please answer all questions! thanks!

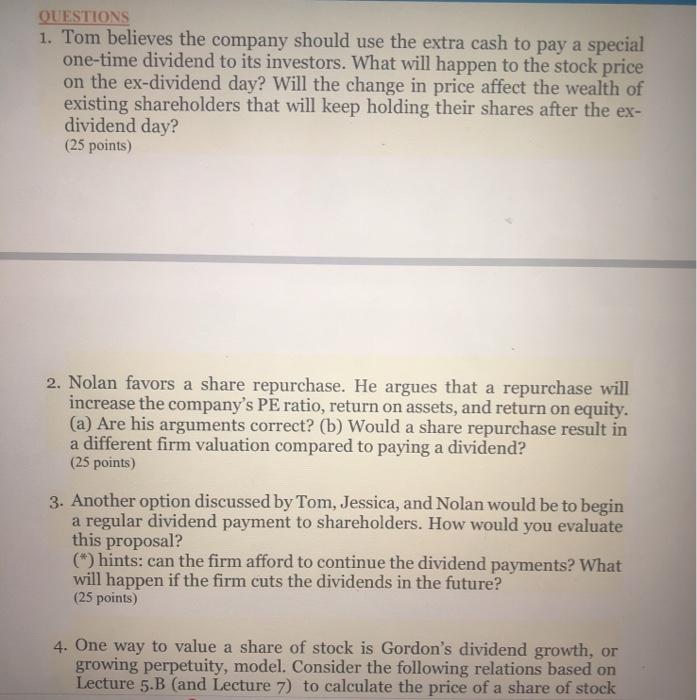

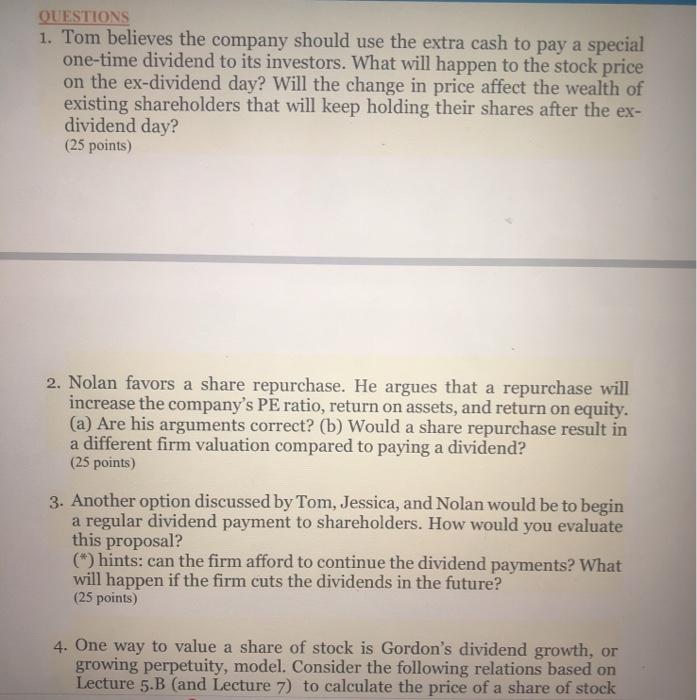

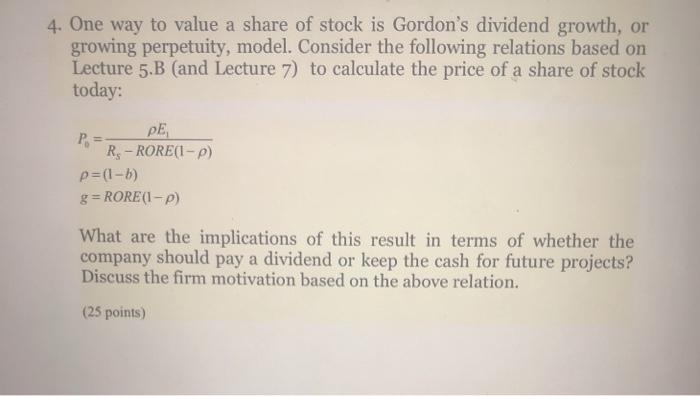

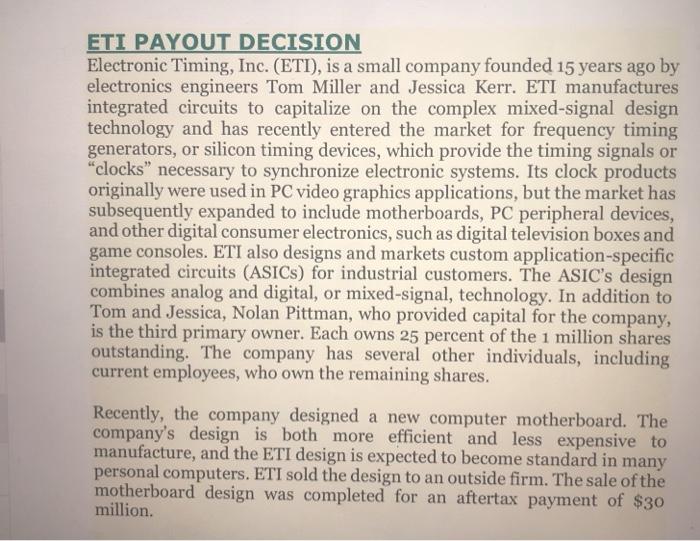

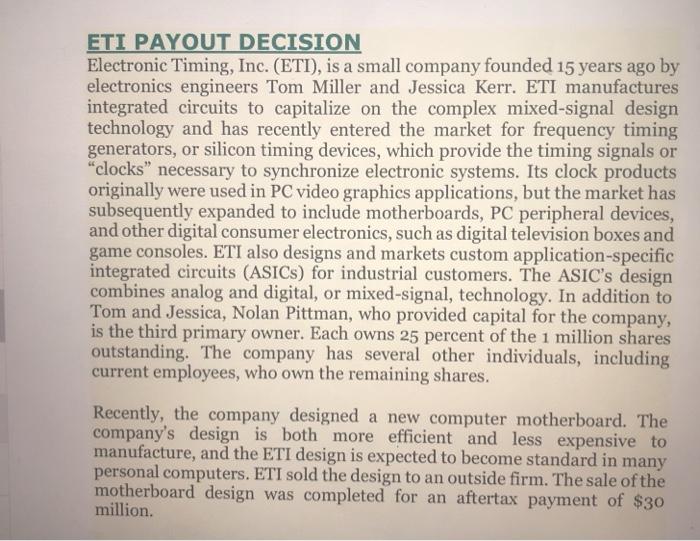

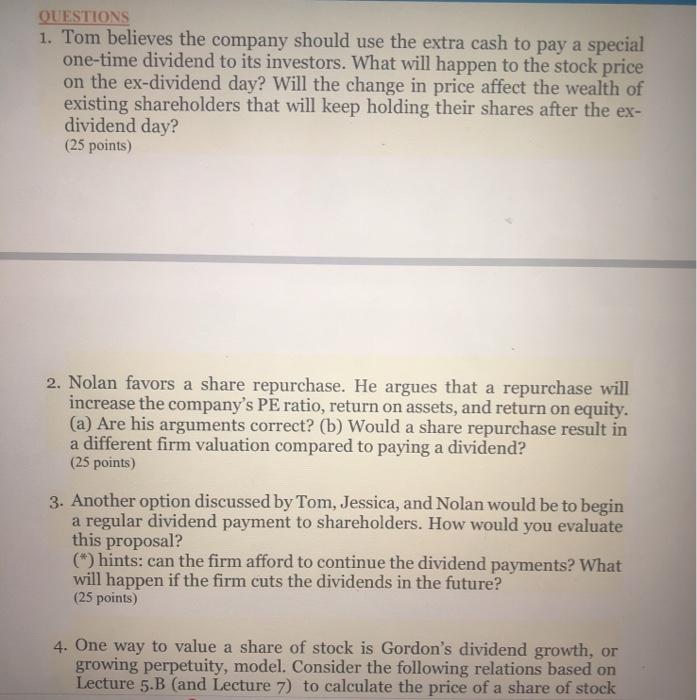

4. One way to value a share of stock is Gordon's dividend growth, or growing perpetuity, model. Consider the following relations based on Lecture 5.B (and Lecture 7) to calculate the price of a share of stock today: P = PE R - RORE(1-) p=(1-1) g=RORE(1-P) What are the implications of this result in terms of whether the company should pay a dividend or keep the cash for future projects? Discuss the firm motivation based on the above relation. (25 points) ETI PAYOUT DECISION Electronic Timing, Inc. (ETI), is a small company founded 15 years ago by electronics engineers Tom Miller and Jessica Kerr. ETI manufactures integrated circuits to capitalize on the complex mixed-signal design technology and has recently entered the market for frequency timing generators, or silicon timing devices, which provide the timing signals or "clocks" necessary to synchronize electronic systems. Its clock products originally were used in PC video graphics applications, but the market has subsequently expanded to include motherboards, PC peripheral devices, and other digital consumer electronics, such as digital television boxes and game consoles. ETI also designs and markets custom application-specific integrated circuits (ASICS) for industrial customers. The ASIC's design combines analog and digital, or mixed-signal, technology. In addition to Tom and Jessica, Nolan Pittman, who provided capital for the company, is the third primary owner. Each owns 25 percent of the 1 million shares outstanding. The company has several other individuals, including current employees, who own the remaining shares. Recently, the company designed a new computer motherboard. The company's design is both more efficient and less expensive to manufacture, and the ETI design is expected to become standard in many personal computers. ETI sold the design to an outside firm. The sale of the motherboard design was completed for an aftertax payment of $30 million. ETI PAYOUT DECISION Electronic Timing, Inc. (ETI), is a small company founded 15 years ago by electronics engineers Tom Miller and Jessica Kerr. ETI manufactures integrated circuits to capitalize on the complex mixed-signal design technology and has recently entered the market for frequency timing generators, or silicon timing devices, which provide the timing signals or "clocks" necessary to synchronize electronic systems. Its clock products originally were used in PC video graphics applications, but the market has subsequently expanded to include motherboards, PC peripheral devices, and other digital consumer electronics, such as digital television boxes and game consoles. ETI also designs and markets custom application-specific integrated circuits (ASICS) for industrial customers. The ASIC's design combines analog and digital, or mixed-signal, technology. In addition to Tom and Jessica, Nolan Pittman, who provided capital for the company, is the third primary owner. Each owns 25 percent of the 1 million shares outstanding. The company has several other individuals, including current employees, who own the remaining shares. Recently, the company designed a new computer motherboard. The company's design is both more efficient and less expensive to manufacture, and the ETI design is expected to become standard in many personal computers. ETI sold the design to an outside firm. The sale of the motherboard design was completed for an aftertax payment of $30 million. 4. One way to value a share of stock is Gordon's dividend growth, or growing perpetuity, model. Consider the following relations based on Lecture 5.B (and Lecture 7) to calculate the price of a share of stock today: P = PE R - RORE(1-) p=(1-1) g=RORE(1-P) What are the implications of this result in terms of whether the company should pay a dividend or keep the cash for future projects? Discuss the firm motivation based on the above relation. (25 points) ETI PAYOUT DECISION Electronic Timing, Inc. (ETI), is a small company founded 15 years ago by electronics engineers Tom Miller and Jessica Kerr. ETI manufactures integrated circuits to capitalize on the complex mixed-signal design technology and has recently entered the market for frequency timing generators, or silicon timing devices, which provide the timing signals or "clocks" necessary to synchronize electronic systems. Its clock products originally were used in PC video graphics applications, but the market has subsequently expanded to include motherboards, PC peripheral devices, and other digital consumer electronics, such as digital television boxes and game consoles. ETI also designs and markets custom application-specific integrated circuits (ASICS) for industrial customers. The ASIC's design combines analog and digital, or mixed-signal, technology. In addition to Tom and Jessica, Nolan Pittman, who provided capital for the company, is the third primary owner. Each owns 25 percent of the 1 million shares outstanding. The company has several other individuals, including current employees, who own the remaining shares. Recently, the company designed a new computer motherboard. The company's design is both more efficient and less expensive to manufacture, and the ETI design is expected to become standard in many personal computers. ETI sold the design to an outside firm. The sale of the motherboard design was completed for an aftertax payment of $30 million. ETI PAYOUT DECISION Electronic Timing, Inc. (ETI), is a small company founded 15 years ago by electronics engineers Tom Miller and Jessica Kerr. ETI manufactures integrated circuits to capitalize on the complex mixed-signal design technology and has recently entered the market for frequency timing generators, or silicon timing devices, which provide the timing signals or "clocks" necessary to synchronize electronic systems. Its clock products originally were used in PC video graphics applications, but the market has subsequently expanded to include motherboards, PC peripheral devices, and other digital consumer electronics, such as digital television boxes and game consoles. ETI also designs and markets custom application-specific integrated circuits (ASICS) for industrial customers. The ASIC's design combines analog and digital, or mixed-signal, technology. In addition to Tom and Jessica, Nolan Pittman, who provided capital for the company, is the third primary owner. Each owns 25 percent of the 1 million shares outstanding. The company has several other individuals, including current employees, who own the remaining shares. Recently, the company designed a new computer motherboard. The company's design is both more efficient and less expensive to manufacture, and the ETI design is expected to become standard in many personal computers. ETI sold the design to an outside firm. The sale of the motherboard design was completed for an aftertax payment of $30 million