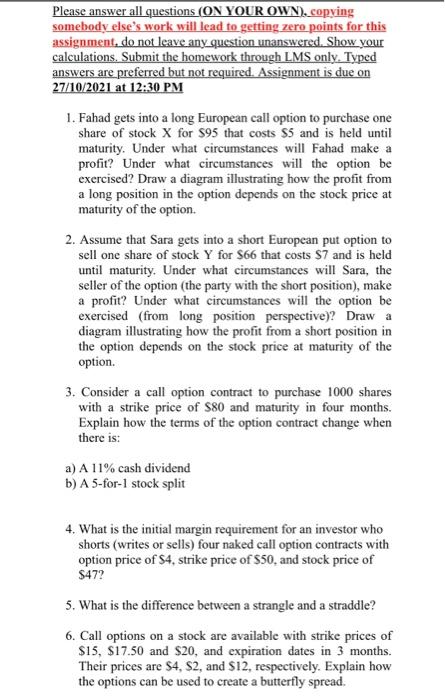

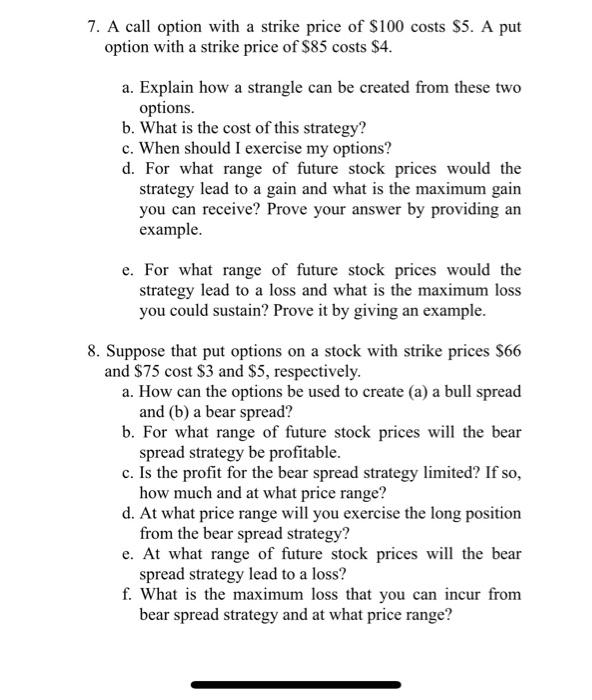

Please answer all questions (ON YOUR OWN), copying somebody else's work will lead to getting zero points for this assignment, do not leave any question unanswered. Show your calculations. Submit the homework through LMS only. Typed answers are preferred but not required. Assignment is due on 27/10/2021 at 12:30 PM 1. Fahad gets into a long European call option to purchase one share of stock X for $95 that costs $5 and is held until maturity. Under what circumstances will Fahad make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option 2. Assume that Sara gets into a short European put option to sell one share of stock Y for $66 that costs $7 and is held until maturity. Under what circumstances will Sara, the seller of the option (the party with the short position), make a profit? Under what circumstances will the option be exercised (from long position perspective)? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the option. 3. Consider a call option contract to purchase 1000 shares with a strike price of $80 and maturity in four months. Explain how the terms of the option contract change when there is: a) A 11% cash dividend b) A 5-for-1 stock split 4. What is the initial margin requirement for an investor who shorts (writes or sells) four naked call option contracts with option price of S4, strike price of $50, and stock price of $472 5. What is the difference between a strangle and a straddle? 6. Call options on a stock are available with strike prices of $15, $17.50 and $20, and expiration dates in 3 months. Their prices are S4, S2, and $12, respectively. Explain how the options can be used to create a butterfly spread. 7. A call option with a strike price of $100 costs $5. A put option with a strike price of $85 costs $4. a. Explain how a strangle can be created from these two options. b. What is the cost of this strategy? c. When should I exercise my options? d. For what range of future stock prices would the strategy lead to a gain and what is the maximum gain you can receive? Prove your answer by providing an example. e. For what range of future stock prices would the strategy lead to a loss and what is the maximum loss you could sustain? Prove it by giving an example. 8. Suppose that put options on a stock with strike prices $66 and $75 cost $3 and $5, respectively. a. How can the options be used to create (a) a bull spread and (b) a bear spread? b. For what range of future stock prices will the bear spread strategy be profitable. c. Is the profit for the bear spread strategy limited? If so, how much and at what price range? d. At what price range will you exercise the long position from the bear spread strategy? e. At what range of future stock prices will the bear spread strategy lead to a loss? f. What is the maximum loss that you can incur from bear spread strategy and at what price range