Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions, Thank you. Short-term financing through bank loans Consider this case: Big T Burgers and Fries Corp. needs to take out a

Please answer all questions, Thank you.

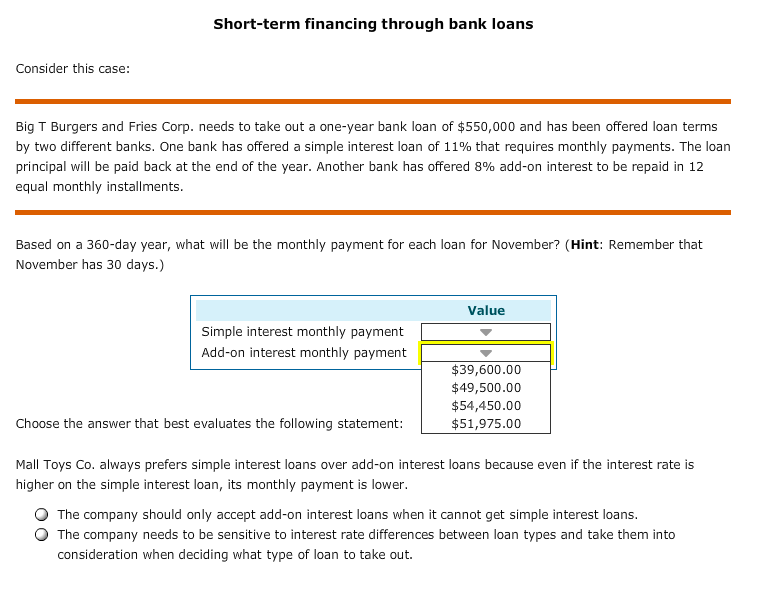

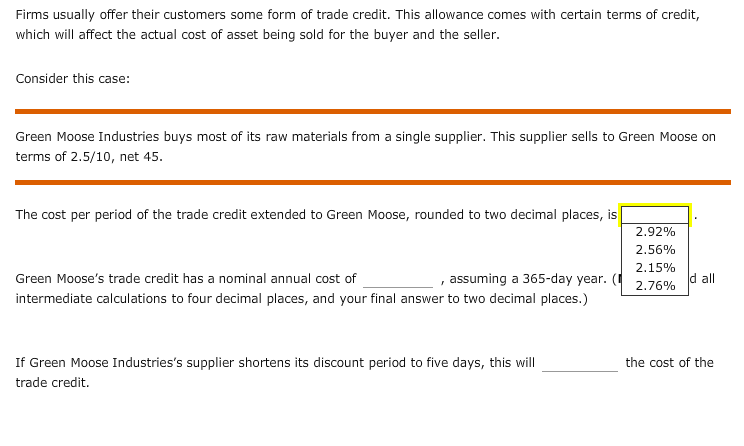

Short-term financing through bank loans Consider this case: Big T Burgers and Fries Corp. needs to take out a one-year bank loan of $550,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 11% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 8% add-on interest to be repaid in 12 equal monthly installments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment $39,600.00 $49,500.00 $54,450.00 $51,975.00 Choose the answer that best evaluates the following statement: Mall Toys Co. always prefers simple interest loans over add-on interest loans because even if the interest rate is higher on the simple interest loan, its monthly payment is lower. The company should only accept add-on interest loans when it cannot get simple interest loans. The company needs to be sensitive to interest rate differences between loan types and take them into consideration when deciding what type of loan to take out. Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which will affect the actual cost of asset being sold for the buyer and the seller. Consider this case: Green Moose Industries buys most of its raw materials from a single supplier. This supplier sells to Green Moose on terms of 2.5/10, net 45. The cost per period of the trade credit extended to Green Moose, rounded to two decimal places, is 2.92% 2.56% 2.15% Green Moose's trade credit has a nominal annual cost of , assuming a 365-day year. 1 2.76% intermediate calculations to four decimal places, and your final answer to two decimal places.) d all the cost of the If Green Moose Industries's supplier shortens its discount period to five days, this will trade creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started