Answered step by step

Verified Expert Solution

Question

1 Approved Answer

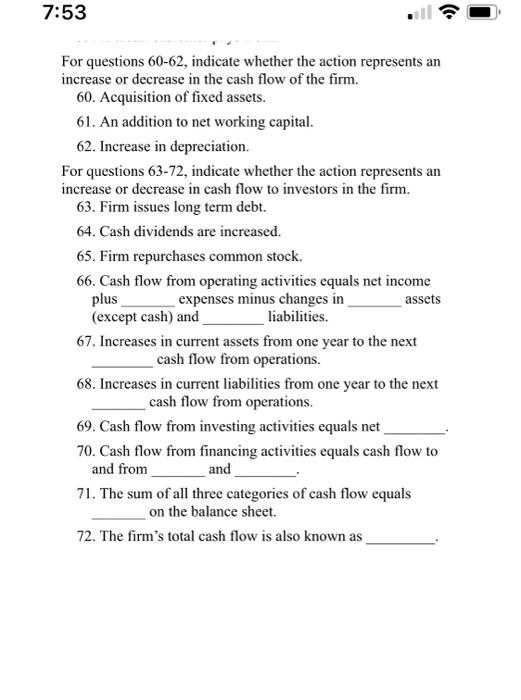

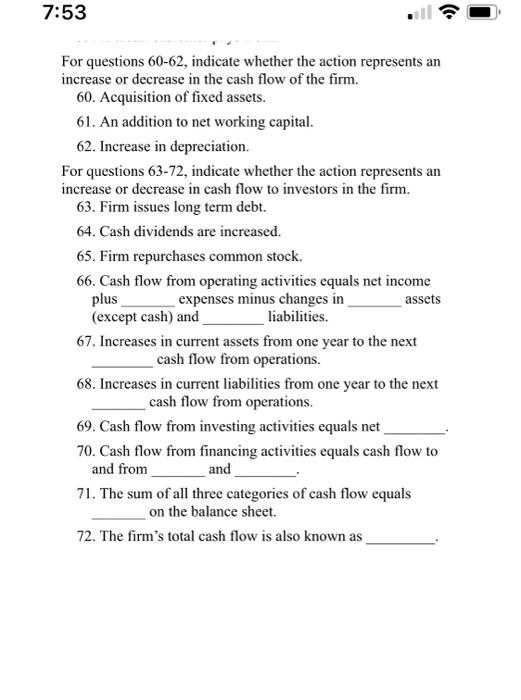

please answer all questions or dont answer at all For questions 60-62, indicate whether the action represents an increase or decrease in the cash flow

please answer all questions or dont answer at all

For questions 60-62, indicate whether the action represents an increase or decrease in the cash flow of the firm. 60. Acquisition of fixed assets. 61. An addition to net working capital. 62. Increase in depreciation. For questions 63-72, indicate whether the action represents an increase or decrease in cash flow to investors in the firm. 63. Firm issues long term debt. 64. Cash dividends are increased. 65. Firm repurchases common stock. 66. Cash flow from operating activities equals net income plus expenses minus changes in assets (except cash) and liabilities. 67. Increases in current assets from one year to the next cash flow from operations. 68. Increases in current liabilities from one year to the next cash flow from operations. 69. Cash flow from investing activities equals net 70. Cash flow from financing activities equals cash flow to and from and 71. The sum of all three categories of cash flow equals on the balance sheet. 72. The firm's total cash flow is also known as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started