Answered step by step

Verified Expert Solution

Question

1 Approved Answer

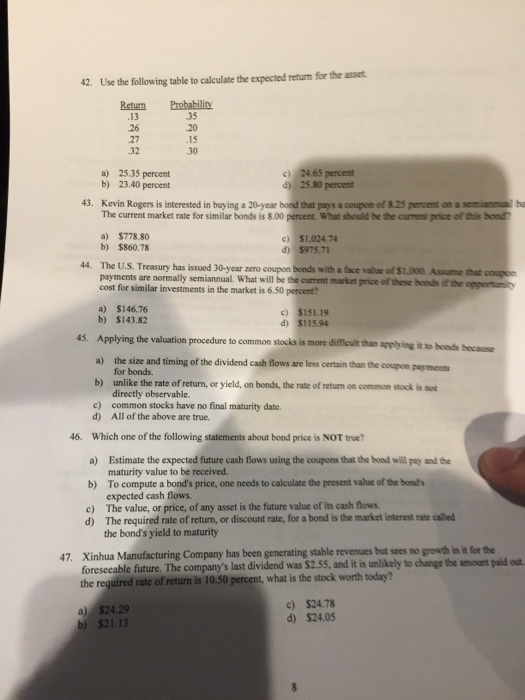

please answer all t 42. Use the following table to calculate the expected return for the asset Retum Probability 13 26 27 32 35 20

please answer all

t 42. Use the following table to calculate the expected return for the asset Retum Probability 13 26 27 32 35 20 15 30 a) 25.35 percent b) 23.40 percent c) 24.65 percent 25.80 percent 43. Kevin Rogers is interested in buying a 20-year bond that pays a coupon of 8.25 percent on a semna The current market rate for similar bonds is 8.00 percent. What should be the current price of this hond a) $778.80 b) $860.78 c) $1,024.74 d) $975.71 44. The U.S. Treasury has issued 30-year zero coupon bonds with a face value of $1,000 Assume that coupo payments are normally semiannual. What will be the current market price of these honds if the oportan cost for similar investments in the market is 6.50 percent? a) $146.76 b) $143.82 c) $151.19 d) $115.94 to common stocks is more difficult than applying it to honds because a) the size and timing of the dividend cash flows are less certain than the coupon paymens for bonds. unlike the rate of returm, or yield, on bonds, the rate of returm on common stock is ot directly observable b) c) common stocks have no final maturity date d) All of the above are true 46. Which one of the following statements about bond price is NOT true? a) Estimate the expected future cash flows using the coupons that the bond will pay and the maturity value to be received b) To compute a bond's price, one needs to calculate the present value of the bon's expected cash flows c) The value, or price, of any asset is the future value of its cash flows d) The required rate of return, or discount rate, for a bond is the market interest rate calted the bond's yield to maturity 47. Xinhua Manufacturing Company has been generating stable revenues but rate of retun is 10.50 percent, what is the stock worth today? sees no growth in it for the foresecable future. The company's last dividend was $2.55, and it is unlikely to change the amount paid odt the a) 524.29 b) $21.13 c) $24.78 d) $24.05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started