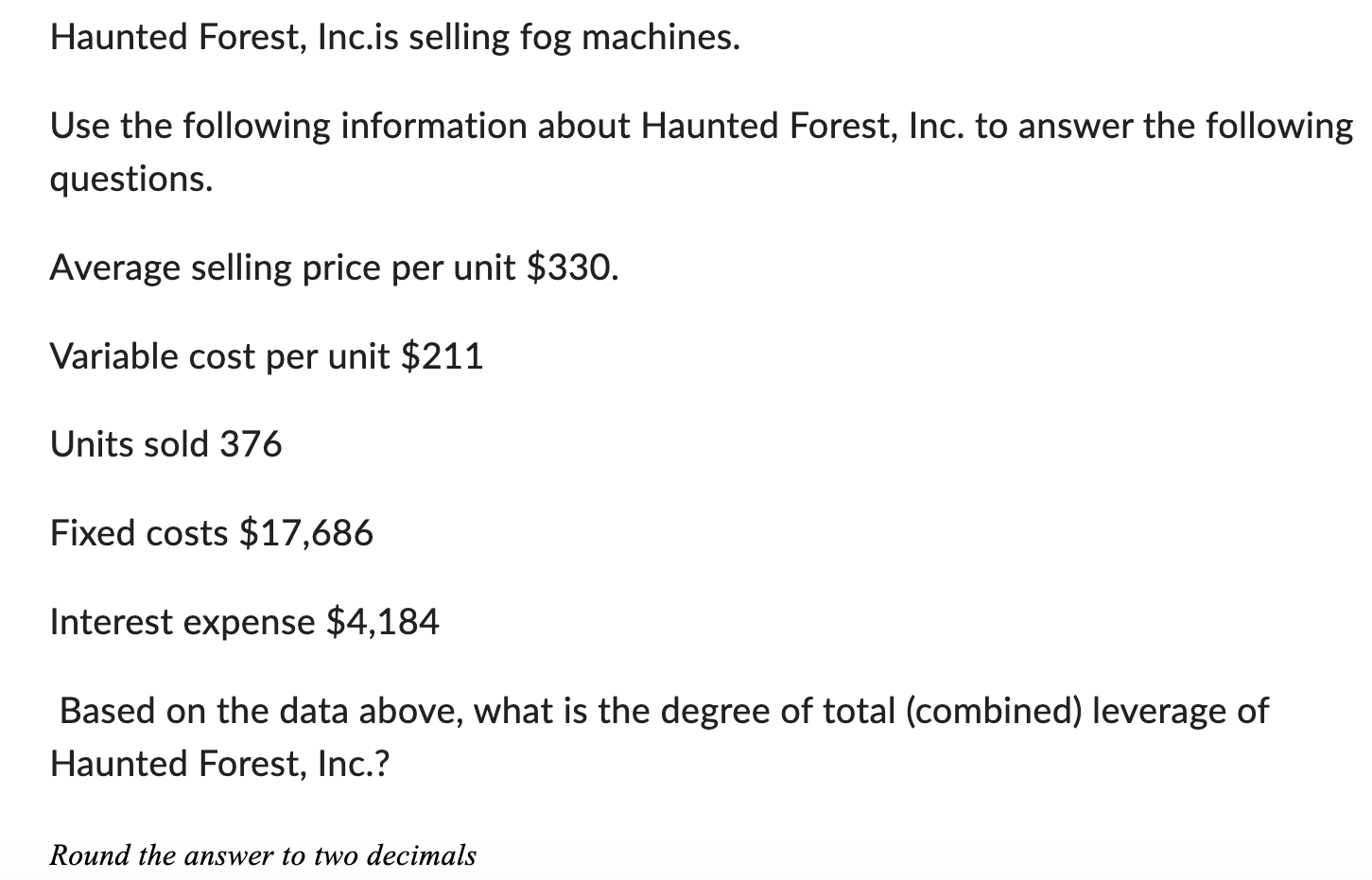

PLEASE ANSWER ALL QUESTIONS! Haunted Forest, Inc.is selling fog machines. Use the following information about Haunted Forest, Inc. to answer the following questions. Average selling

PLEASE ANSWER ALL QUESTIONS!

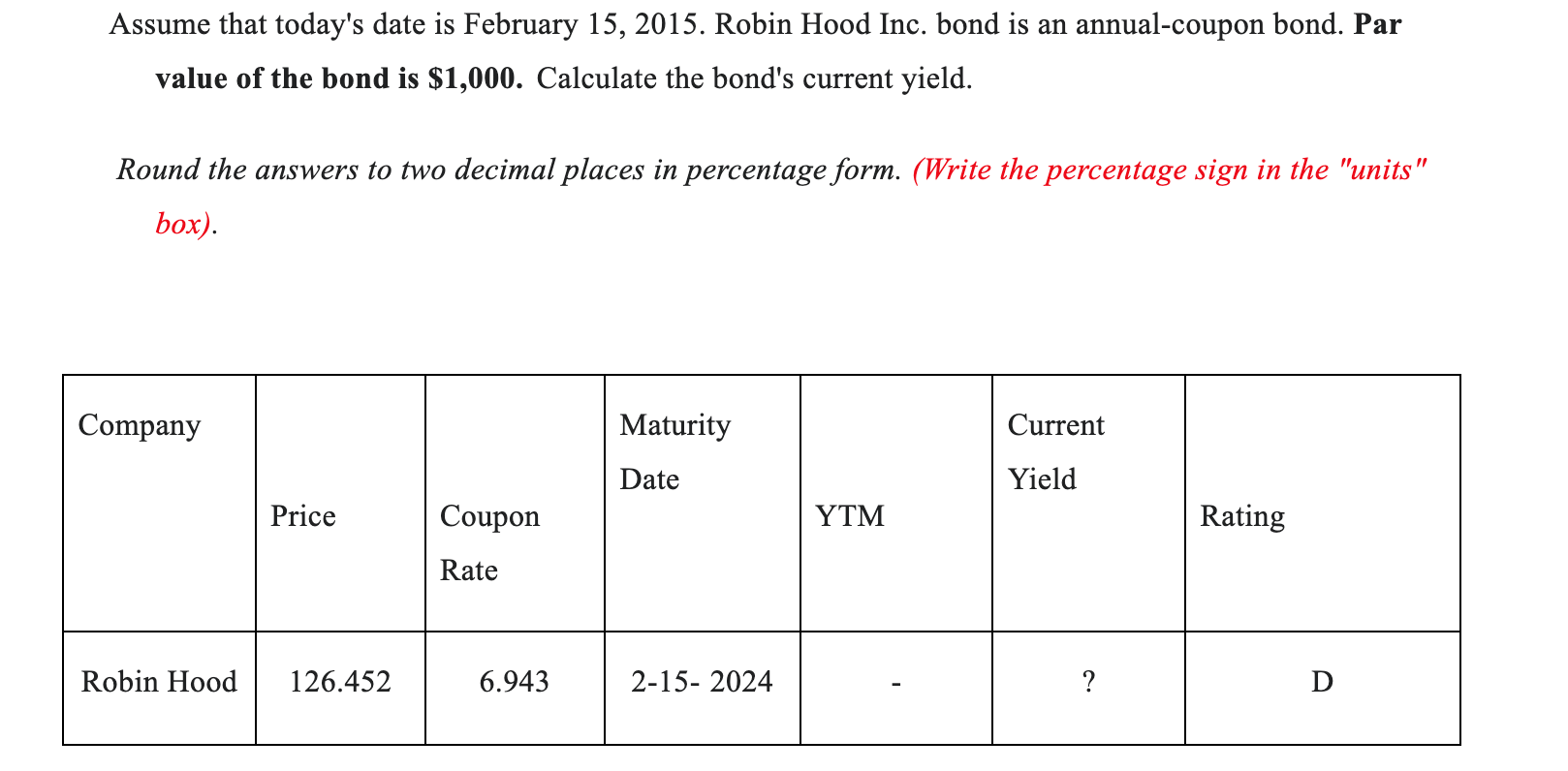

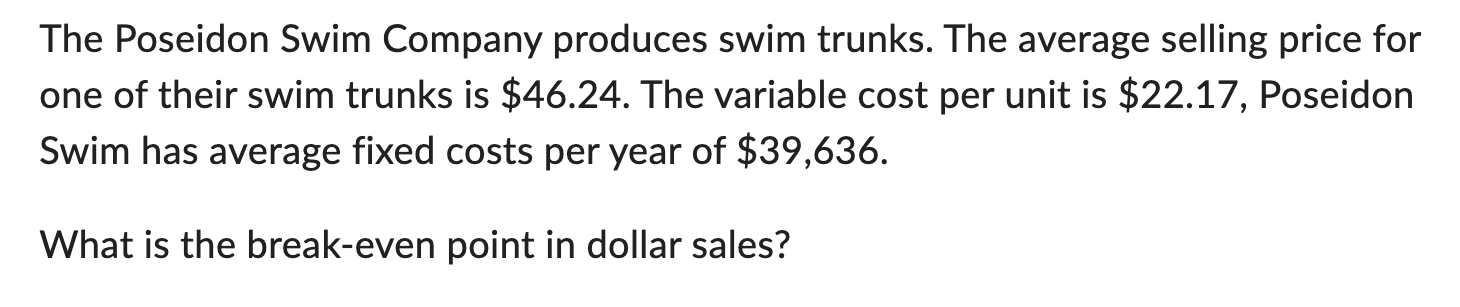

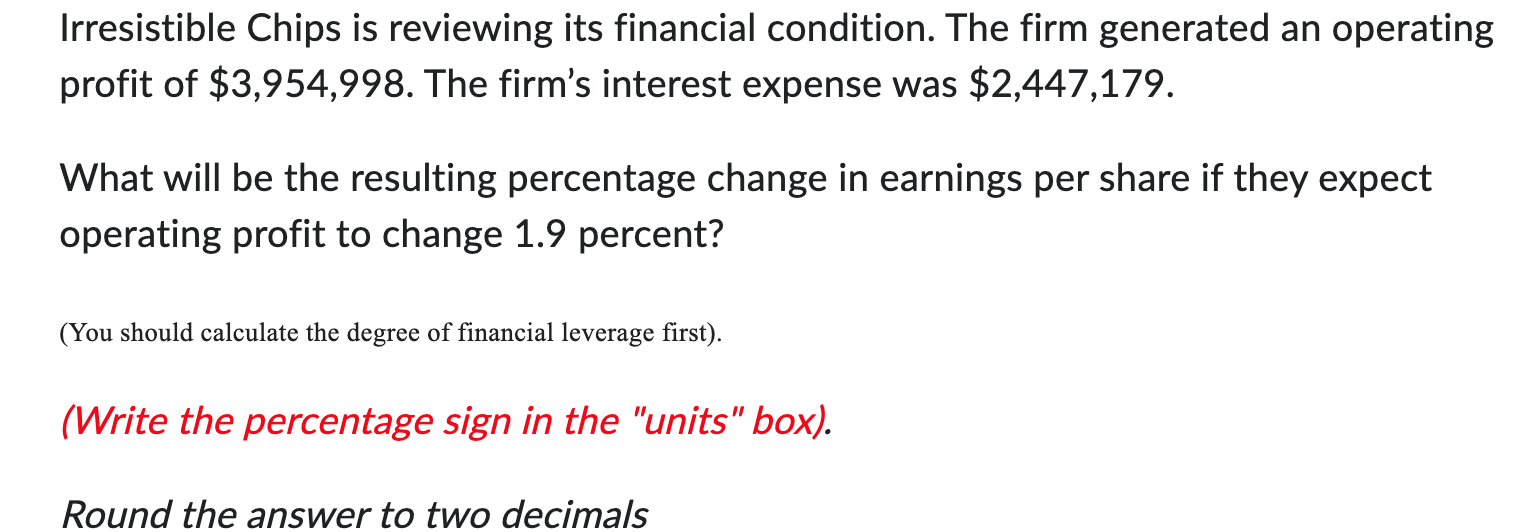

Haunted Forest, Inc.is selling fog machines. Use the following information about Haunted Forest, Inc. to answer the following questions. Average selling price per unit \\( \\$ 330 \\). Variable cost per unit \\( \\$ 211 \\) Units sold 376 Fixed costs \\( \\$ 17,686 \\) Interest expense \\( \\$ 4,184 \\) Based on the data above, what is the degree of total (combined) leverage of Haunted Forest, Inc.? Assume that today's date is February 15, 2015. Robin Hood Inc. bond is an annual-coupon bond. Par value of the bond is \\( \\mathbf{\\$ 1 , 0 0 0} \\). Calculate the bond's current yield. Round the answers to two decimal places in percentage form. (Write the percentage sign in the \"units\" box). The Poseidon Swim Company produces swim trunks. The average selling price for one of their swim trunks is \\( \\$ 46.24 \\). The variable cost per unit is \\( \\$ 22.17 \\), Poseidon Swim has average fixed costs per year of \\( \\$ 39,636 \\). What is the break-even point in dollar sales? Irresistible Chips is reviewing its financial condition. The firm generated an operating profit of \\( \\$ 3,954,998 \\). The firm's interest expense was \\( \\$ 2,447,179 \\). What will be the resulting percentage change in earnings per share if they expect operating profit to change 1.9 percent? (You should calculate the degree of financial leverage first). (Write the percentage sign in the \"units\" box)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started