Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all sections of the problem, thank you! Munoz Corporation uses ABC to determine product costs for external financial reports. At the beginning of

please answer all sections of the problem, thank you!

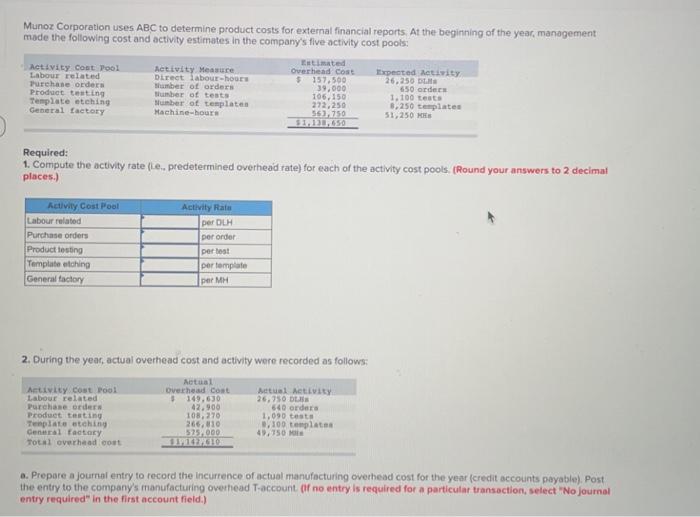

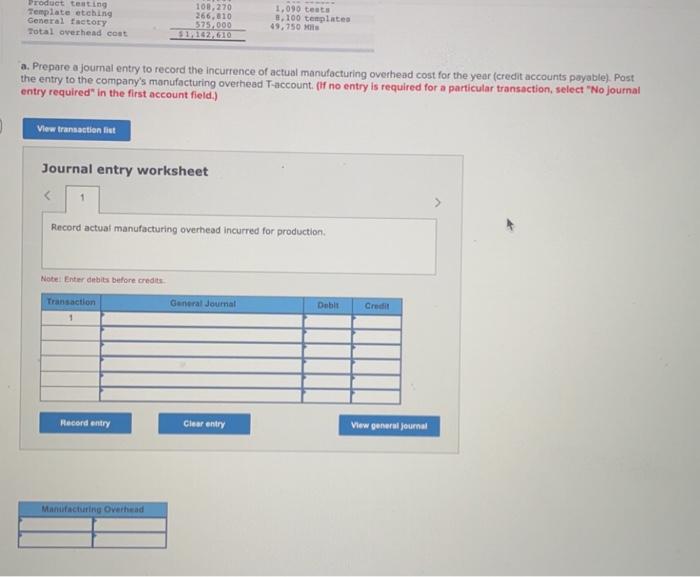

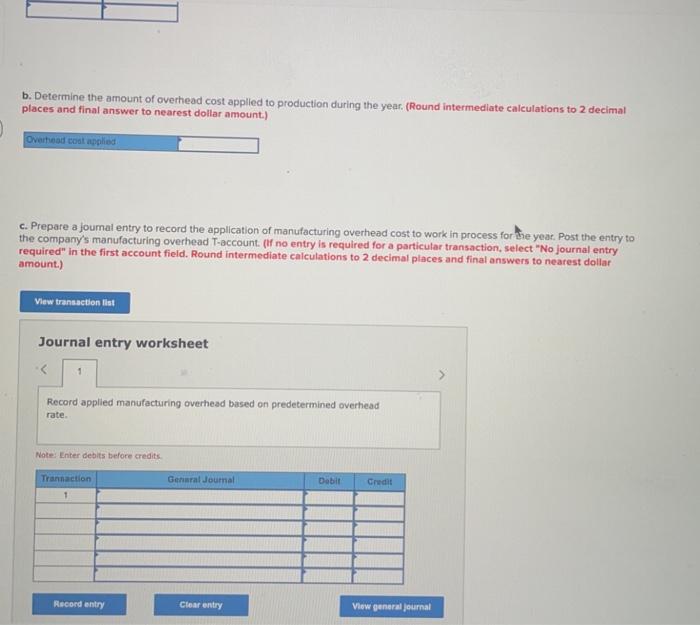

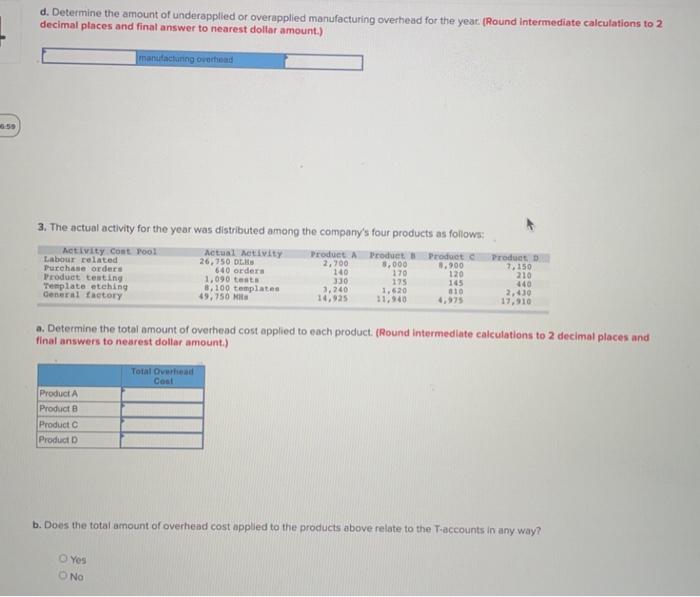

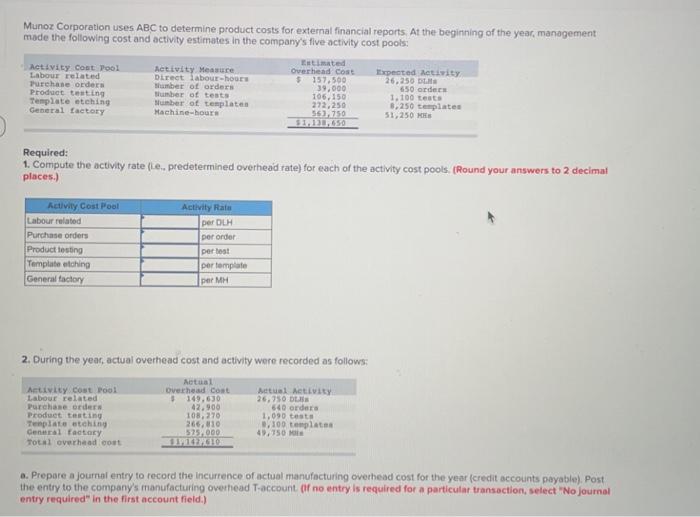

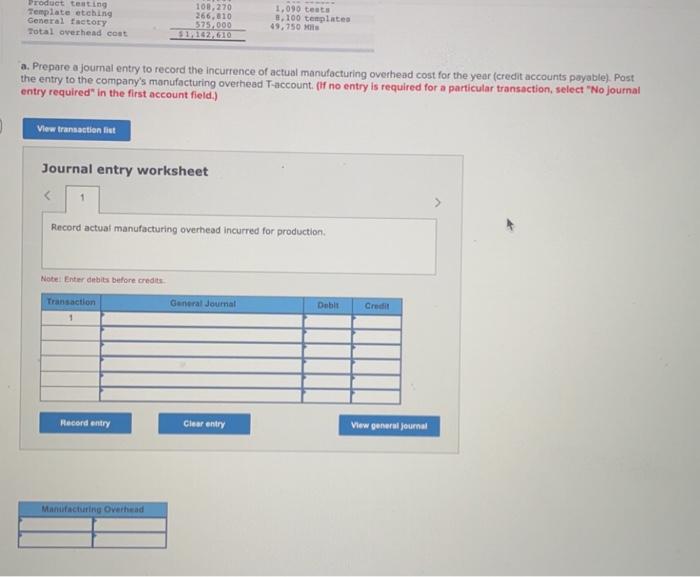

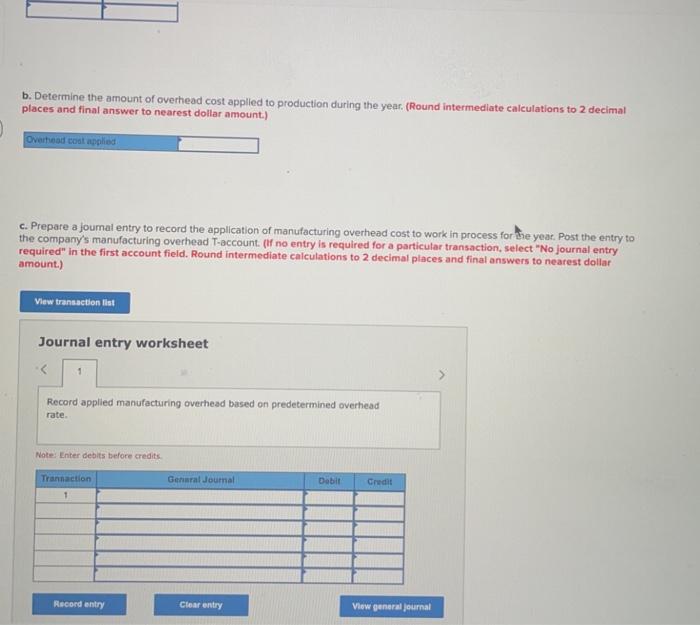

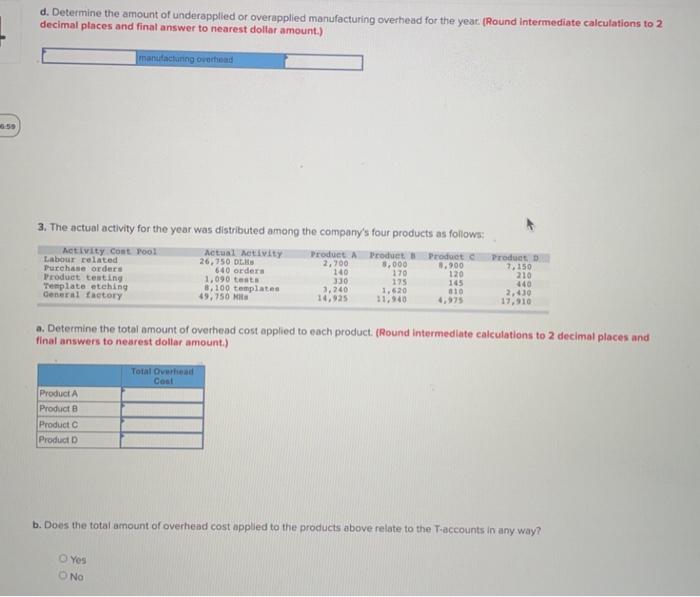

Munoz Corporation uses ABC to determine product costs for external financial reports. At the beginning of the year, management made the following cost and activity estimates in the company's five activity cost pools: imated Activity Cost Pool Activity Measure Overhead Cost Expected activity Labour related Direct labour-hours $157.500 26,250 L Purchase orders Number of orders 39.000 650 otec Product testing Blumber of tests 106,150 1.100 teste Template etching Number of templates 272,250 8.250 templates General factory Machine-hours 55.750 51,250 5,121,650 Required: 1. Compute the activity rate (l. predetermined overhead rate) for each of the activity cost pools. (Round your answers to 2 decimal places.) Activity Cost Pool Labour related Purchase orders Product testing Template etching General factory Activity Ratu per DLH por order per tot per template per MH 2. During the year, actual overhead cost and activity were recorded as follows: Actual Activity cost Pool Overhead cost Actual Activity Labour related $149.630 26,750 DEN Purchase order 42.900 640 orders Product testing 108,270 1,090 tests Template etching 266.810 3.100 templates Central Factory 525.000 49 150 Total overhead coat a. Prepare a journal entry to record the incurrence of actual manufacturing overhead cost for the year (credit accounts payable). Post the entry to the company's manufacturing overhead T-account of no entry is required for a particular transaction, select "No journal entry required" in the first account field.) Product testing Template etching General factory Total overhead coat 108,270 266,810 575,000 1,162,610 1.090 tests 3.100 templates 49,750 M a. Prepare a journal entry to record the incurrence of actual manufacturing overhead cost for the year (credit accounts payable) Post the entry to the company's manufacturing overhead T-account. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction fist Journal entry worksheet 1 > Record actual manufacturing overhead incurred for production Note Enter debit before credits Transaction General Journal Doble Credit 1 Record entry Clear entry View general journal Manufacturing Overhead b. Determine the amount of overhead cost applied to production during the year. (Round intermediate calculations to 2 decimal places and final answer to nearest dollar amount.) Overhead coat applied c. Prepare a joumal entry to record the application of manufacturing overhead cost to work in process for the year. Post the entry to the company's manufacturing overhead T-account. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Round intermediate calculations to 2 decimal places and final answers to nearest dollar amount.) View transaction list Journal entry worksheet Record applied manufacturing overhead based on predetermined overhead rate. Note: Enter debits before credits Transaction Geral Journal Dabit Credit 1 Record entry Clear entry View general Journal d. Determine the amount of underapplied or overapplied manufacturing overhead for the year. (Round intermediate calculations to 2 decimal places and final answer to nearest dollar amount.) manufacturing overhead 3. The actual activity for the year was distributed among the company's four products as follows: Activity Cost Pool Actual Activity Product Product Product Product Labour related 26,750 DEALS Purchase orders 2,700 3,000 8.900 7,150 640 ordera 140 170 Product testing 120 210 1.090 tests 330 175 Template otehing 440 8,100 templates 1,240 1,620 General factory 010 2, 430 49,750 Mita 14,925 11.40 17,910 145 a. Determine the total amount of overhead cost applied to each product. (Round intermediate calculations to 2 decimal places and final answers to nearest dollar amount.) Total Overhead Cool Product A Products Product C Product D b. Does the total amount of overhead cost applied to the products above relate to the T-accounts in any way? Yes NO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started