Please answer all questions, not just one. Thanks in advance!

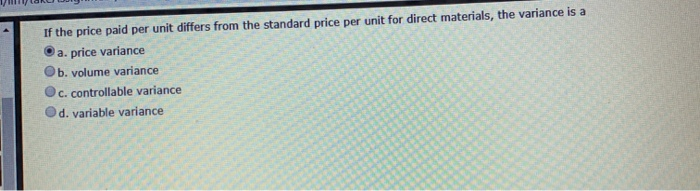

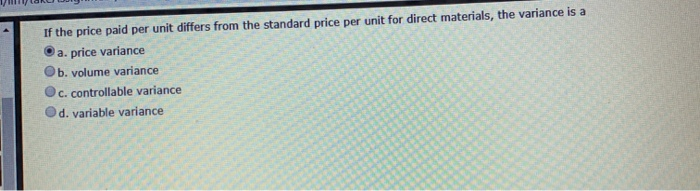

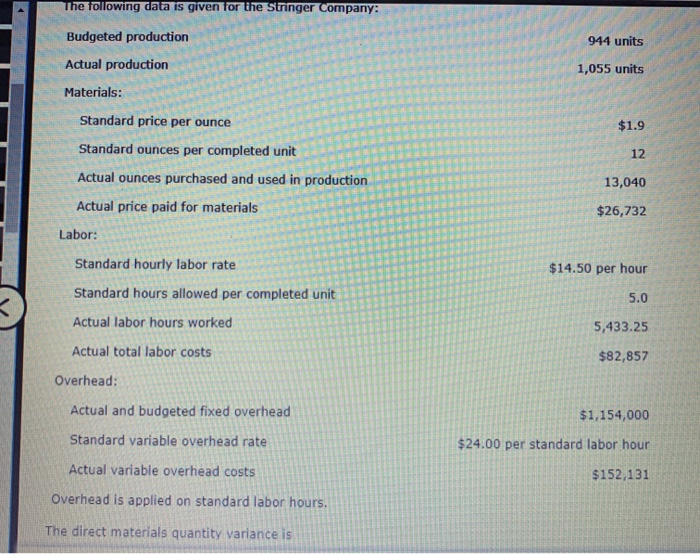

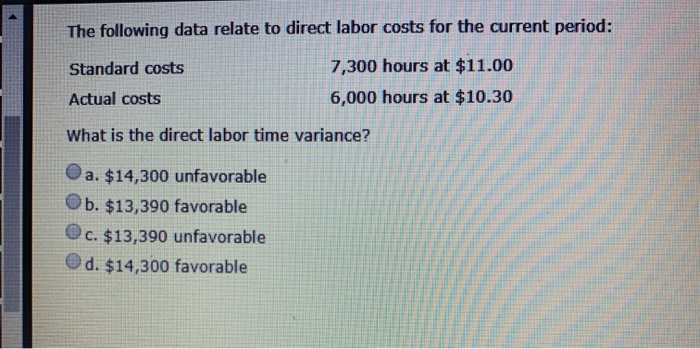

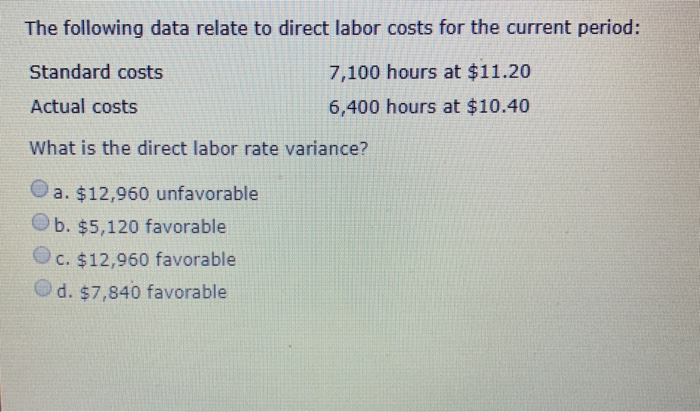

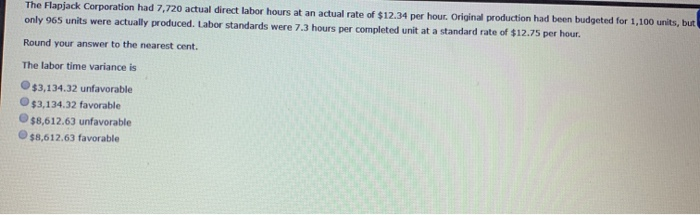

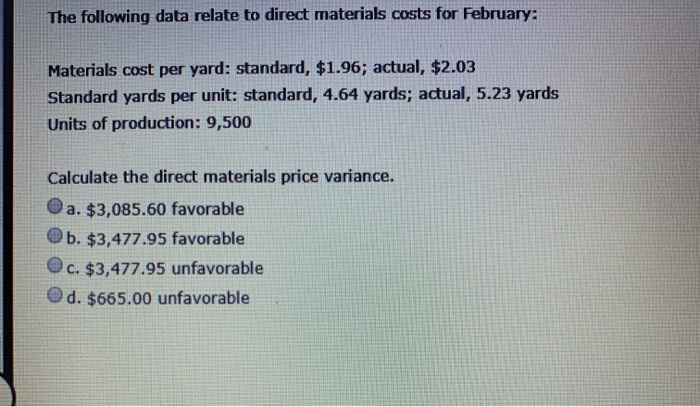

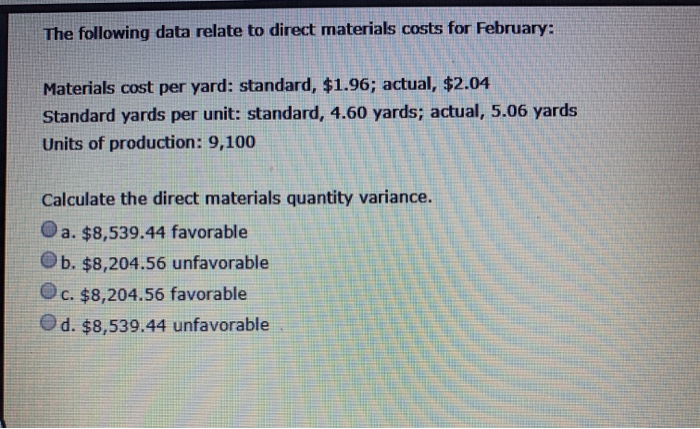

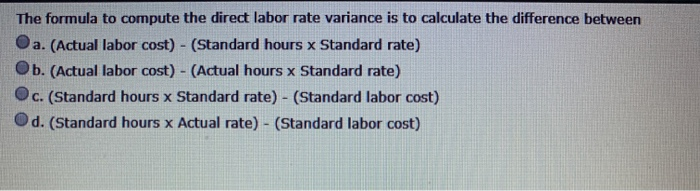

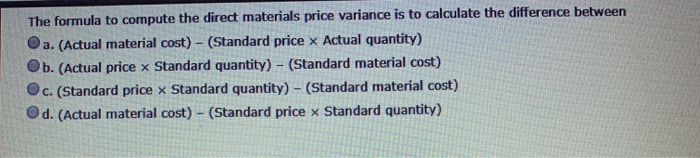

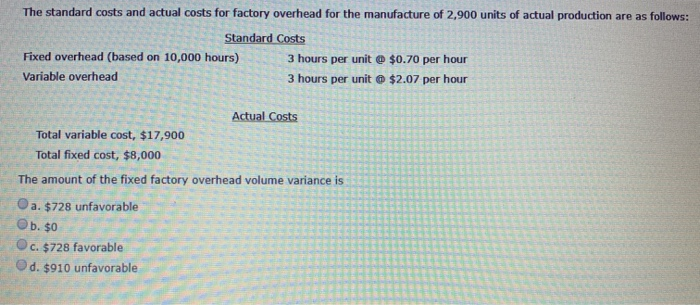

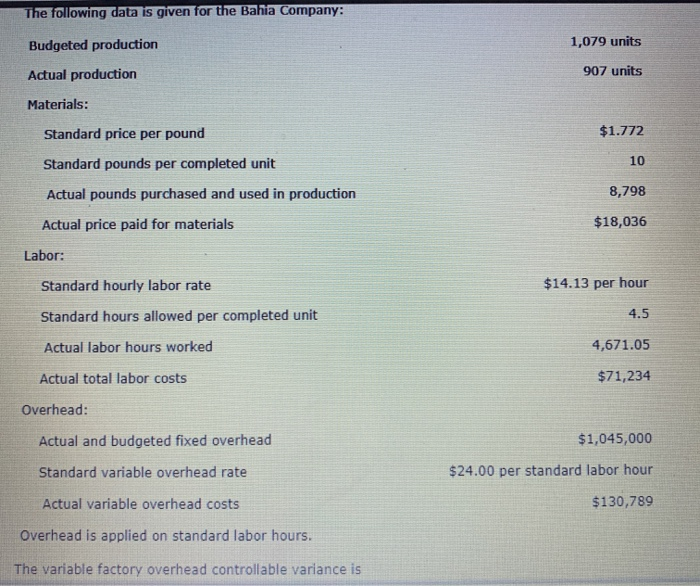

If the price paid per unit differs from the standard price per unit for direct materials, the variance is a a. price variance b. volume variance c. controllable variance d. variable variance od. variable variance The following data is given for the stringer Company: 944 units Budgeted production Actual production 1,055 units $1.9 Materials: Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in producti Actual price paid for materials 12 13,040 $26,732 Labor: $14.50 per hour Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked 5.0 5,433.25 $82,857 Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead rate Actual variable overhead costs Overhead is applied on standard labor hours. $1,154,000 $24.00 per standard labor hour $152,131 The direct materials quantity variance is The following data relate to direct labor costs for the current period: Standard costs 7,300 hours at $11.00 Actual costs 6,000 hours at $10.30 What is the direct labor time variance? a. $14,300 unfavorable b. $13,390 favorable c. $13,390 unfavorable d. $14,300 favorable The following data relate to direct labor costs for the current period: Standard costs Actual costs 7,100 hours at $11.20 6,400 hours at $10.40 What is the direct labor rate variance? a. $12,960 unfavorable b. $5,120 favorable c. $12,960 favorable d. $7,840 favorable The Flapjack Corporation had 7,720 actual direct labor hours at an actual rate of $12.34 per hour. Original production had been budgeted for 1.100 units, but only 965 units were actually produced, Labor standards were 7.3 hours per completed unit at a standard rate of $12.75 per hour Round your answer to the nearest cent. The labor time variance is $3,134.32 unfavorable $3,134.32 favorable $8,612.63 unfavorable $8,612.63 favorable The following data relate to direct materials costs for February: Materials cost per yard: standard, $1.96; actual, $2.03 Standard yards per unit: standard, 4.64 yards; actual, 5.23 yards Units of production: 9,500 Calculate the direct materials price variance. a. $3,085.60 favorable b. $3,477.95 favorable c. $3,477.95 unfavorable d. $665.00 unfavorable The following data relate to direct materials costs for February: Materials cost per yard: standard, $1.96; actual, $2.04 Standard yards per unit: standard, 4.60 yards; actual, 5.06 yards Units of production: 9,100 Calculate the direct materials quantity variance. a. $8,539.44 favorable b. $8,204.56 unfavorable Oc. $8,204.56 favorable d. $8,539.44 unfavorable The formula to compute the direct labor rate variance is to calculate the difference between Oa. (Actual labor cost) - (Standard hours x Standard rate) Ob. (Actual labor cost) - (Actual hours x Standard rate) Oc. (Standard hours x Standard rate) - (Standard labor cost) Od. (Standard hours x Actual rate) - (Standard labor cost) The formula to compute the direct materials price variance is to calculate the difference between a. (Actual material cost) - (Standard price x Actual quantity) Ob. (Actual price x Standard quantity) - (Standard material cost) c. (Standard price x Standard quantity) - (Standard material cost) Od. (Actual material cost) - (Standard price x Standard quantity) The standard costs and actual costs for factory overhead for the manufacture of 2,900 units of actual production are as follows: Standard Costs Fixed overhead (based on 10,000 hours) 3 hours per unit @ $0.70 per hour Variable overhead 3 hours per unit @ $2.07 per hour Actual Costs Total variable cost, $17,900 Total fixed cost, $8,000 The amount of the fixed factory overhead volume variance a. $728 unfavorable b. $0 c. $728 favorable d. $910 unfavorable The following data is given for the Bahia Company: Budgeted production 1,079 units 907 units Actual production Materials: Standard price per pound Standard pounds per completed unit $1.772 10 Actual pounds purchased and used in production 8,798 Actual price paid for materials $18,036 Labor: $14.13 per hour Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked 4.5 4,671.05 Actual total labor costs $71,234 Overhead: Actual and budgeted fixed overhead $1,045,000 Standard variable overhead rate Actual variable overhead costs Overhead is applied on standard labor hours. $24.00 per standard labor hour $130,789 The variable factory overhead controllable variance is