Please answer all questions to receive full credit.

Assignment:

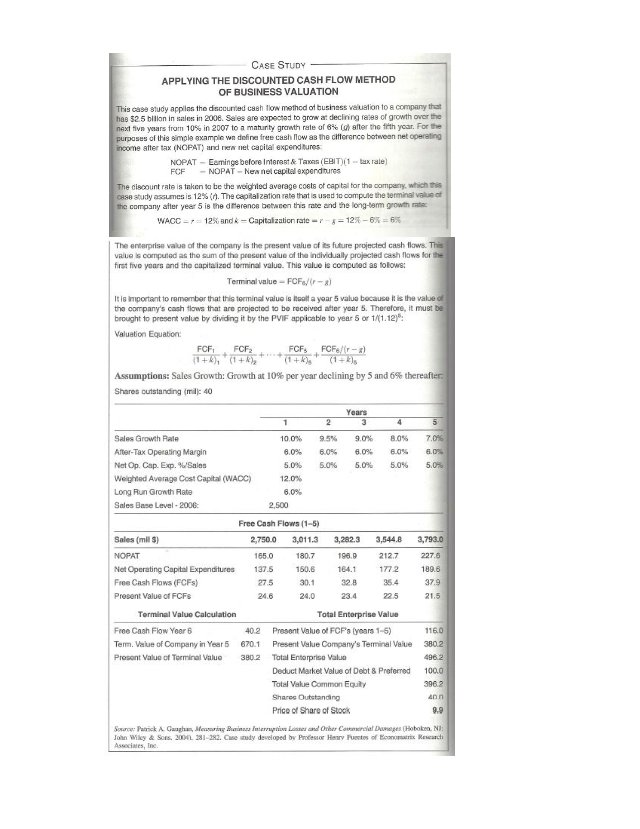

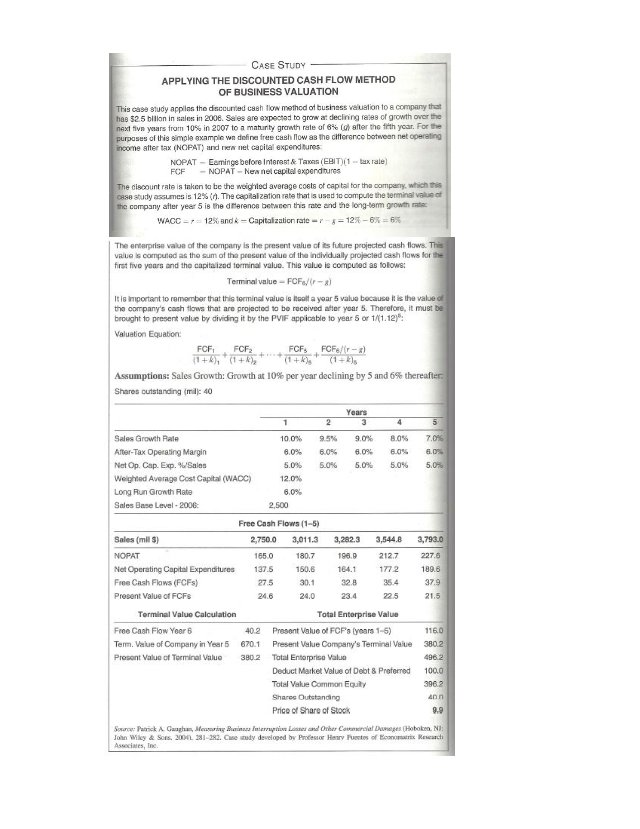

This assignment has two parts. Review the Case Study Applying the Discounted Cash Flow Method of Business Valuation on page 565 and 566 of the text. (see attached image)

Part 1: Make two simple assumption changes:

Base year revenue is $2.0 billion in 2006 (as compared to $2.5 billion in the Book and Lecture).

The maturity growth rate is 7%, rather than 6%.

Please recreate the Free Cash Flow, Terminal Value and Total Enterprise Value tables and fill in numbers based on these assumption changes.

You should use Excel for the calculations. Then copy and paste that to Word. Please Paste Special and select Microsoft Excel Worksheet Object.

Part 2: Discuss some of the benefits and disadvantages of using the Discounted Cash Flow valuation method.

Please keep the text for Part 2 to less than 200 words.

CASE STUDY APPLYING THE DISCOUNTED CASH FLOW METHOD OF BUSINESS VALUATION This casa study applas the disccurted cash Tiow method of business vauation to s company that has 52.5 bllion in sales in 2008. Saies are expected ho grow at decining rates of growth over the next fivn yars from 10% in 2007 to a matunty growth rate of 6% G after the tth year. For the purpases of this simple axampie wn define free cash Ilow as the ciftorerco botwean net operating income atter tax (NOPAT) and ner net capital expendures NOPAT FCF-NOPAT-Newnel capitel expendtureS Eaminge before Interast&Taxas (EBIT)x rale) The ciscount rate is tnken to be the weighled average costs ot capital tor tha company, which nis cese study assumes is 12% 'r). The capital zation rate that is used lo oompue teemn ivAer thc company after year 5 is the d erance betwsen this rabe and he long-tem growth WACC-r : 12% and k-Capitalization rate-r 8-12%-6% 6% The enterprise value of the company is the present value of its future projected cash flows. Thi vaue is computed as the sum of tha prosont value of the individually projected cash lows for the first fivo yoars and tho capitaizod torminal valuo. This value is compused as tolows: Termnal value-FCFa/(r-a) It is important to remember that this torminal valuo is toalt a year 5 value bocause t is the value of tho company's cash lows that are projectod to bo received after yoar 5. Therefore, it must be brought to present value by dividing it by the PVIF appicable to year 5or 111 Valuation Equabion FCF FCF FCFs Assumptions: Sales Growth: Growth at 10% per year declining by 5 and 6% thereafter Shares cutstanding (mlk 40 Years Sales Growth Rate Arter-Tax Operating Margin Net Op. Cap. Exp.%)Sales Weighted Average Cost Capital (WADC) Long Run Gronth Rate Sales Base Level-2006 100% 6,0% 5.0% 12.0% 60% 95% 6,0% 5.0% 90% 6.0% 5.0% 80% 6.0% 5.0% 7.0% 6.0% 5.0% 2,500 Free Cosh Flows (1-5) 2,7500 3,0113 3,282.3 3,544.8 3,793.0 227.6 Net Operating Copital Expenditures 137.5 150.8 184. 1772 1898 37.9 21.5 Sales (ml S NOPAT 165.0 180,7 196.9 212.7 27.5 30.1 32.8 Free Cash Flows (FCFs) Present Value of FCFs 354 24.6 24.0 23.4 22.5 Terminal Value Calculation Total Enterprise Value Free Cash Flow Yeer 6 Term. Value of Company in Year Prosont Value of Terminal Valuo 3802 Total Entorpriso Valua 116.0 3802 496.2 100.0 3962 402 Present Value of FCPs (yoars 1-5) 670 Present Velue Company's Terminal Value Deduct Market Value of Debt & Preferred Total Vakue Common Equity Shares Outstanding Price of Share of Stock 9.9 Join Wiky & Sots. 200 281-282. Cse mudy developed by Protessor Henry Puectes of Econoatrix Kesearcti