Answered step by step

Verified Expert Solution

Question

1 Approved Answer

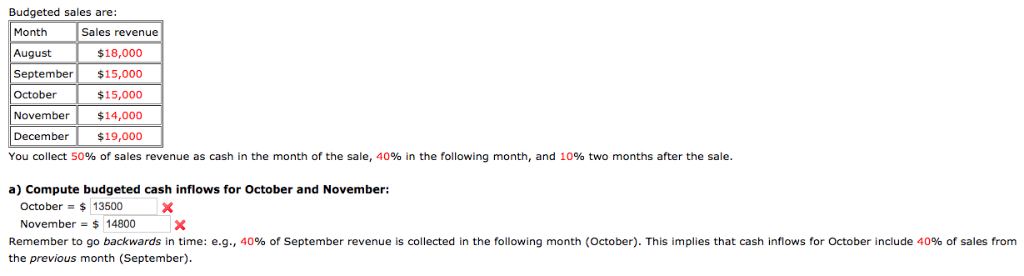

================================ Please answer ALL questions to get positive upvote. Thanks. Budgeted sales are: Sales revenue August September$15,000 October November $14,000 December 19,000 $18,000 $15,000 You

================================

Please answer ALL questions to get positive upvote.

Thanks.

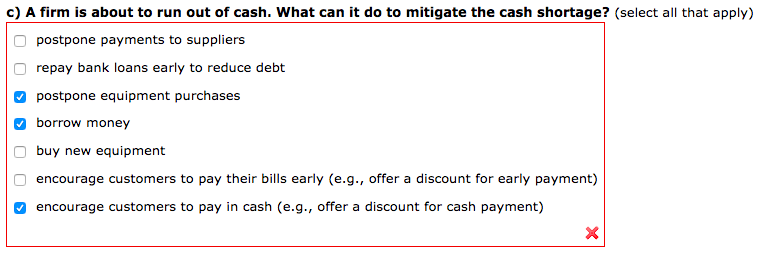

Budgeted sales are: Sales revenue August September$15,000 October November $14,000 December 19,000 $18,000 $15,000 You collect 50% of sales revenue as cash in the month of the sale, 40% in the following month, and 10% two months after the sale a) Compute budgeted cash inflows for October and November: October13500 November-$ 14800X Remember to go backwards in t me: e g the previous month (September) 40% of September revenue is collected in the following month October . This implies that a sh n o s for October include 4 % of sales rom c) A firm is about to run out of cash. What can it do to mitigate the cash shortage? (select all that apply) postpone payments to suppliers O repay bank loans early to reduce debt postpone equipment purchases borrow money buy new equipment encourage customers to pay their bills early (e.g., offer a discount for early payment) encourage customers to pay in cash (e.g., offer a discount for cash payment) Budgeted sales are: Sales revenue August September$15,000 October November $14,000 December 19,000 $18,000 $15,000 You collect 50% of sales revenue as cash in the month of the sale, 40% in the following month, and 10% two months after the sale a) Compute budgeted cash inflows for October and November: October13500 November-$ 14800X Remember to go backwards in t me: e g the previous month (September) 40% of September revenue is collected in the following month October . This implies that a sh n o s for October include 4 % of sales rom c) A firm is about to run out of cash. What can it do to mitigate the cash shortage? (select all that apply) postpone payments to suppliers O repay bank loans early to reduce debt postpone equipment purchases borrow money buy new equipment encourage customers to pay their bills early (e.g., offer a discount for early payment) encourage customers to pay in cash (e.g., offer a discount for cash payment)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started