Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions Problem 4 - Goodwill Refer to the Valuing Goodwill reading posted on Blackboard to help with this problem. The president of

Please answer all questions

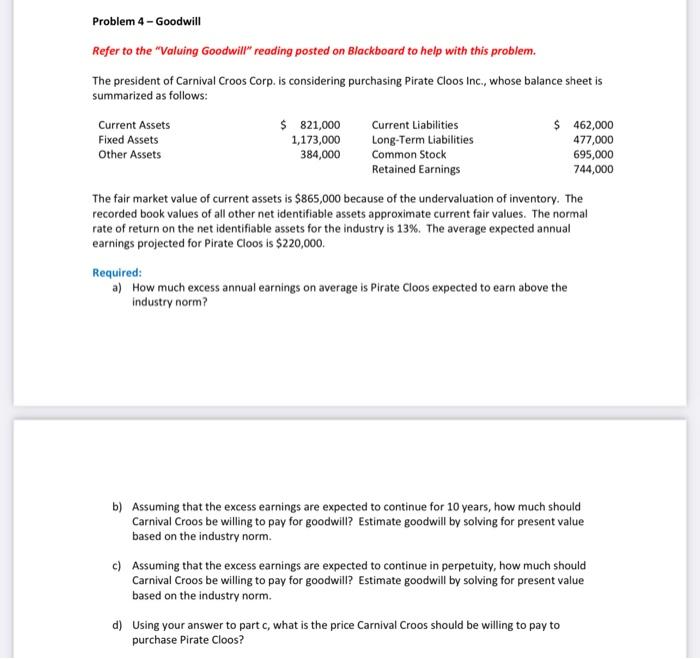

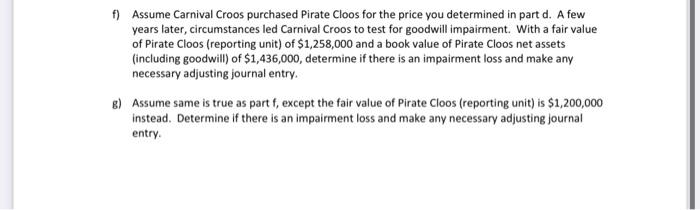

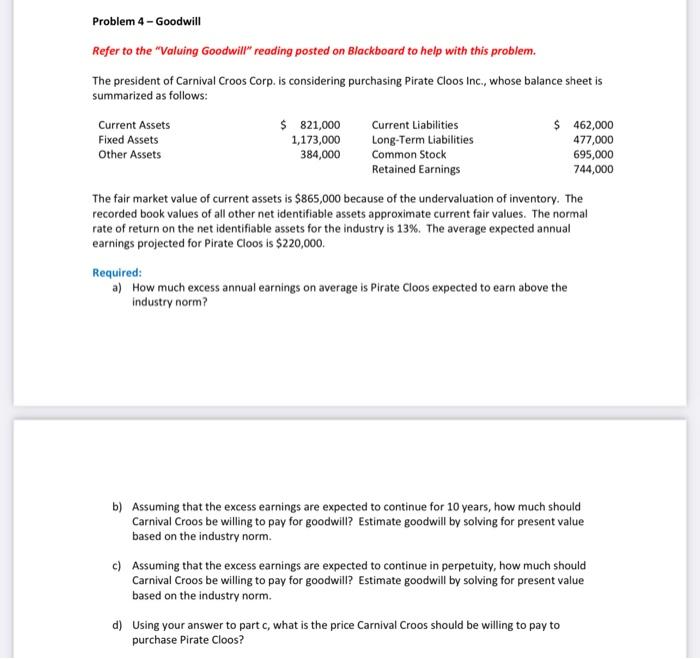

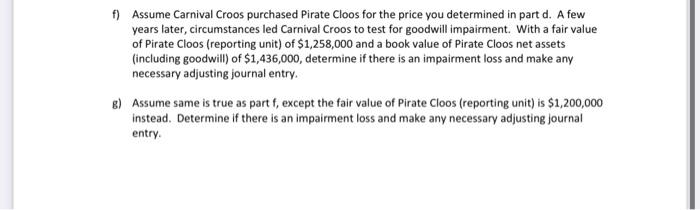

Problem 4 - Goodwill Refer to the "Valuing Goodwill" reading posted on Blackboard to help with this problem. The president of Carnival Croos Corp. is considering purchasing Pirate Cloos Inc., whose balance sheet is summarized as follows: Current Assets $ 821,000 Current Liabilities $ 462,000 Fixed Assets 1,173,000 Long-Term Liabilities 477,000 Other Assets 384,000 Common Stock 695,000 Retained Earnings 744,000 The fair market value of current assets is $865,000 because of the undervaluation of inventory. The recorded book values of all other net identifiable assets approximate current fair values. The normal rate of return on the net identifiable assets for the industry is 13%. The average expected annual earnings projected for Pirate Cloos is $220,000, Required: a) How much excess annual earnings on average is Pirate Cloos expected to earn above the industry norm? b) Assuming that the excess earnings are expected to continue for 10 years, how much should Carnival Croos be willing to pay for goodwill? Estimate goodwill by solving for present value based on the industry norm. c) Assuming that the excess earnings are expected to continue in perpetuity, how much should Carnival Croos be willing to pay for goodwill? Estimate goodwill by solving for present value based on the industry norm. d) Using your answer to part c, what is the price Carnival Croos should be willing to pay to purchase Pirate Cloos? f) Assume Carnival Croos purchased Pirate Cloos for the price you determined in part d. A few years later, circumstances led Carnival Croos to test for goodwill impairment. With a fair value of Pirate Cloos (reporting unit) of $1,258,000 and a book value of Pirate Cloos net assets (including goodwill) of $1,436,000, determine if there is an impairment loss and make any necessary adjusting journal entry. B) Assume same is true as part f, except the fair value of Pirate Cloos (reporting unit) is $1,200,000 instead. Determine if there is an impairment loss and make any necessary adjusting journal entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started