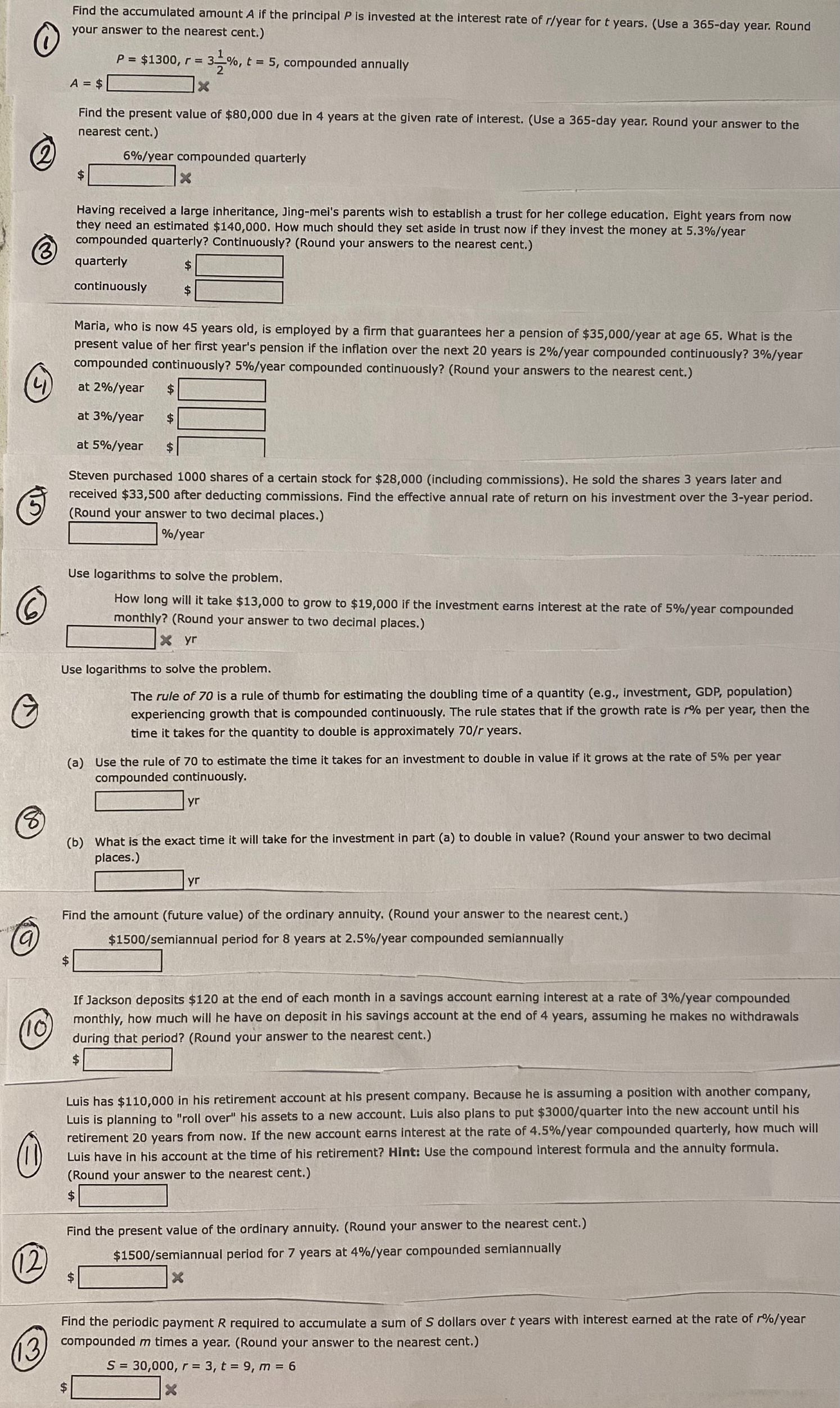

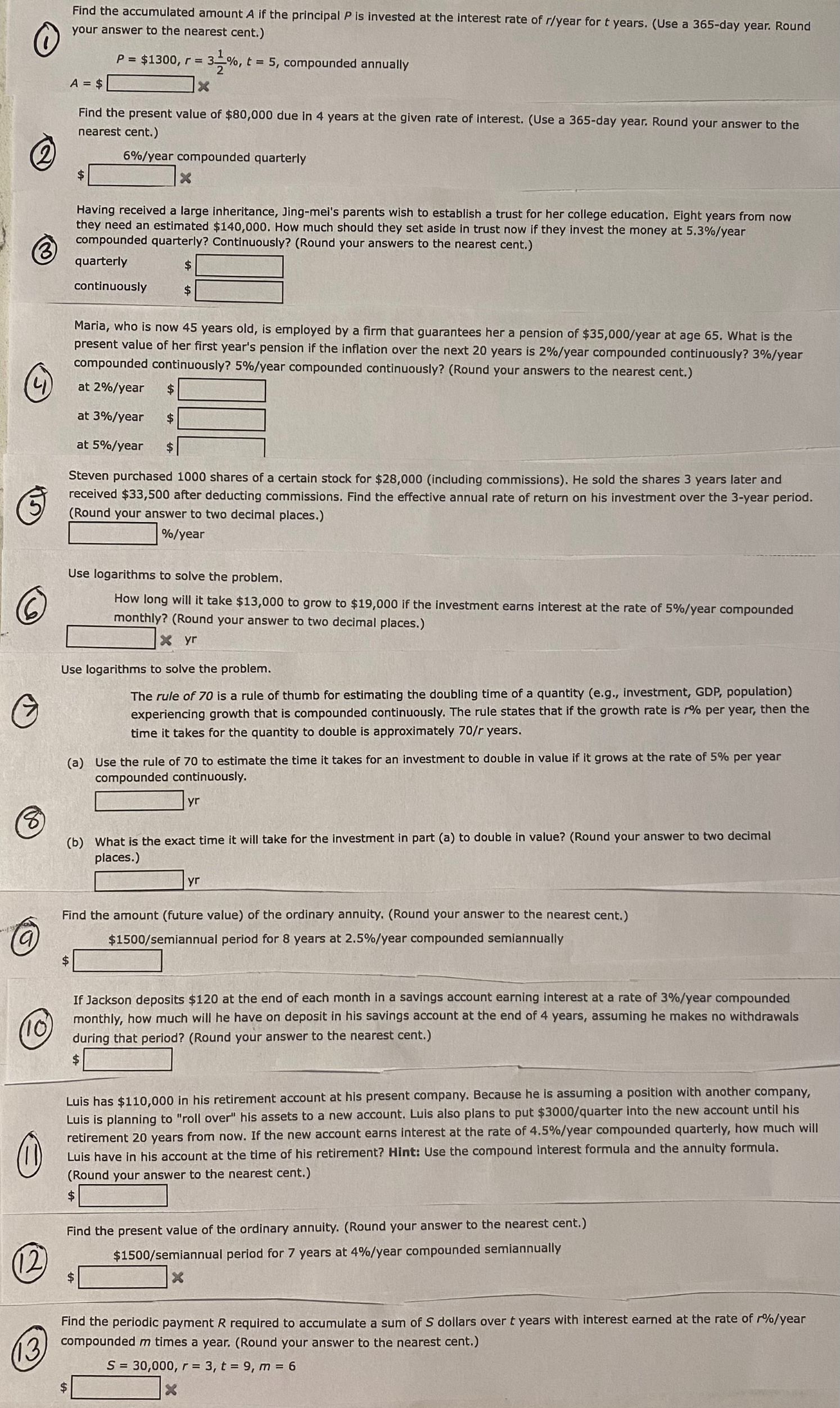

Please answer all questions. Thank you.

P=$1300,r=321%,t=5, compounded annually A=$ Find the present value of $80,000 due in 4 years at the given rate of interest. (Use a 365 -day year. Round your answer to the nearest cent.) 2) 6%/ year compounded quarterly Having received a large inheritance, Jing-mei's parents wish to establish a trust for her college education. Eight years from now they need an estimated $140,000. How much should they set aside in trust now if they invest the money at 5,3%/ year (3) compounded quarterly? Continuously? (Round your answers to the nearest cent.) quarterly continuously Maria, who is now 45 years old, is employed by a firm that guarantees her a pension of $35,000/y year at age 65 . What is the present value of her first year's pension if the inflation over the next 20 years is 2%/ year compounded continuously? 3%/y ear compounded continuously? 5\%/year compounded continuously? (Round your answers to the nearest cent.) at 2%/ year $ at 3%/year at 5%/ year Steven purchased 1000 shares of a certain stock for $28,000 (including commissions). He sold the shares 3 years later and received $33,500 after deducting commissions. Find the effective annual rate of return on his investment over the 3 -year period. (Round your answer to two decimal places.) %/ year Use logarithms to solve the problem. How long will it take $13,000 to grow to $19,000 if the investment earns interest at the rate of 5%/ year compounded monthly? (Round your answer to two decimal places.) \& yr Use logarithms to solve the problem. The rule of 70 is a rule of thumb for estimating the doubling time of a quantity (e.g., investment, GDP, population) experiencing growth that is compounded continuously. The rule states that if the growth rate is r% per year, then the time it takes for the quantity to double is approximately 70/r years. (a) Use the rule of 70 to estimate the time it takes for an investment to double in value if it grows at the rate of 5% per year compounded continuously. (b) What is the exact time it will take for the investment in part (a) to double in value? (Round your answer to two decimal places.) Find the amount (future value) of the ordinary annuity. (Round your answer to the nearest cent.) $1500/ semiannual period for 8 years at 2.5%/ year compounded semiannually If Jackson deposits $120 at the end of each month in a savings account earning interest at a rate of 3%/ year compounded monthly, how much will he have on deposit in his savings account at the end of 4 years, assuming he makes no withdrawals during that period? (Round your answer to the nearest cent.) $ Luis has $110,000 in his retirement account at his present company. Because he is assuming a position with another company, Luis is planning to "roll over" his assets to a new account. Luis also plans to put $3000/ quarter into the new account until his retirement 20 years from now. If the new account earns interest at the rate of 4.5%/ year compounded quarterly, how much will Luis have in his account at the time of his retirement? Hint: Use the compound interest formula and the annuity formula. (Round your answer to the nearest cent.) $ Find the present value of the ordinary annuity. (Round your answer to the nearest cent.) $1500/ semiannual period for 7 years at 4%/ year compounded semiannually Find the periodic payment R required to accumulate a sum of S dollars over t years with interest earned at the rate of r\%/year compounded m times a year. (Round your answer to the nearest cent.) S=30,000,r=3,t=9,m=6