Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions If the risk of a project is equal to that of the firm as a whole, the WACC for the project

please answer all questions

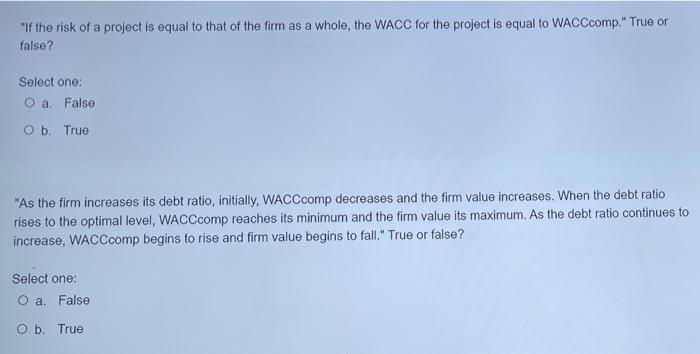

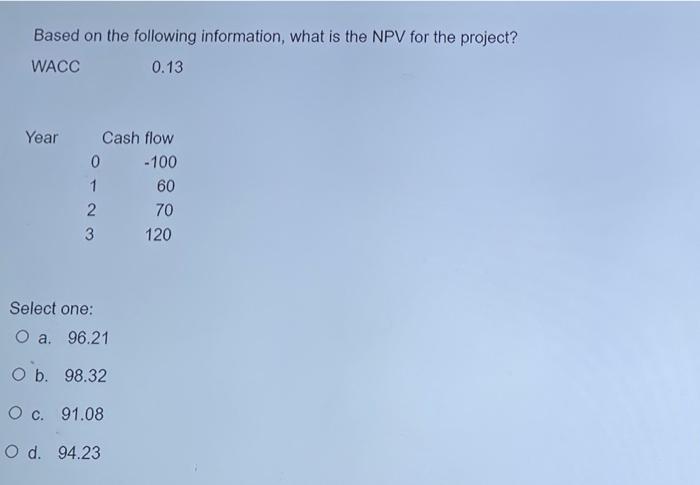

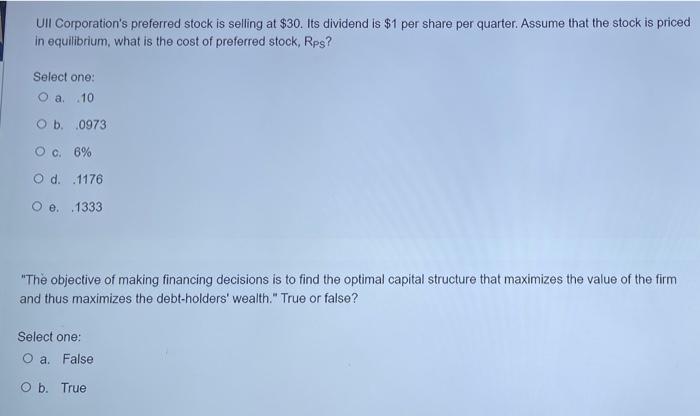

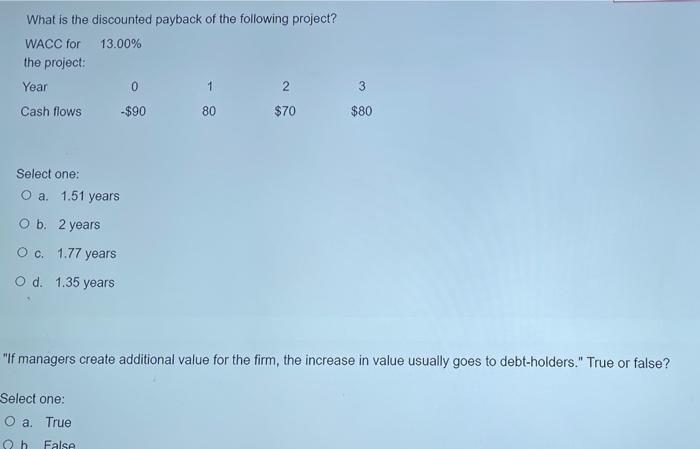

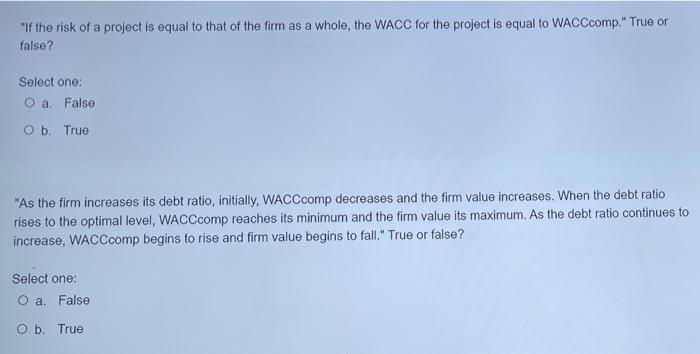

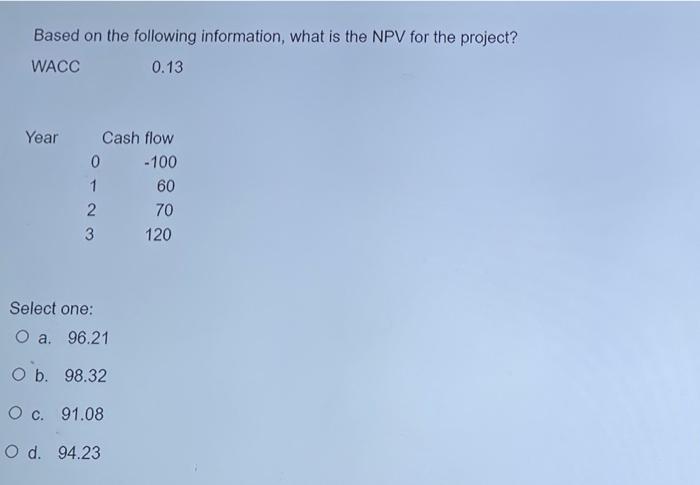

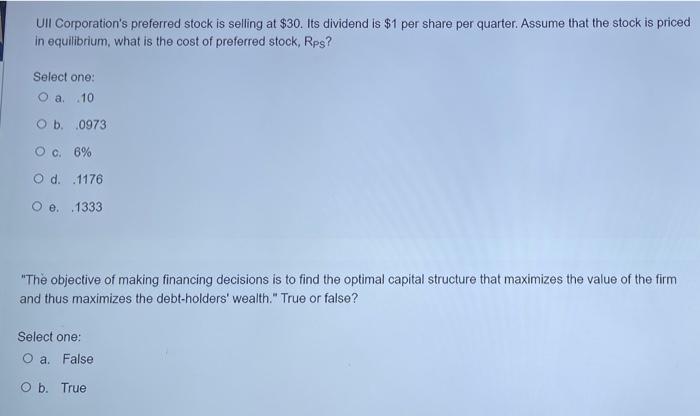

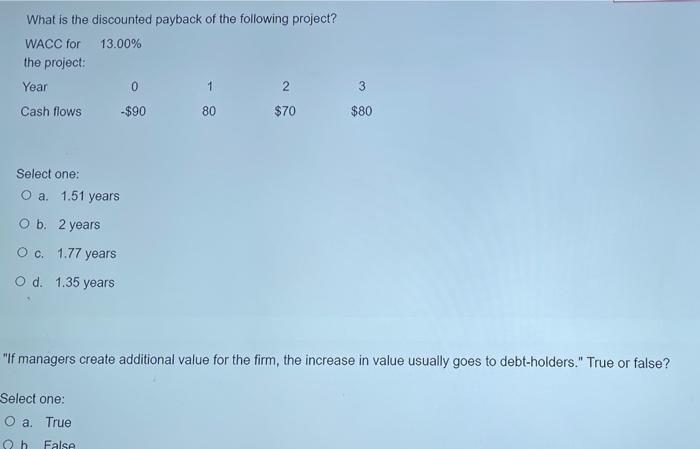

"If the risk of a project is equal to that of the firm as a whole, the WACC for the project is equal to WACCcomp." True or false? Select one: O a. False O b. True "As the firm increases its debt ratio, initially, WACCcomp decreases and the firm value increases. When the debt ratio rises to the optimal level, WACCcomp reaches its minimum and the firm value its maximum. As the debt ratio continues to increase, WACCcomp begins to rise and firm value begins to fall." True or false? Select one: O a. False O b. True Based on the following information, what is the NPV for the project? WACC 0.13 Year Cash flow 0 -100 1 60 2 70 3 120 Select one: O a. 96.21 Ob. 98.32 O c. 91.08 O d. 94.23 Ull Corporation's preferred stock is selling at $30. Its dividend is $1 per share per quarter. Assume that the stock is priced in equilibrium, what is the cost of preferred stock, Rps? Select one: O a 10 O b. 0973 O c. 6% Od 1176 O e. 1333 "The objective of making financing decisions is to find the optimal capital structure that maximizes the value of the firm and thus maximizes the debt-holders' wealth." True or false? Select one: O a False Ob. True What is the discounted payback of the following project? WACC for 13.00% the project: Year 2 Cash flows -$90 80 $70 0 1 3 $80 Select one: O a. 1.51 years O b. 2 years Oc. 1.77 years O d. 1.35 years "If managers create additional value for the firm, the increase in value usually goes to debt-holders." True or false? Select one: O a True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started