Answered step by step

Verified Expert Solution

Question

1 Approved Answer

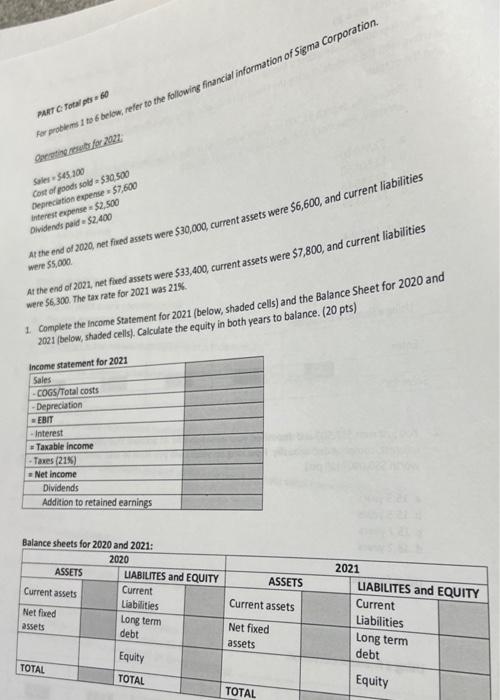

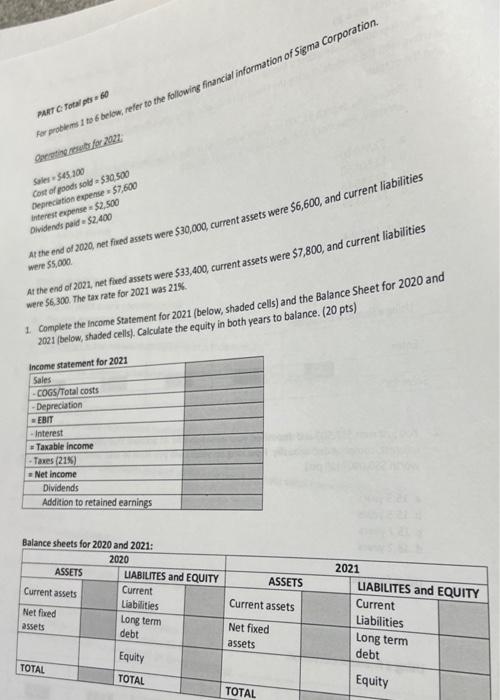

Please answer all questions n charts. Sales = $45,100 Cost of goods sold = $30,500 Depreciation expense = $7,600 Interest expense = $2,500 Dividends paid

Please answer all questions n charts.

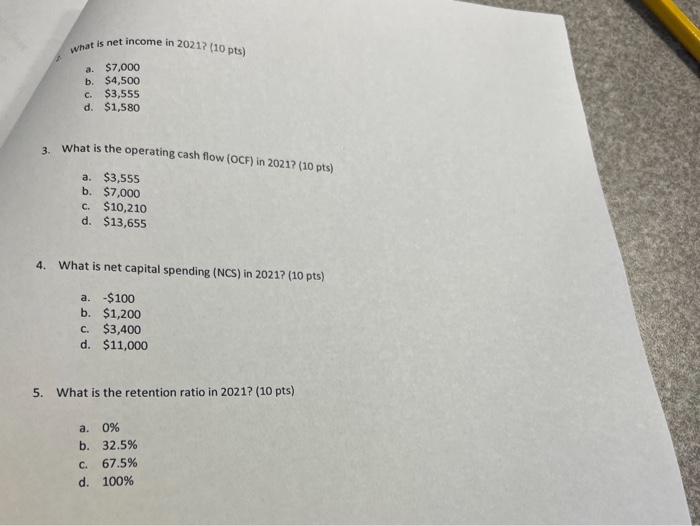

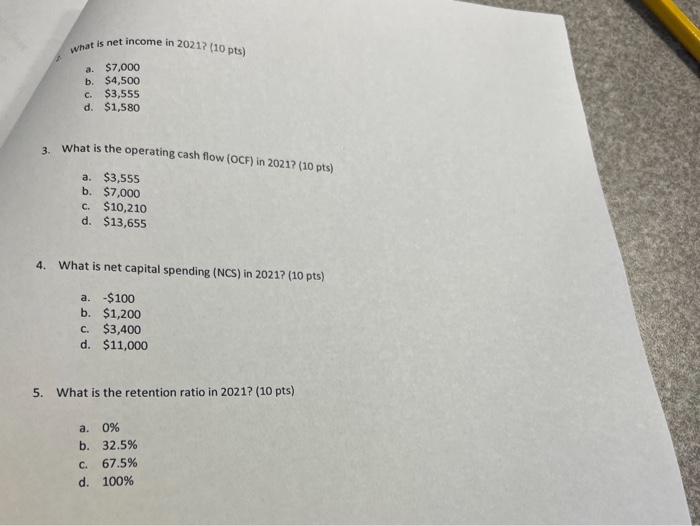

areatine ocosurfoce 2022 cost of poodis sold =530500 opprecation evense =57,600 interest epense =$2,500 At the end of 2020, net fured assets were $30,000, current assets were $6,600, and current liabilities were $5,000. At the end of 2021 , net fred assets were $33,400, current assets were $1,800, and current liabilities were 56,300 . The tax rate for 2021 was 21%. 1. Complete the income statement for 2021 (below, shaded cells) and the Balance sheet for 2020 and 2021 (below, shaded cells). Calculate the equity in both years to balance. ( 20pts ) What is net income in 2021 ? (10 pts) a. $7,000 b. $4,500 c. $3,555 d. $1,580 3. What is the operating cash flow (OCF) in 2021 ? (10 pts) a. $3,555 b. $7,000 c. $10,210 d. $13,655 4. What is net capital spending (NCS) in 2021? (10 pts) a. $100 b. $1,200 c. $3,400 d. $11,000 5. What is the retention ratio in 2021 ? (10 pts) a. 0% b. 32.5% c. 67.5% d. 100% Sales = $45,100

Cost of goods sold = $30,500

Depreciation expense = $7,600

Interest expense = $2,500

Dividends paid = $2,400

At the end of 2020, net fixed assets were $30,000, current assets were $6,600, and current liabilities

were $5,000.

At the end of 2021, net fixed assets were $33,400, current assets were $7,800, and current liabilities

were $6,300. The tax rate for 2021 was 21%.

Complete the Income Statement for 2021 (below, shaded cells) and the Balance Sheet for 2020 and

2021 (below, shaded cells). Calculate the equity in both years to balance. (20 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started