Answered step by step

Verified Expert Solution

Question

1 Approved Answer

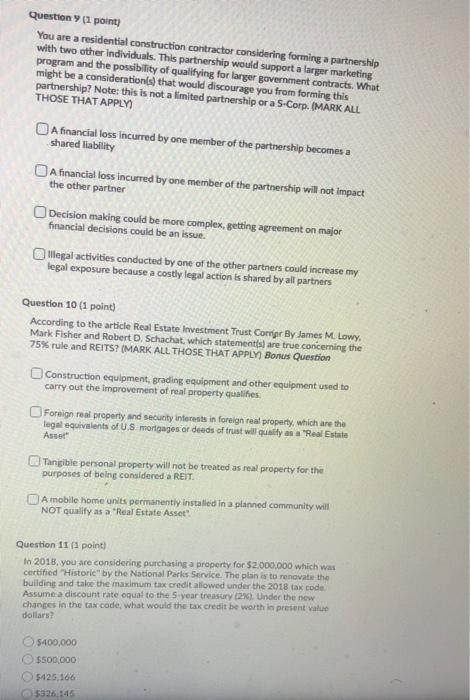

please answer all questions posted #9-11 thanks Question 1 point) You are a residential construction contractor considering forming a partnership with two other individuals. This

please answer all questions posted #9-11 thanks

Question 1 point) You are a residential construction contractor considering forming a partnership with two other individuals. This partnership would support a larger marketing program and the possibility of qualifying for larger government contracts. What might be a considerationis) that would discourage you from forming this partnership? Note: this is not a limited partnership or a 5-Corp. (MARK ALL THOSE THAT APPLY A financial loss incurred by one member of the partnership becomes a shared liability A financial loss incurred by one member of the partnership will not impact the other partner Decision making could be more complex, getting agreement on major financial decisions could be an issue. legal activities conducted by one of the other partners could increase my legal exposure because a costly legal action is shared by all partners Question 10 (1 point) According to the article Real Estate Investment Trust Commor By James M. Lowy Mark Fisher and Robert D. Schachat which statements are true concerning the 75% rule and REITS? (MARK ALL THOSE THAT APPLY) Bonus Question Construction equipment, grading equipment and other equipment used to carry out the improvement of real property qualifies Foreign real property and security interests in foreign real property, which are the legal equivalent of U.S. mortgages or deeds of trust will quality as a "Real Estate Asset" Tangible personal property will not be treated as real property for the purposes of being considered a REIT. A mobile home units permanently installed in a planned community will NOT qualify as a "Real Estate Asset Question 111 point) In 2018, you are considering purchasing a property for $2.000.000 which was certified "Historie" by the National Parks Service. The plan is to renovate the building and take the maximum tax credit allowed under the 2018 tax code Assume a discount rate equal to the 5-year treasury (26). Under the new changes in the tax code, what would the tax credit be worth in present value dollars? 5400,000 $500,000 $425,166 5326,145

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started