Question

Please answer all requirements. Berkner Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and

Please answer all requirements.

Berkner Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $905,000. Projected net cash inflows are as follows:

The projected net cash inflows:

| Year 1. . . . . . . . . . . . . . . . . . | $263,000 |

| Year 2. . . . . . . . . . . . . . . . . . | $255,000 |

| Year 3. . . . . . . . . . . . . . . . . . | $225,000 |

| Year 4. . . . . . . . . . . . . . . . . . | $213,000 |

| Year 5. . . . . . . . . . . . . . . . . . | $200,000 |

| Year 6. . . . . . . . . . . . . . . . . . | $178,000 |

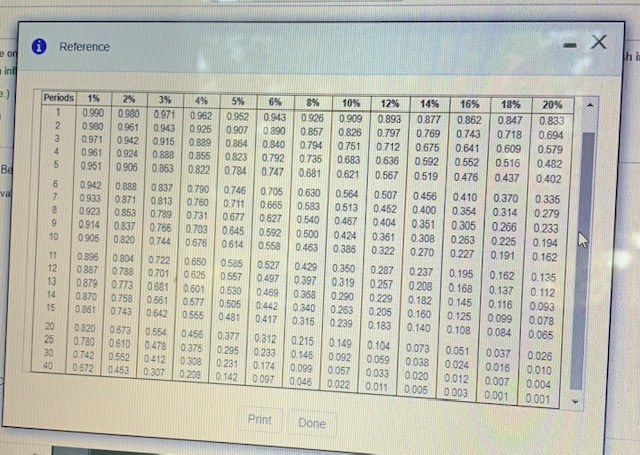

The present value table:

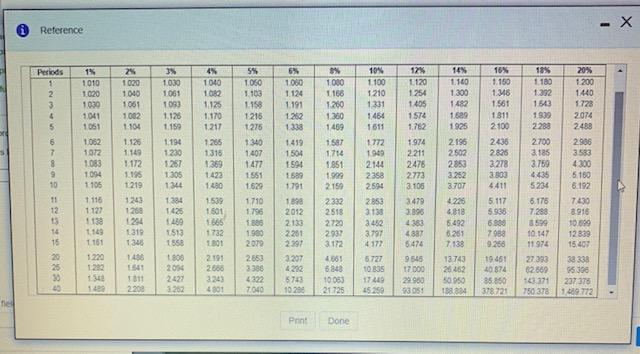

The future value table:

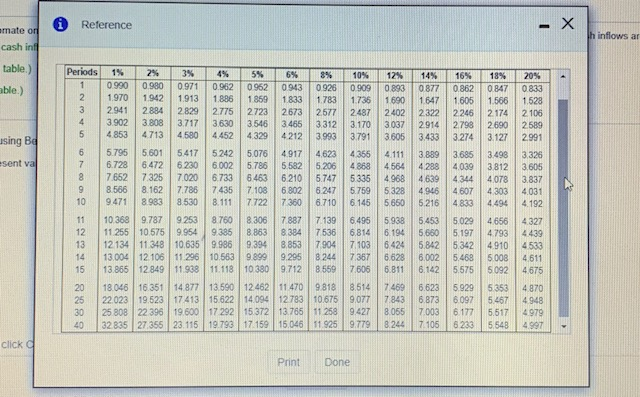

The present value annuity table:

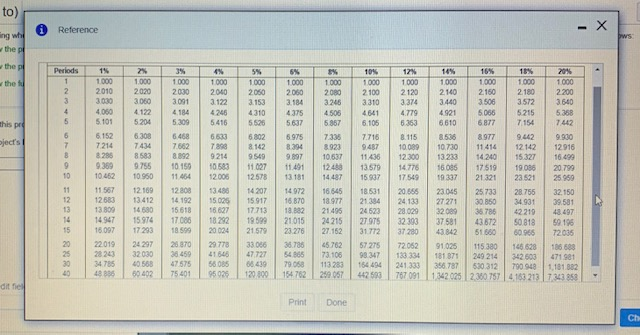

The future value annuity table:

Requirements:

1. Compute this project's NPV using Berkner Industries' 16% hurdle rate. Should the company invest in the equipment? Why or why not?

2. Berkner Industries could refurbish the equipment at the end of six years for $104,000. The refurbished equipment could be used one more year, providing $73,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $52,000 residual value at the end of Year 7. Should Berkner Industries invest in the equipment and refurbish it after six years? Why or whynot? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.)

Requirement 1. Compute this project's NPV using Berkner Industries' 16% hurdle rate. Should Berkner Industries invest in the equipment? Why or why not?

Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.)

Net present value $:

i Reference on 20% Periods 1% 2% 0.990 0.980 0 9800 961 0.971 0.942 0.961 0.924 0.951 0906 0.942 0.888 0933 0871 0.923 0853 0914 0.837 0.905 con 3% 0.971 0943 0915 0.888 0.863 0837 0.813 0.789 4% 0.962 0.925 0.889 0.855 0.822 0790 0.760 0.731 0.703 0676 0.650 0 625 0.601 0.577 5% 0.952 0.907 0.864 0823 0.784 0.746 0.711 0.677 0.645 0614 0.585 0.557 0.530 0.505 0.481 0.377 0.295 0 231 0.142 6% 0.943 0.890 0.840 0.792 0747 0.705 0.666 0.627 0.592 8% 10% 12% 14% 16% 18% 0.926 09090.893 0.877 0.862 0.847 0.857 0826 0.769 0.743 0.718 0.794 0.751 0.712 0.675 10.641 0.609 0.735 0.683 0.636 0.592 0.552 0.516 0.681 0.621 0.567 0.519 0.476 0.437 0.630 0.564 0.507 10.456 0.410 0.370 0583 0513 0.452 0.400 0.354 0.314 0.540 0.467 0.404 0.351 0.305 0.266 0.500 0424 0361 0.308 0.263 0.463 0.225 0.386 0.322 0.270 0.227 0.191 0.429 0.3500 287 0.237 0.1950.162 0.397 0.319 0.257 0.368 0.168 0.137 0.290 0 229 0.182 0.340 0.145 0.116 0.263 0205 0.160 0315 0.125 0.239 0.099 0.183 0.140 0.108 0.084 0215 0.149 0.104 0.073 0.146 0.092 0.051 0.037 0.059 0.099 0.038 0057 0033 0.016 0.0460022 0.011 0.012 0.007 0.005 0.003 0.833 0.694 0.579 0.482 0.402 0.335 0 279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 089 0804 0.788 0.773 0209 0.887 0.879 0.870 0.861 0.820 0.780 0.758 07 0.442 588 a AV 0673 0.610 0312 0.065 0.375 0.233 0.174 0.024 0097 0.020 0.026 0.010 0.004 0.001 0.001 Print Done i Reference 12% 1010 1040 1 080 1166 10% 1.100 1210 1.030 1061 1093 14% 1.100 1.300 1.020 1040 1082 1.103 1030 1061 1082 1.125 1.158 1.191 1.250 1331 1.254 1405 1.574 1.762 1482 1561 1 811 1440 1.728 2074 1041 1.051 1062 1.170 1217 1 216 1 275 18% 1.180 1.392 1543 1939 2288 2700 3.185 3.759 1.104 1 159 1469 2100 1126 1974 1072 1.194 1 230 1 340 1.407 1419 1504 1.149 2211 1772 1949 2144 3583 1265 1316 1359 1.422 1083 1094 2436 2825 3.278 1 257 1689 1925 2.196 2502 2853 3.252 3.707 4 225 1587 1.714 1.951 1.999 2.159 1 172 1477 1551 4300 2476 2.773 1195 1219 2358 3803 4435 1305 1344 5.150 6.192 1.105 1480 1529 4411 5234 1.116 123 1539 2332 1184 1426 1469 2.594 2853 3.138 1.710 1.796 1800 3.105 3.479 3.896 1501 12 1204 2518 2720 1665 3452 1.149 4 818 5492 6251 1732 2133 2251 2397 1980 1513 1553 3.797 4363 4887 5.474 7999 1801 2937 3.172 4561 2079 5.117 6.175 5935 7 288 6.888 8599 10 147 11 974 19 451 27.393 1874 62.569 $5.950 143 371 1721750 378 7430 8 916 10.699 12839 15.407 38 239 95 396 237378 1.489772 1220 148 3207 13.743 26452 1348 1 806 2191 1541 2094 2666 1 811 2427 220822024901 2653 3386 4322 7040 96.45 17 000 29980 3051 3243 5743 10.335 17.449 45.259 10053 21725 50 950 9 1020 Print Done 0 Reference - X ih inflows a mate of cash in table) Periods 8% 0.926 10% 0909 12% 14% 16% 0 862 0893 able) 0990 1970 1734 1690 1.605 2011 2402 18% 0847 1.566 2 174 2690 3.127 3.902 2322 2914 3037 using Ba 00 woon 3.312 3.993 4623 6% 0943 1833 2673 3.466 4212 4917 5582 6.210 6.802 7360 7.887 8384 2246 2798 3274 3.685 3.606 4.111 5075 8 3.490 20% 0.833 1528 2106 2589 2991 3.326 3.605 3837 4.031 4192 4327 4439 esent va 8009 4564 55 0.980 0.971 0.962 0962 1942 1913 1886 1859 2829 2775 2723 3.630 3.546 4853 4.452 4329 5242 5.736 6.733 8.566 7435 7108 9471 8 530 8.1117.722 10368 9.787 9 253 8760 8.306 11 255 10575 9.954 9.385 8.863 12 134 11 348 10.635 9.986 13.004 12.106 11 296 10 563 13865 12849 11.938 11.113 10380 18.04616 351 14 877 13.590 22.023 19.52317413 15.622 14094 25 808 22 396 19600 17292 15372 32 835 27355 23.115 19.793 17 159 6463 4968 5328 6247 6.710 4078 4303 4494 4607 4833 5.216 7.139 5453 4656 4793 4910 4533 6.002 5 000 4611 9712 6142 5092 5353 5.467 11 470 12783 13.765 15 046 6.873 9077 9427 0779 7.843 8055 4948 4979 7.003 click a Print Done i Reference to) ng why the pe the - X 2030 2040 212 3245 300 4122 5204 14 5.309 5.415 SZE? LESS 7336 3123 7999 9214 2 150 3310 4641 6.105 7.716 947 11436 13570 1537 28 350 1062 5.975 8394 9897 1191 7434 8.583 9.755 10 950 12.100 7662 8892 10.150 11 454 12108 14192 10.537 124 14487 17 549 2050 3153 4310 5520 6802 8142 9549 11097 12578 14207 15 917 1773 195 21579 33006 47727 14 120.000 20.799 25959 11.50 134 15.00 12 14972 170 2120 2100 2150 2100 36 3508 3572 4921 5215 5610 6877 7 154 742 3.508 8977 9.900 10099 10730 11.414 12142 12916 12300 13233 14.240 15 327 16.499 14776 16085 17519 19038 19337 23.521 23.045 25733 28755 24123 27271 30050 34931 30581 219 37581 50313 51.560 50 965 72052 91025 115 120 105 520 13171 249 214 342 503 471 241 333 356787 530312790 1.101 302 767 091 11420252 07574153213733853 1545 13 YT 13.30 15 974 17290 17 05 1329 20004 21015 LOLE CAT 24215 27.152 512 18531 21354 24523 279 31772 57 275 98 347 15414 442503 29773 35 59 2570 20459 47575 75401 OLO CE 1990 SHO 13558 00402 95035 154 11323 259057 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started