Please answer all requirements

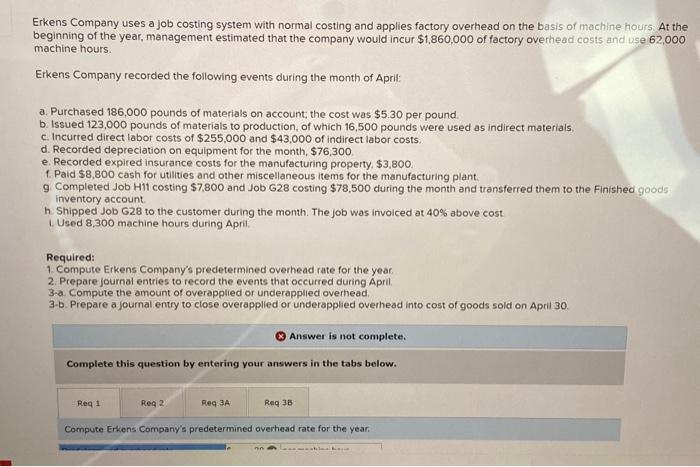

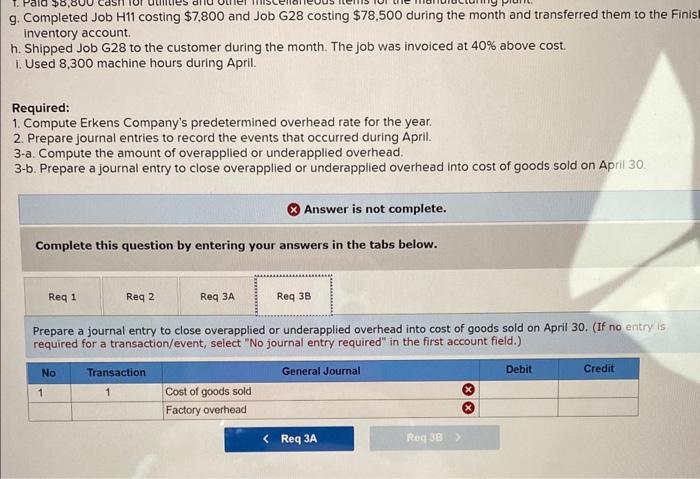

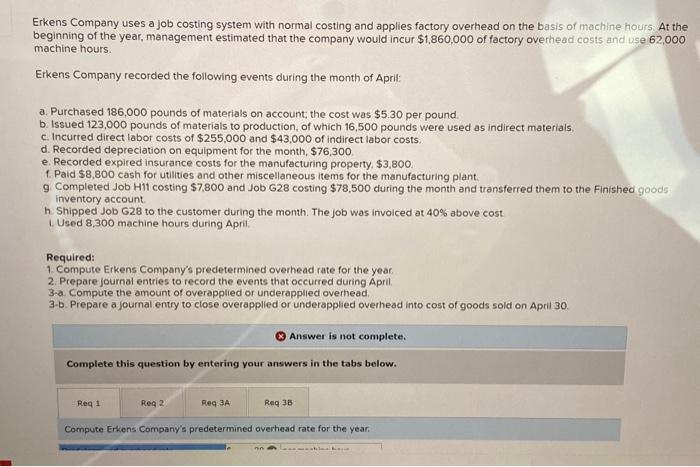

Erkens Company uses a job costing system with normal costing and applies factory overhead on the basis of machine hours. At the beginning of the year, management estimated that the company would incur $1,860,000 of factory overhead costs and use 62,000 machine hours. Erkens Company recorded the following events during the month of April: a. Purchased 186,000 pounds of materials on account, the cost was $5.30 per pound. b. Issued 123,000 pounds of materials to production, of which 16,500 pounds were used as indirect materials. c. Incurred direct labor costs of $255,000 and $43,000 of indirect labor costs: d. Recorded depreciation on equipment for the month, $76,300. e. Recorded expired insurance costs for the manufacturing property, $3,800. f. Paid $8,800 cash for utilities and other miscellaneous items for the manufacturing plant. 9 Completed Job Hil costing $7,800 and Job G28 costing $78,500 during the month and transferred them to the Finished goods inventory account. h. Shipped Job G28 to the customer during the month. The job was invoiced at 40% above cost. L. Used 8,300 machine hours during Aprit. Required: 1. Compute Erkens Company's predetermined overhead rate for the year. 2. Prepare journal entries to record the events that occurred during April. 3-a. Compute the amount of overapplied or underapplied overhead. 3.b. Prepare a journal entry to close overapplied or underapplied overhead into cost of goods soid on April 30. (3) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute Erkens Company's predetermined overhead rate for the year. b. Issued 123,000 pounds of materials to production, of which 16,500 pounds were used as indirect material: c. Incurred direct labor costs of $255,000 and $43,000 of indirect labor costs. d. Recorded depreciation on equipment for the month, $76,300. e. Recorded expired insurance costs for the manufacturing property, $3,800. f. Paid $8,800 cash for utilities and other miscellaneous items for the manufacturing plant. g. Completed Job H11 costing $7,800 and Job G28 costing $78,500 during the month and transferred them tt inventory account. h. Shipped Job G28 to the customer during the month. The job was invoiced at 40% above cost, i. Used 8,300 machine hours during April. Required: 1. Compute Erkens Company's predetermined overhead rate for the year. 2. Prepare journal entries to record the events that occurred during April. 3-a. Compute the amount of overapplied or underapplied overhead. 3-b. Prepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30 Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the amount of overapplied or underapplied overhead. g. Completed Job H11 costing $7,800 and Job G28 costing $78,500 during the month and transferred them to the Finisi inventory account. h. Shipped Job G28 to the customer during the month. The Job was invoiced at 40% above cost. i. Used 8,300 machine hours during April. Required: 1. Compute Erkens Company's predetermined overhead rate for the year. 2. Prepare journal entries to record the events that occurred during April. 3-a. Compute the amount of overapplied or underapplied overhead. 3-b. Prepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30 . Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)