Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions! Question 2 . ILI corporation manufactures surgical masks. The corporation has spent $38m in fixed production costs (excluding depreciation cost). Each

Please answer all questions!

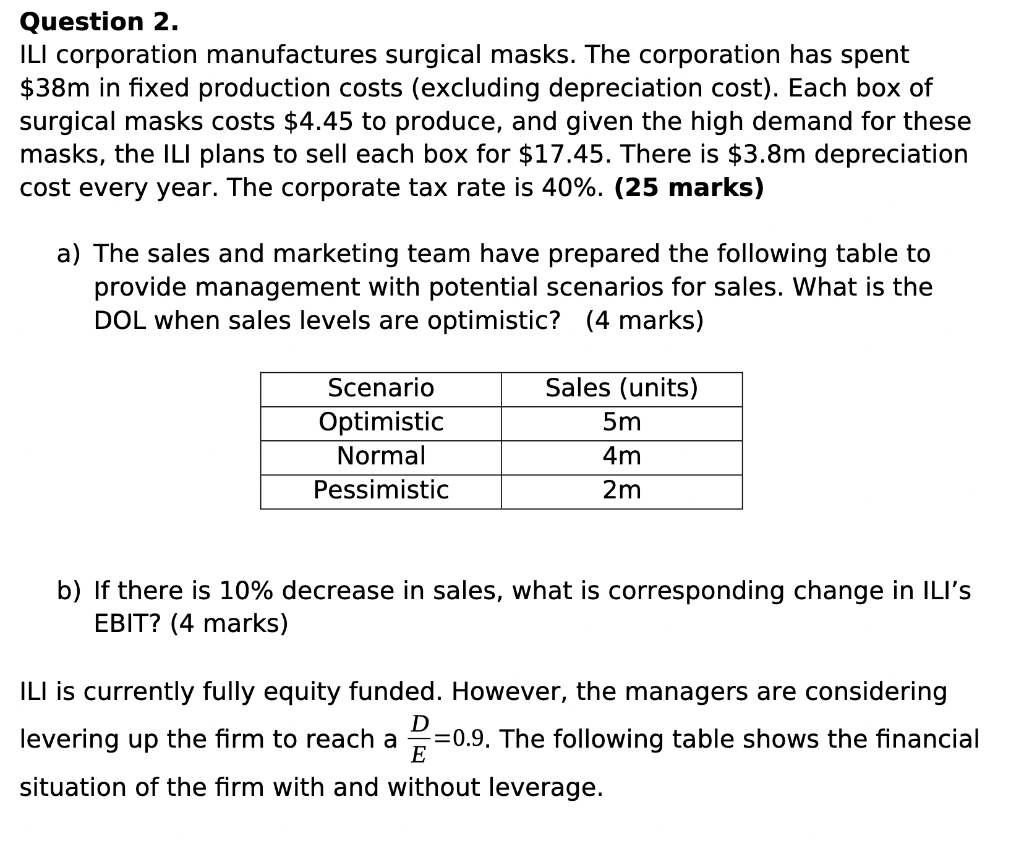

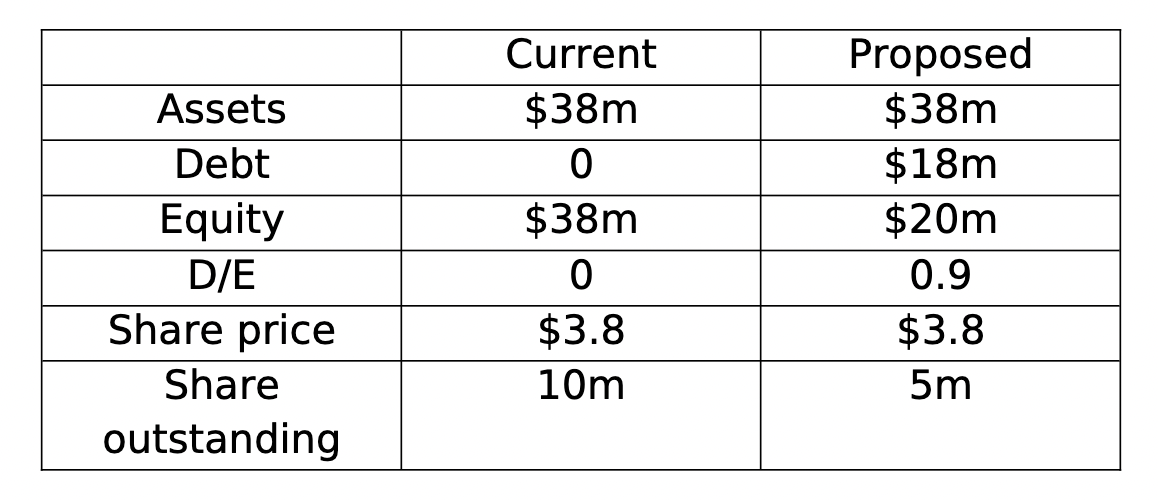

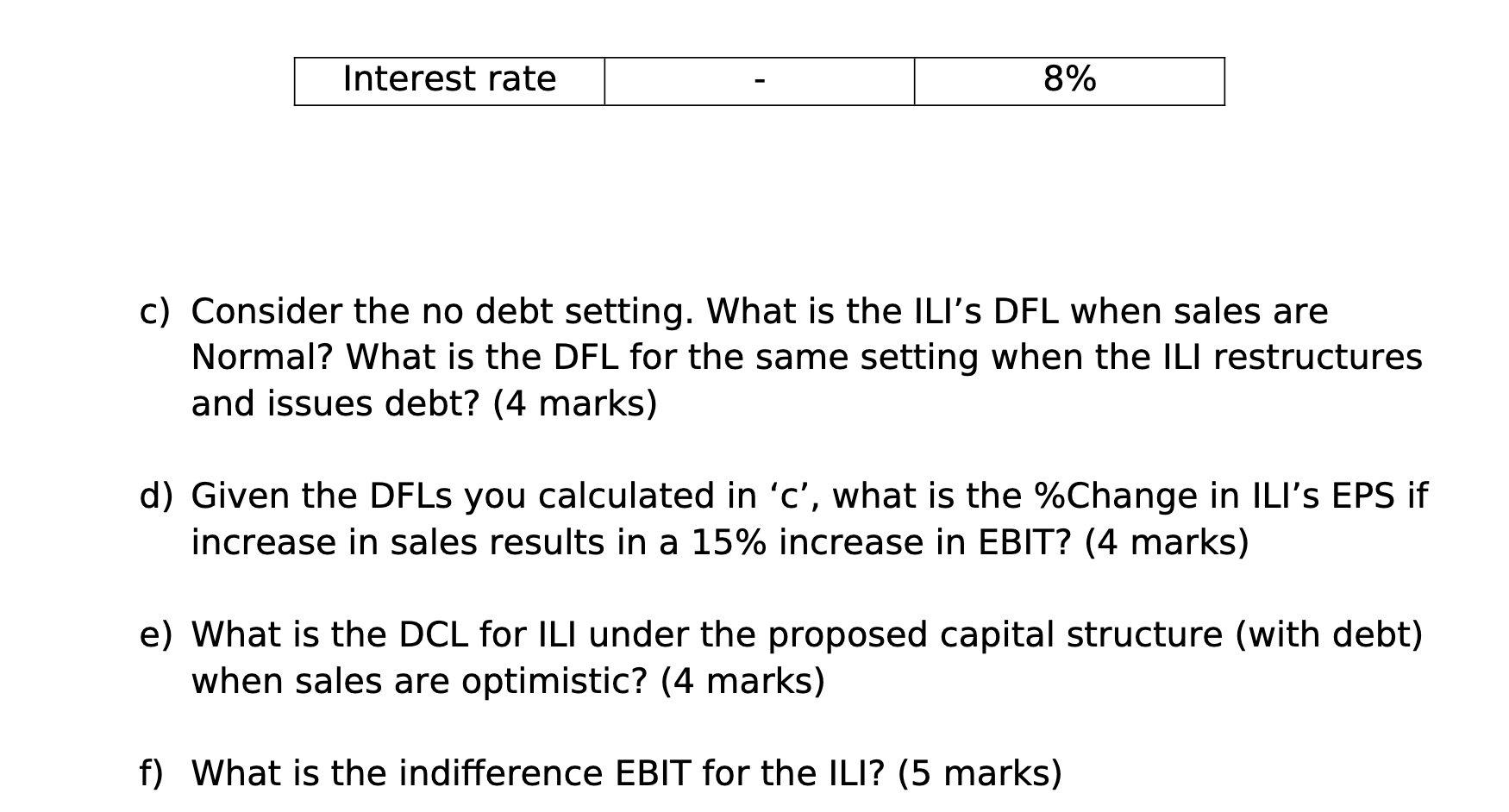

Question 2 . ILI corporation manufactures surgical masks. The corporation has spent $38m in fixed production costs (excluding depreciation cost). Each box of surgical masks costs $4.45 to produce, and given the high demand for these masks, the ILI plans to sell each box for $17.45. There is $3.8m depreciation cost every year. The corporate tax rate is 40%. (25 marks) a) The sales and marketing team have prepared the following table to provide management with potential scenarios for sales. What is the DOL when sales levels are optimistic? (4 marks) b) If there is 10% decrease in sales, what is corresponding change in ILI's EBIT? (4 marks) ILI is currently fully equity funded. However, the managers are considering levering up the firm to reach a ED=0.9. The following table shows the financial situation of the firm with and without leverage. \begin{tabular}{|c|c|c|} \hline & Current & Proposed \\ \hline Assets & $38m & $38m \\ \hline Debt & 0 & $18m \\ \hline Equity & $38m & $20m \\ \hline D/E & 0 & 0.9 \\ \hline Share price & $3.8 & $3.8 \\ \hline Share outstanding & 10m & 5m \\ \hline \end{tabular} c) Consider the no debt setting. What is the ILI's DFL when sales are Normal? What is the DFL for the same setting when the ILI restructures and issues debt? (4 marks) d) Given the DFLs you calculated in ' c ', what is the \%Change in ILI's EPS if increase in sales results in a 15% increase in EBIT? (4 marks) e) What is the DCL for ILI under the proposed capital structure (with debt) when sales are optimistic? (4 marks) f) What is the indifference EBIT for the ILIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started