Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions. thank you! Which of the following are not parts of total paid-in-capital? A) Retained earnings B) Treasury stock C) Neither retained

please answer all questions. thank you!

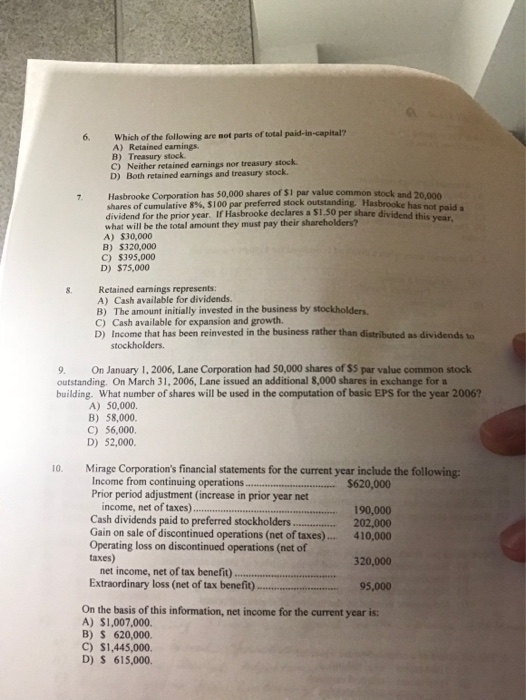

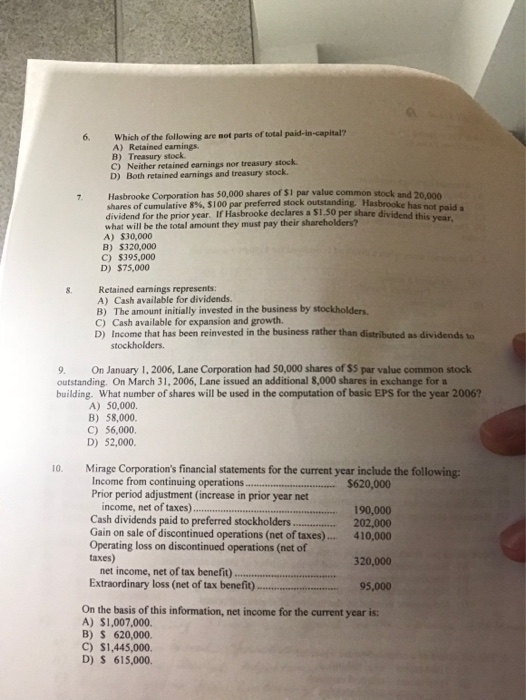

Which of the following are not parts of total paid-in-capital? A) Retained earnings B) Treasury stock C) Neither retained earnings nor treasury stock D) Both retained earnings and treasury stock. 6. 7. Hasbrooke Corporation has 50,000 shares of S1 par value common stock and 20.000 ferred stock outstanding. Hasbrooke has not paid a shares of cumulative 8%, S 100 par pre dividend for the prior year, If Hasbrooke declares a s1.50 per share dividend this year what will be the total amount they must pay their shareholders? A) $30,000 ) $320,000 C) $395,000 D) $75,000 Retained earnings represents: A) Cash available for dividends. B) The amount initially invested in the business by stockholders C) Cash available for expansion and growth. D) Income that has been reinvested in the business rather than distributed as dividends to S. stockholders. 9. On January 1, 2006, Lane Corporation had 50,000 shares of $5 par value common stock outstanding. On March 31, 2006, Lane issued an additional 8,000 shares in exchange for a building. What number of shares will be used in the computation of basic EPS for the year 2006? A) 50,000. B) 58,000. C) 56,000 D) 52,000. 10. Mirage Corporation's financial statements for the current year include the following Income from continuing operations.$620,000 Prior period adjustment (increase in prior year net income, net of taxes) Cash dividends paid to preferred stockholders Gain on sale of discontinued operations (net of taxes)... Operating loss on discontinued operations (net of taxes) 190,000 202,000 410,000 320,000 net income, net of tax benefit) Extraordinary loss(net of tax benefit95,000 On the basis of this information, net income for the current year is: A) $1,007,000. B) S 620,000 C) $1,445,000. D) S 615,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started