Please answer all questions. Thank You!

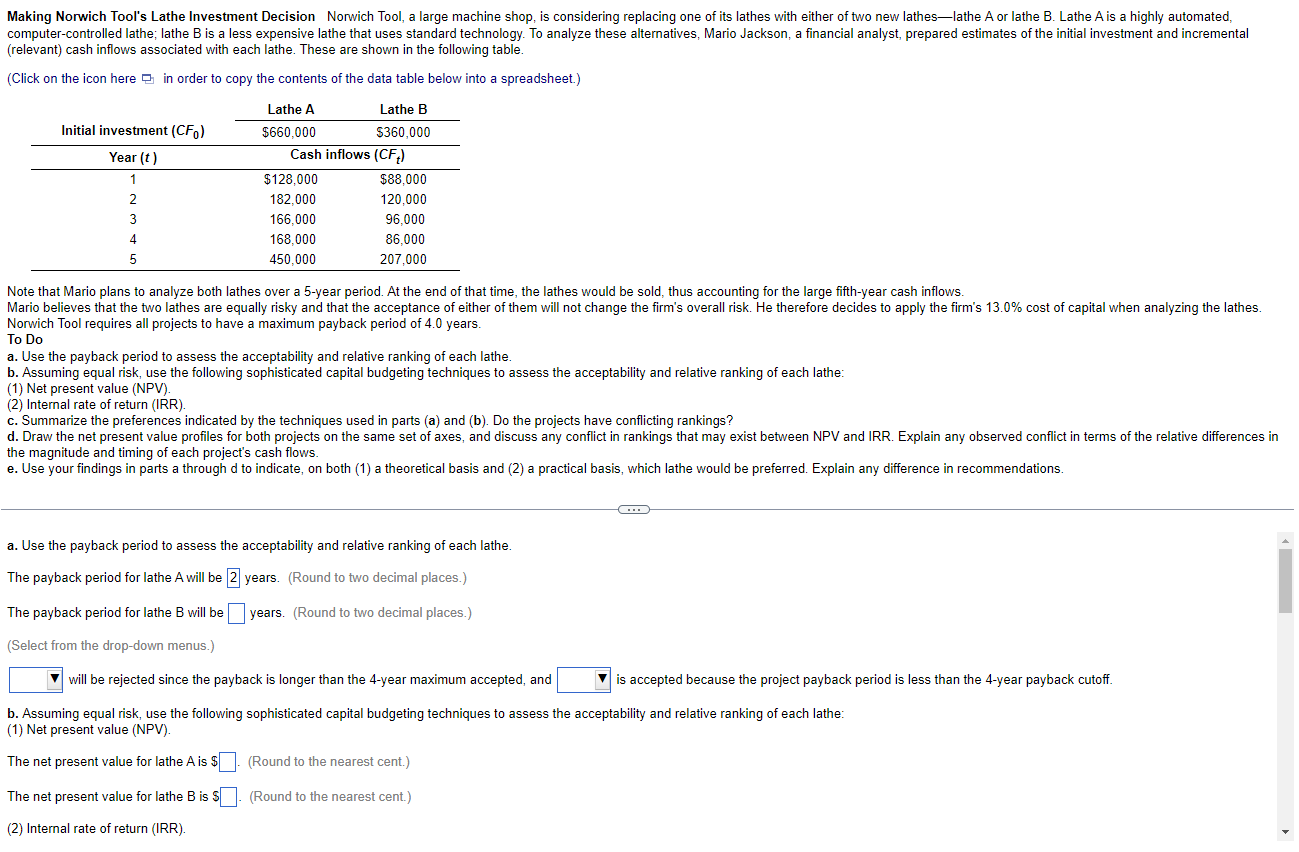

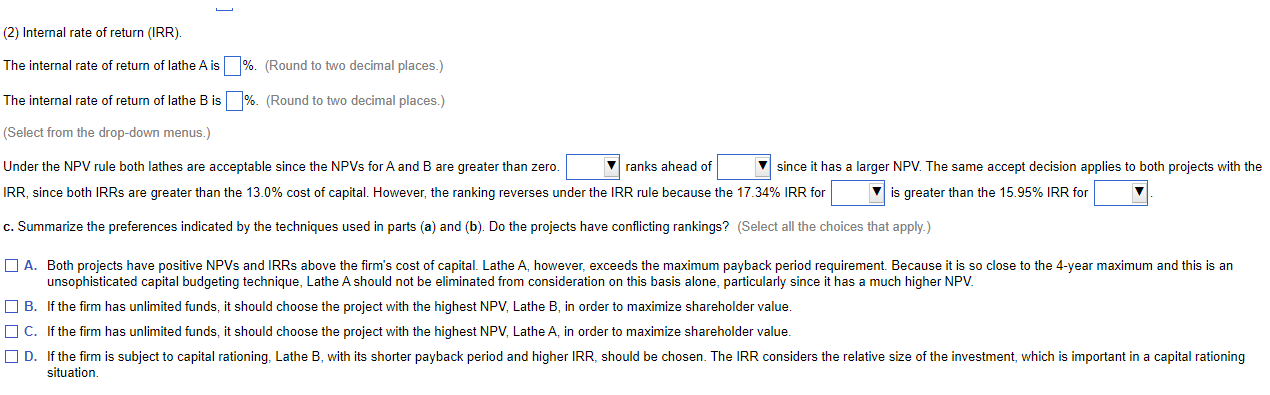

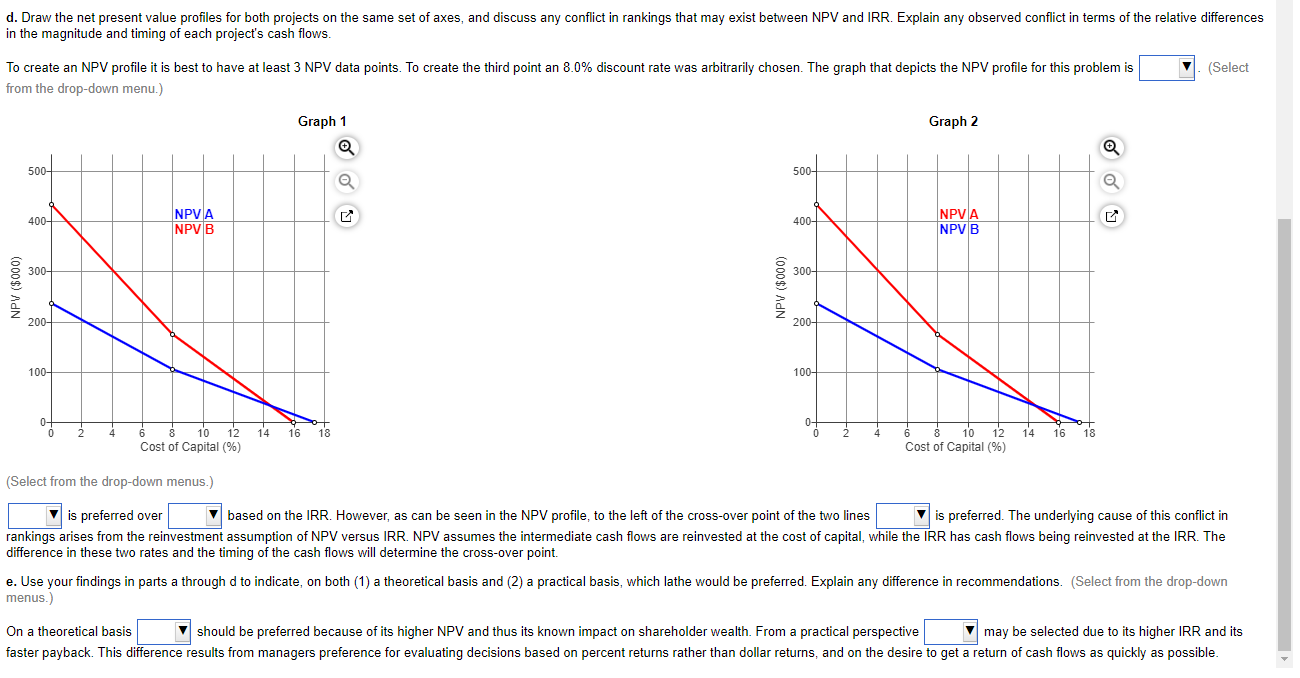

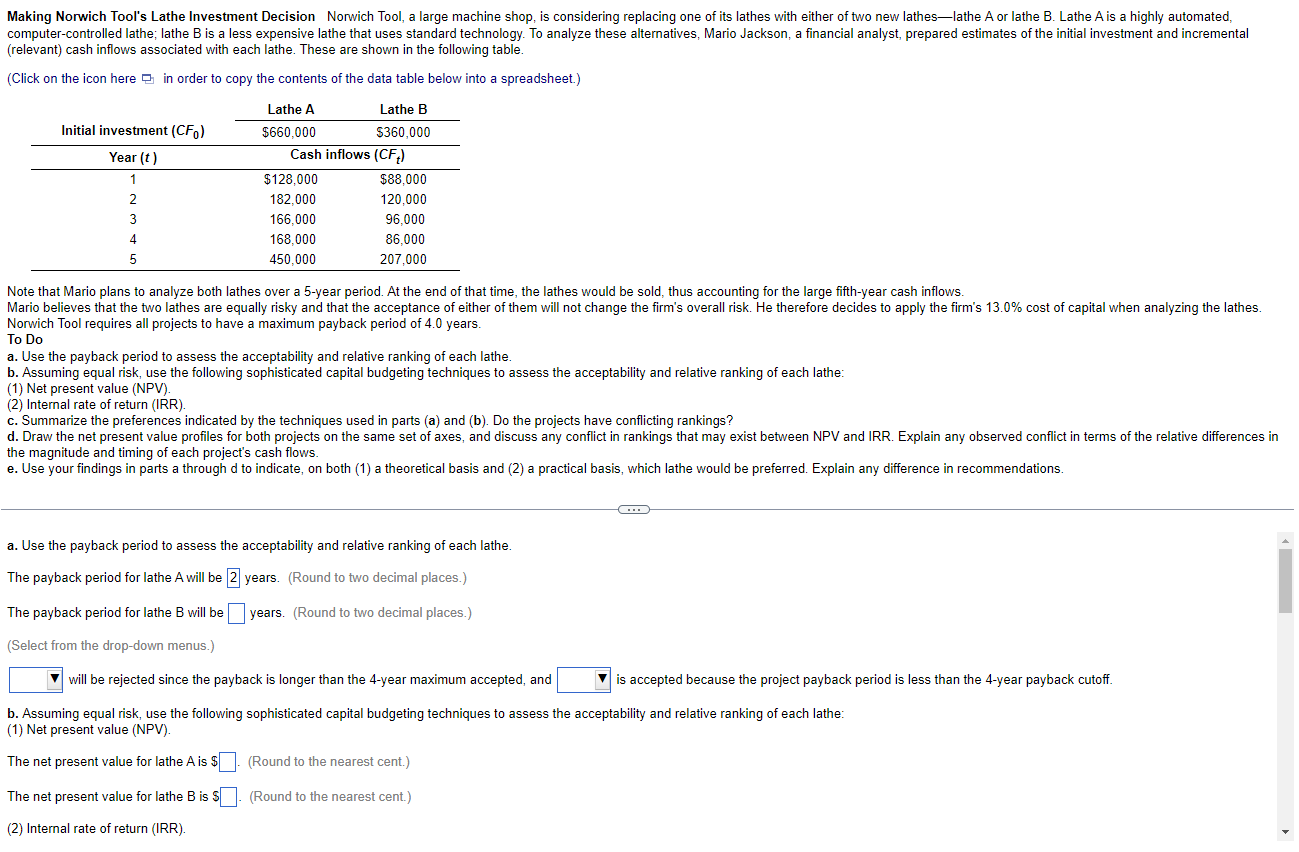

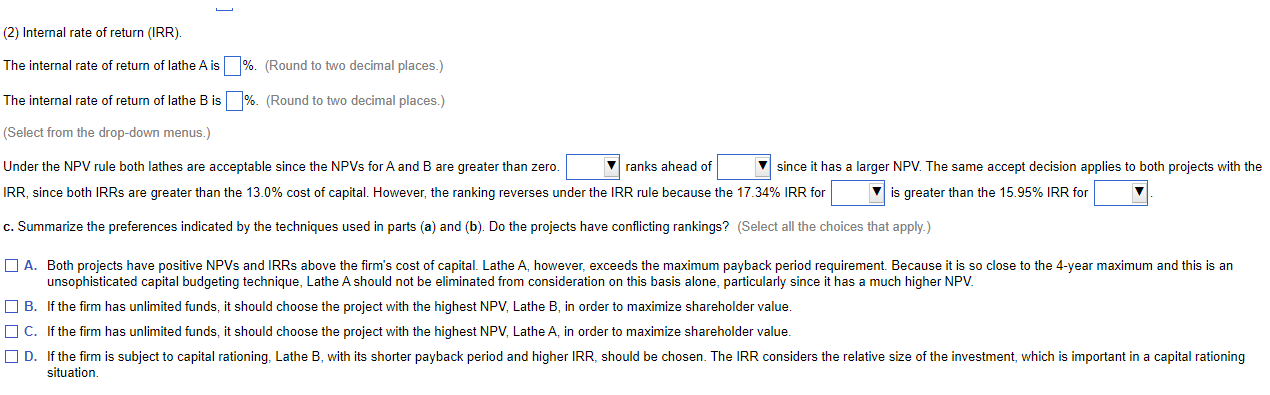

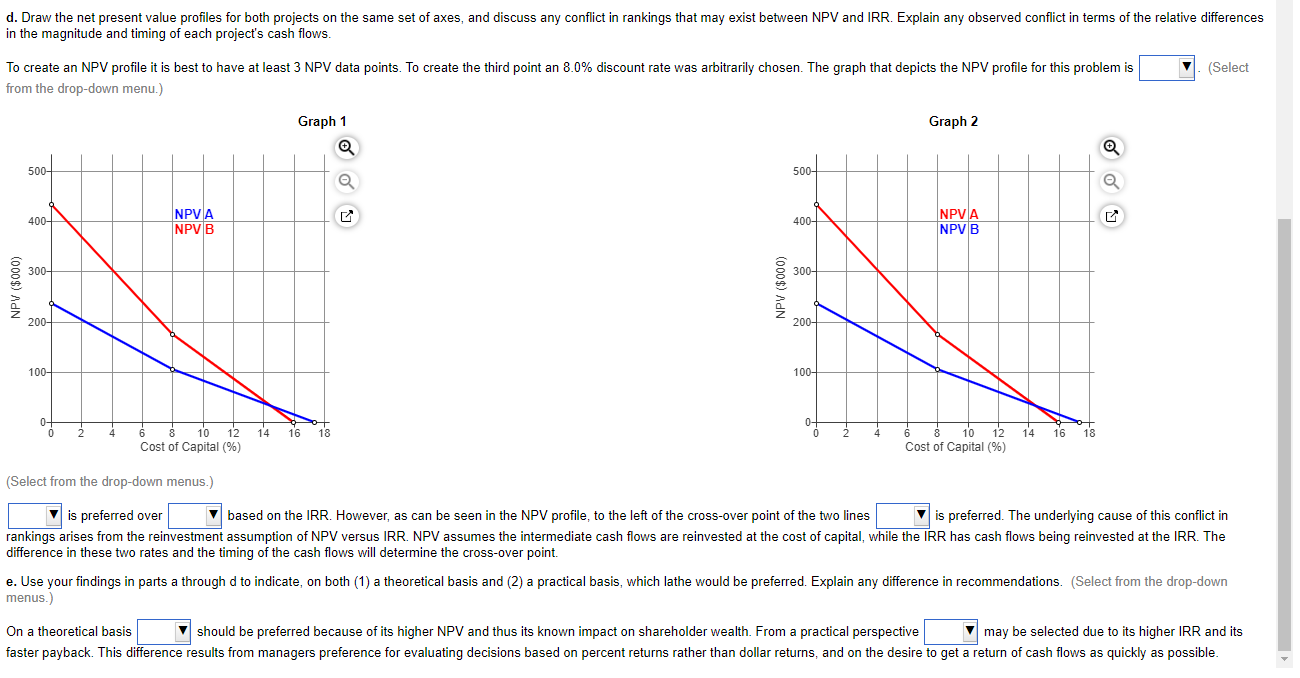

(relevant) cash inflows associated with each lathe. These are shown in the following table. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Note that Mario plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. Norwich Tool requires all projects to have a maximum payback period of 4.0 years. To Do a. Use the payback period to assess the acceptability and relative ranking of each lathe. b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). (2) Internal rate of return (IRR). c. Summarize the preferences indicated by the techniques used in parts (a) and (b). Do the projects have conflicting rankings? the magnitude and timing of each project's cash flows. e. Use your findings in parts a through d to indicate, on both (1) a theoretical basis and (2) a practical basis, which lathe would be preferred. Explain any difference in recommendations. a. Use the payback period to assess the acceptability and relative ranking of each lathe. The payback period for lathe A will be years. (Round to two decimal places.) The payback period for lathe B will be years. (Round to two decimal places.) (Select from the drop-down menus.) will be rejected since the payback is longer than the 4-year maximum accepted, and is accepted because the project payback period is less than the 4-year payback cutoff. b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). The net present value for lathe A is $ (Round to the nearest cent.) The net present value for lathe B is $ (Round to the nearest cent.) (2) Internal rate of return (IRR). The internal rate of return of lathe A is %. (Round to two decimal places.) The internal rate of return of lathe B is %. (Round to two decimal places.) (Select from the drop-down menus.) Under the NPV rule both lathes are acceptable since the NPVs for A and B are greater than zero. ranks ahead of since it has a larger NPV. The same accept decision applies to both projects with the IRR, since both IRRs are greater than the 13.0% cost of capital. However, the ranking reverses under the IRR rule because the 17.34% IRR for is greater than the 15.95% IRR for c. Summarize the preferences indicated by the techniques used in parts (a) and (b). Do the projects have conflicting rankings? (Select all the choices that apply.) unsophisticated capital budgeting technique, Lathe A should not be eliminated from consideration on this basis alone, particularly since it has a much higher NPV. B. If the firm has unlimited funds, it should choose the project with the highest NPV, Lathe B, in order to maximize shareholder value. C. If the firm has unlimited funds, it should choose the project with the highest NPV, Lathe A, in order to maximize shareholder value. situation. in the magnitude and timing of each project's cash flows. (Select from the drop-down menu.) (Select from the drop-down menus.) is preferred over based on the IRR. However, as can be seen in the NPV profile, to the left of the cross-over point of the two lines is preferred. The underlying cause of this conflict in difference in these two rates and the timing of the cash flows will determine the cross-over point. menus.) (relevant) cash inflows associated with each lathe. These are shown in the following table. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Note that Mario plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. Norwich Tool requires all projects to have a maximum payback period of 4.0 years. To Do a. Use the payback period to assess the acceptability and relative ranking of each lathe. b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). (2) Internal rate of return (IRR). c. Summarize the preferences indicated by the techniques used in parts (a) and (b). Do the projects have conflicting rankings? the magnitude and timing of each project's cash flows. e. Use your findings in parts a through d to indicate, on both (1) a theoretical basis and (2) a practical basis, which lathe would be preferred. Explain any difference in recommendations. a. Use the payback period to assess the acceptability and relative ranking of each lathe. The payback period for lathe A will be years. (Round to two decimal places.) The payback period for lathe B will be years. (Round to two decimal places.) (Select from the drop-down menus.) will be rejected since the payback is longer than the 4-year maximum accepted, and is accepted because the project payback period is less than the 4-year payback cutoff. b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). The net present value for lathe A is $ (Round to the nearest cent.) The net present value for lathe B is $ (Round to the nearest cent.) (2) Internal rate of return (IRR). The internal rate of return of lathe A is %. (Round to two decimal places.) The internal rate of return of lathe B is %. (Round to two decimal places.) (Select from the drop-down menus.) Under the NPV rule both lathes are acceptable since the NPVs for A and B are greater than zero. ranks ahead of since it has a larger NPV. The same accept decision applies to both projects with the IRR, since both IRRs are greater than the 13.0% cost of capital. However, the ranking reverses under the IRR rule because the 17.34% IRR for is greater than the 15.95% IRR for c. Summarize the preferences indicated by the techniques used in parts (a) and (b). Do the projects have conflicting rankings? (Select all the choices that apply.) unsophisticated capital budgeting technique, Lathe A should not be eliminated from consideration on this basis alone, particularly since it has a much higher NPV. B. If the firm has unlimited funds, it should choose the project with the highest NPV, Lathe B, in order to maximize shareholder value. C. If the firm has unlimited funds, it should choose the project with the highest NPV, Lathe A, in order to maximize shareholder value. situation. in the magnitude and timing of each project's cash flows. (Select from the drop-down menu.) (Select from the drop-down menus.) is preferred over based on the IRR. However, as can be seen in the NPV profile, to the left of the cross-over point of the two lines is preferred. The underlying cause of this conflict in difference in these two rates and the timing of the cash flows will determine the cross-over point. menus.)