Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL QUESTIONS! Potter's Violin Co. has just issued nonconvertible preferred stock with a par value of ( $ 100 ) and an annual

PLEASE ANSWER ALL QUESTIONS!

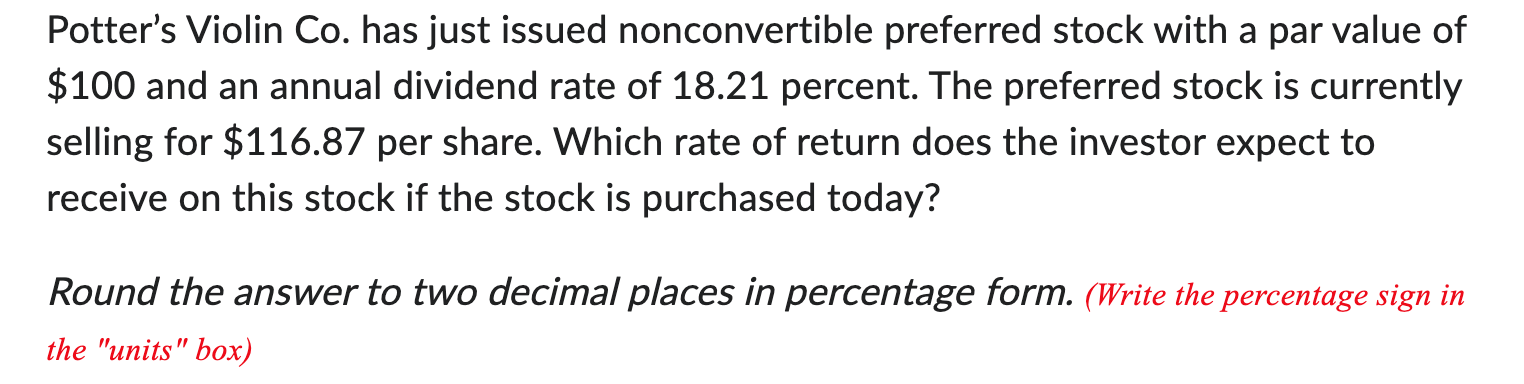

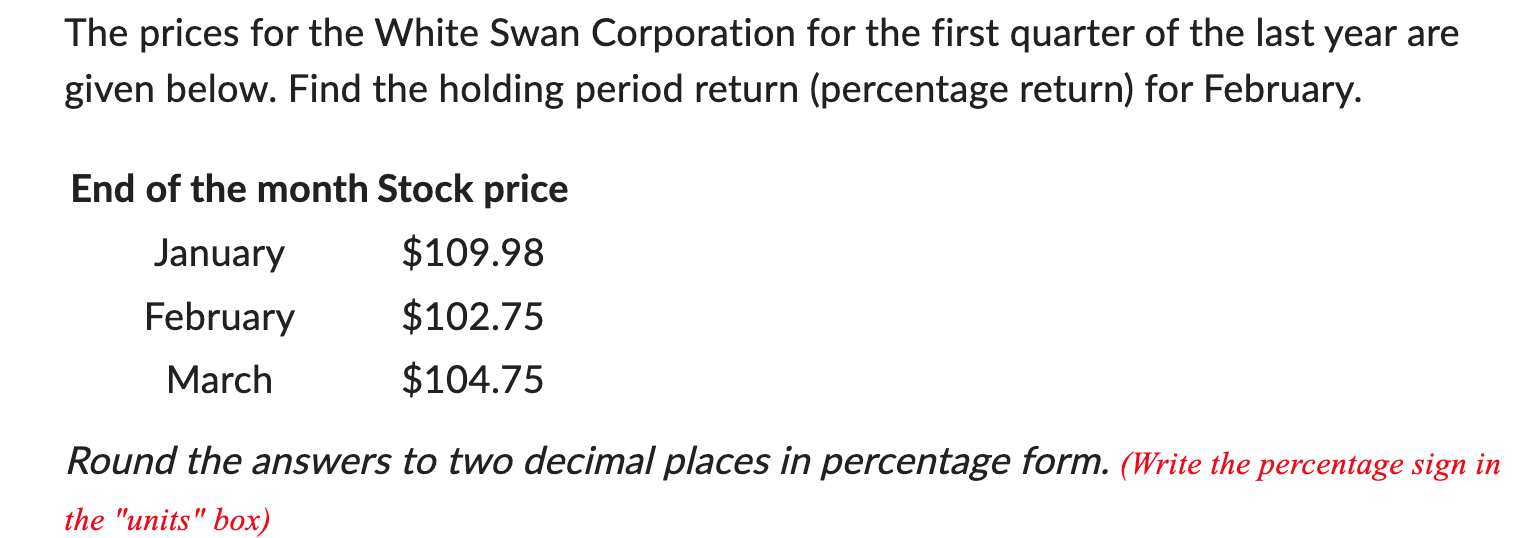

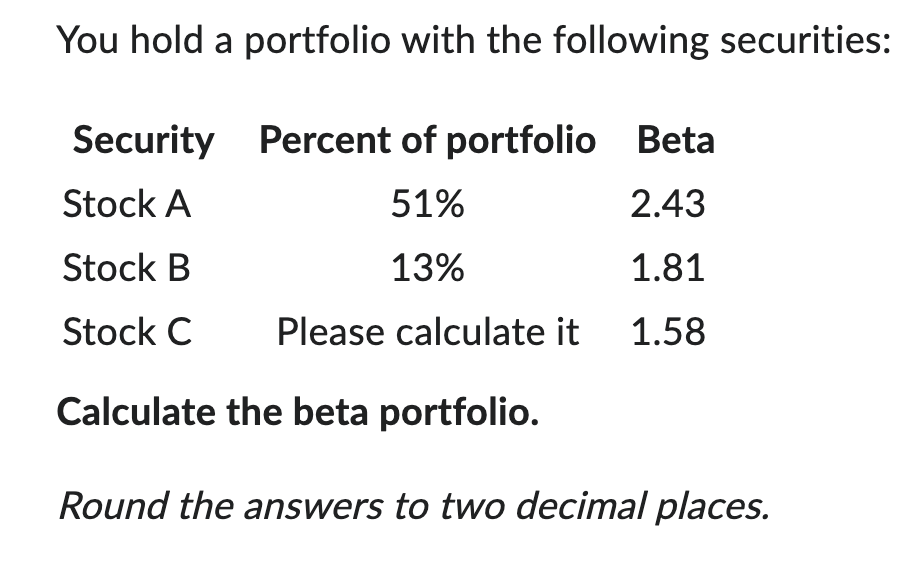

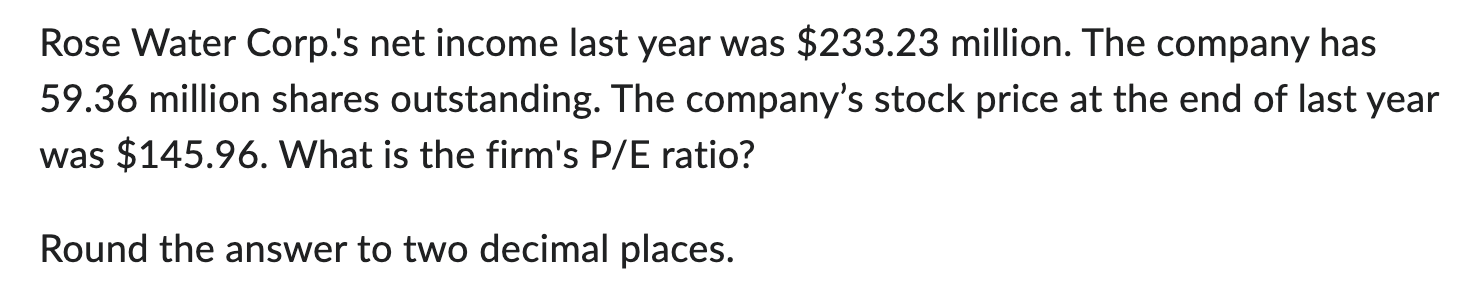

Potter's Violin Co. has just issued nonconvertible preferred stock with a par value of \\( \\$ 100 \\) and an annual dividend rate of 18.21 percent. The preferred stock is currently selling for \\( \\$ 116.87 \\) per share. Which rate of return does the investor expect to receive on this stock if the stock is purchased today? Round the answer to two decimal places in percentage form. (Write the percentage sign in the \"units\" box) The prices for the White Swan Corporation for the first quarter of the last year are given below. Find the holding period return (percentage return) for February. Round the answers to two decimal places in percentage form. (Write the percentage sign in the \"units\" box) You hold a portfolio with the following securities: Calculate the beta portfolio. Round the answers to two decimal places. Rose Water Corp.'s net income last year was \\( \\$ 233.23 \\) million. The company has 59.36 million shares outstanding. The company's stock price at the end of last year was \\( \\$ 145.96 \\). What is the firm's \\( P / E \\) ratio? Round the answer to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started