please answer all requirements with clear notes so i am able to understand

please answer all requirements with clear notes so i am able to understand

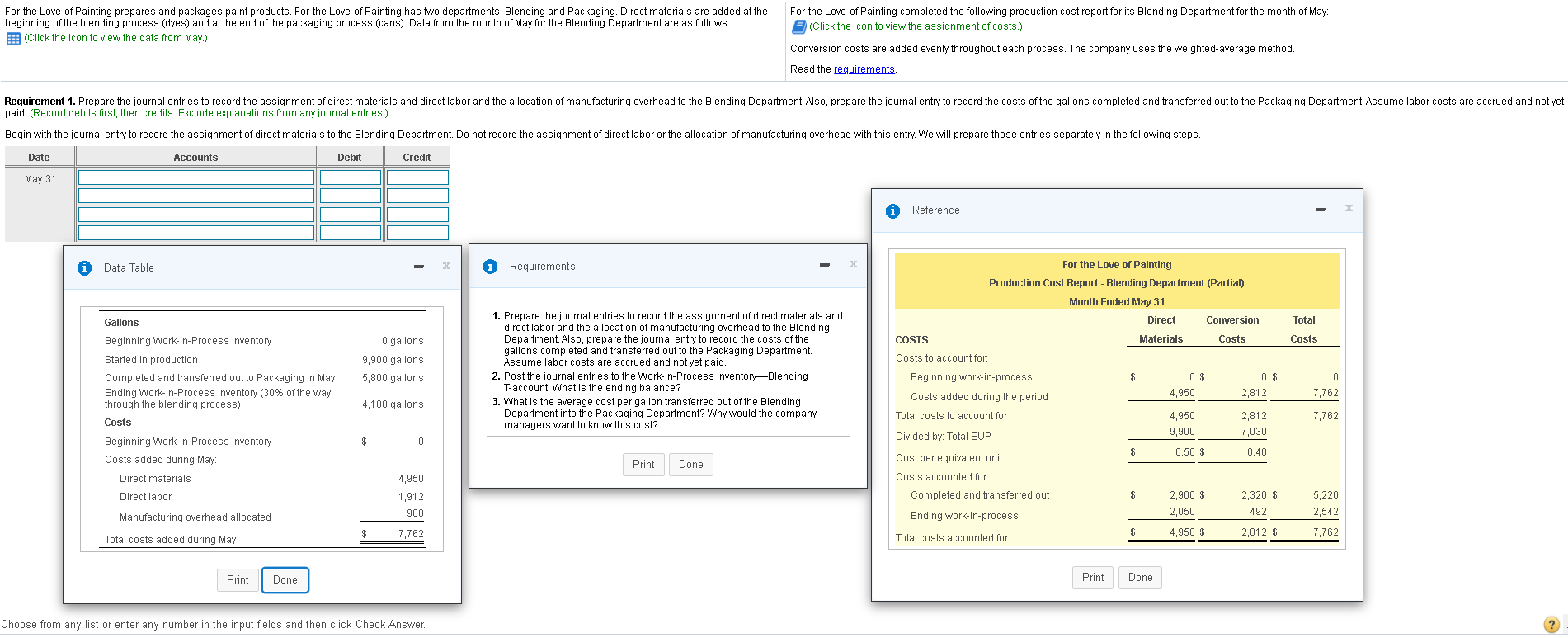

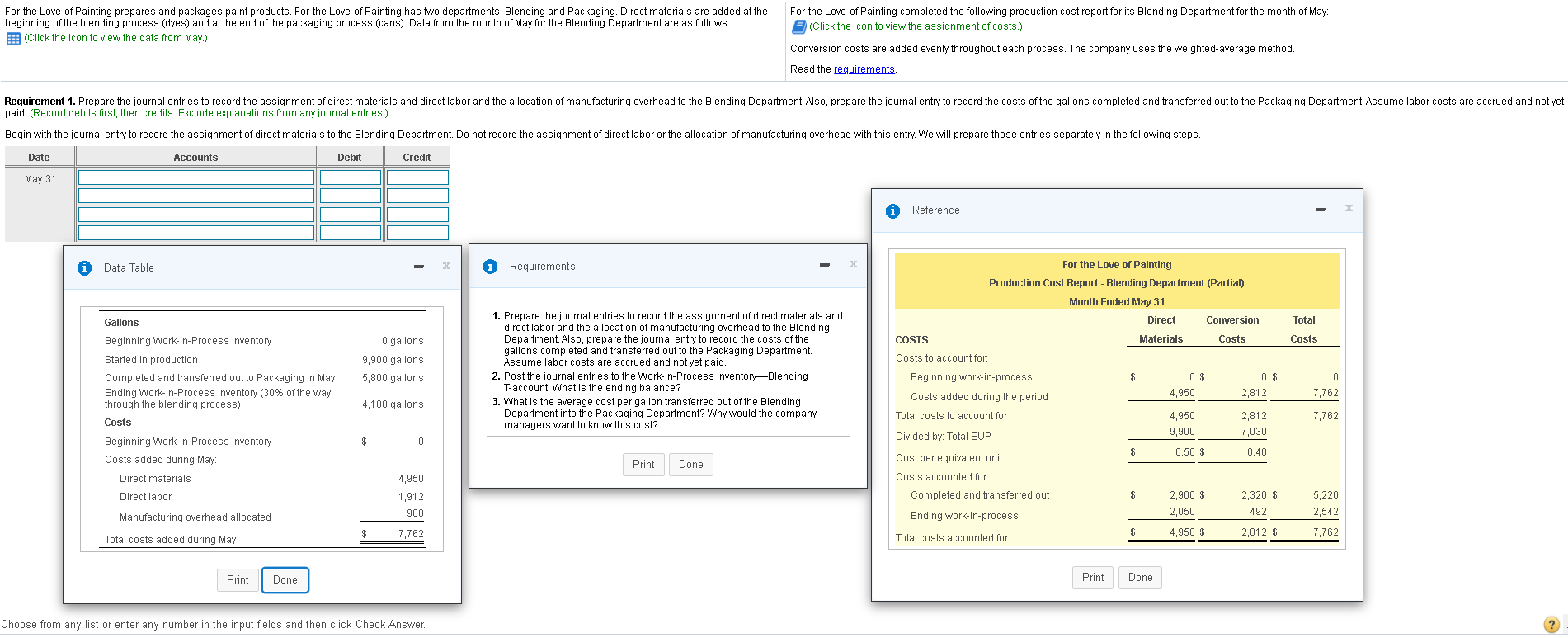

For the Love of Painting prepares and packages paint products. For the Love of Painting has two departments: Blending and Packaging. Direct materials are added at the beginning of the blending process (dyes) and at the end of the packaging process (cans). Data from the month of May for the Blending Department are as follows: B (Click the icon to view the data from May.) For the Love of Painting completed the following production cost report for its Blending Department for the month of May: (Click the icon to view the assignment of costs.) Conversion costs are added evenly throughout each process. The company uses the weighted average method. Read the requirements. Requirement 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Blending Department. Also, prepare the journal entry to record the costs of the gallons completed and transferred out to the Packaging Department. Assume labor costs are accrued and not yet paid. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin with the journal entry to record the assignment of direct materials to the Blending Department. Do not record the assignment of direct labor or the allocation of manufacturing overhead with this entry. We will prepare those entries separately in the following steps. Date Accounts Debit Credit May 31 i Reference Data Table Requirements Gallons Total Beginning Work-in-Process Inventory Costs Started in production 0 gallons 9,900 gallons 5,800 gallons 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Blending Department. Also, prepare the journal entry to record the costs of the gallons completed and transferred out to the Packaging Department. Assume labor costs are accrued and not yet paid. 2. Post the journal entries to the Work-in-Process InventoryBlending T-account. What is the ending balance? 3. What is the average cost per gallon transferred out of the Blending Department into the Packaging Department? Why would the company managers want to know this cost? 0 7,762 4,100 gallons Completed and transferred out to Packaging in May Ending Work-in-Process Inventory (30% of the way through the blending process) Costs Beginning Work-in-Process Inventory Costs added during May: For the Love of Painting Production Cost Report - Blending Department (Partial) Month Ended May 31 Direct Conversion COSTS Materials Costs Costs to account for: Beginning work-in-process 0 $ 0 $ Costs added during the period 4,950 2,812 Total costs to account for 4,950 2,812 Divided by: Total EUP 9,900 7,030 $ Cost per equivalent unit 0.50 $ 0.40 Costs accounted for Completed and transferred out $ 2,900 $ 2,320 $ Ending work-in-process 2,050 492 Total costs accounted for 4,950 $ 2,812 $ 7,762 $ 0 Print Done Direct materials Direct labor 4,950 1,912 900 5,220 2,542 Manufacturing overhead allocated Total costs added during May $ 7,762 7,762 Print Done Print Done Choose from any list or enter any number in the input fields and then click Check