Please answer ALL tables, thank you very very much!!

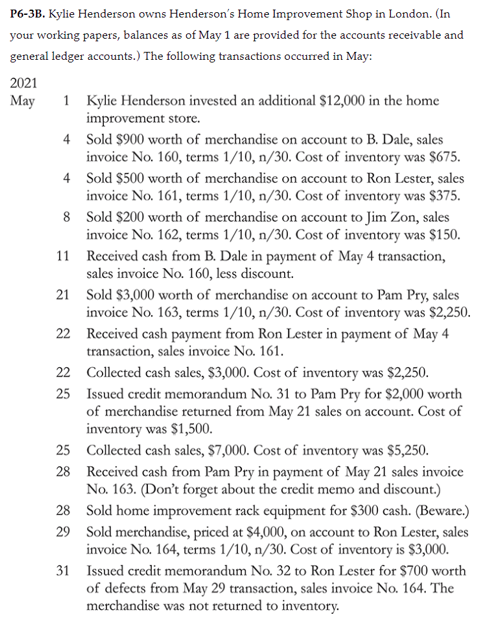

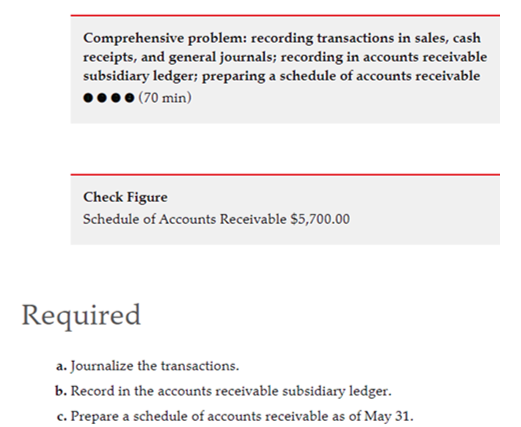

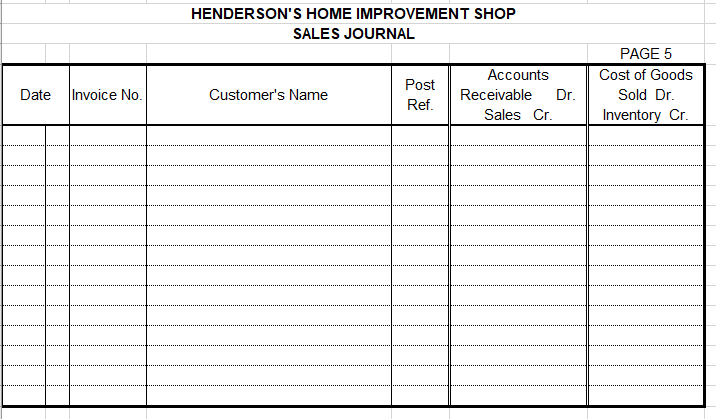

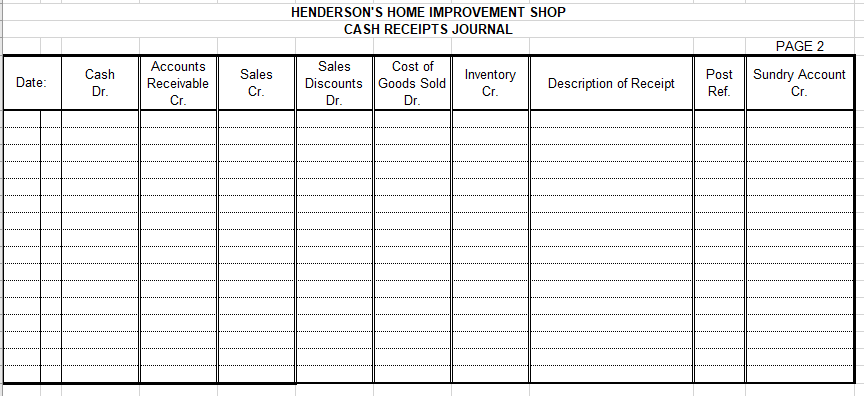

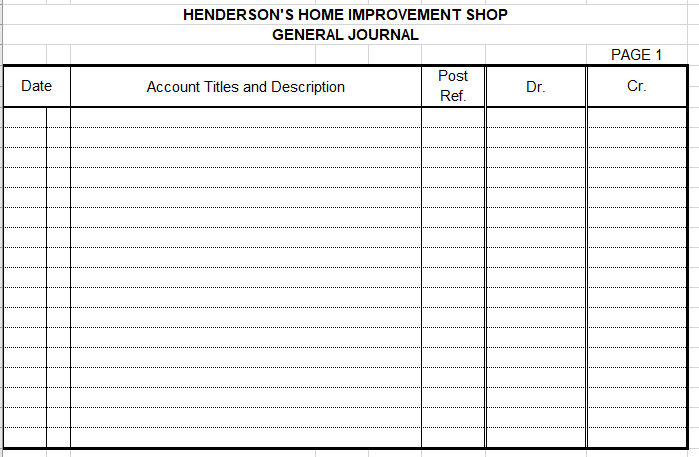

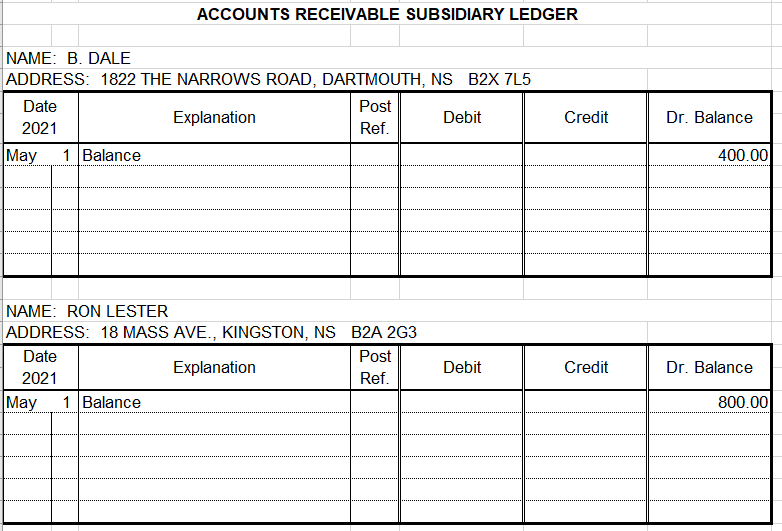

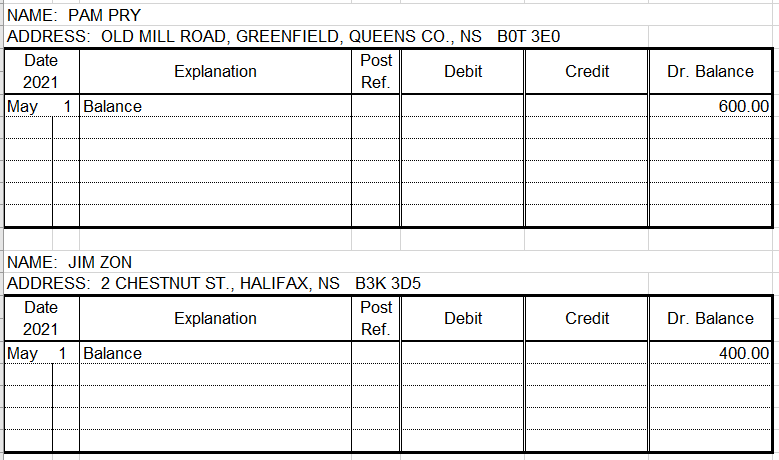

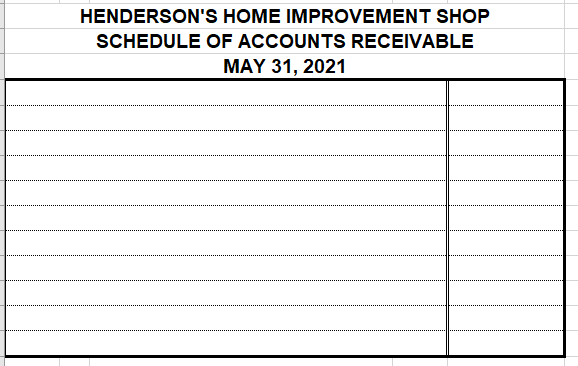

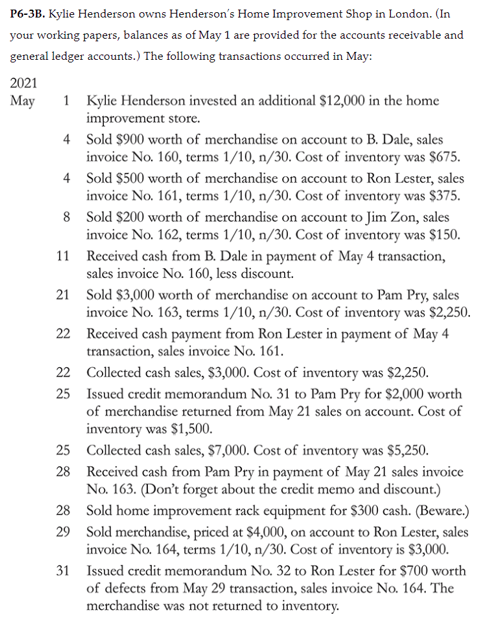

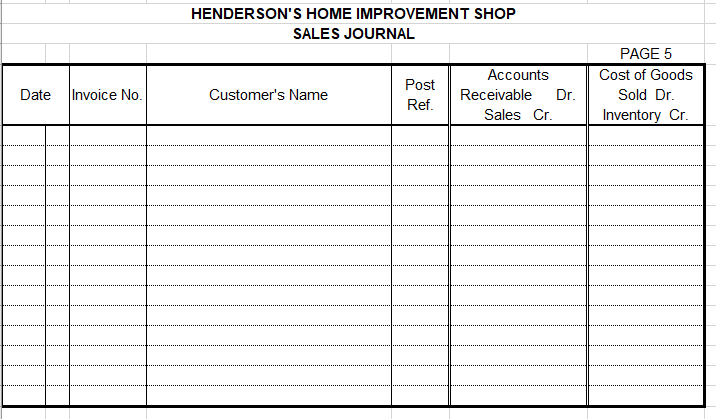

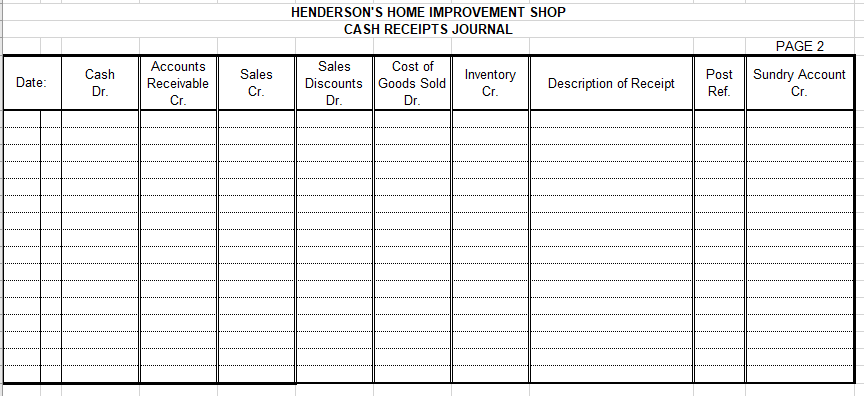

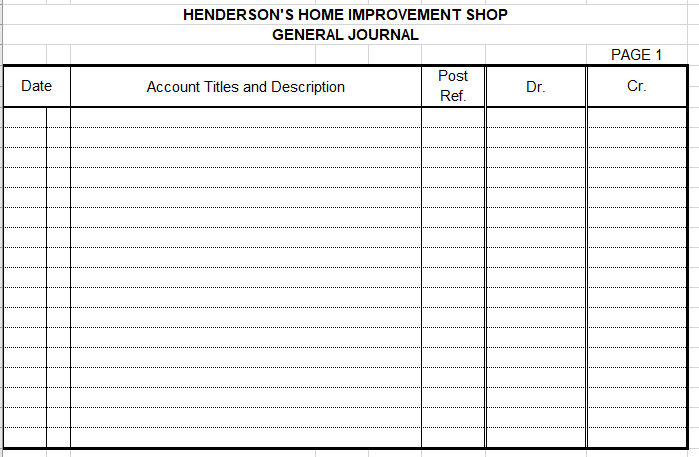

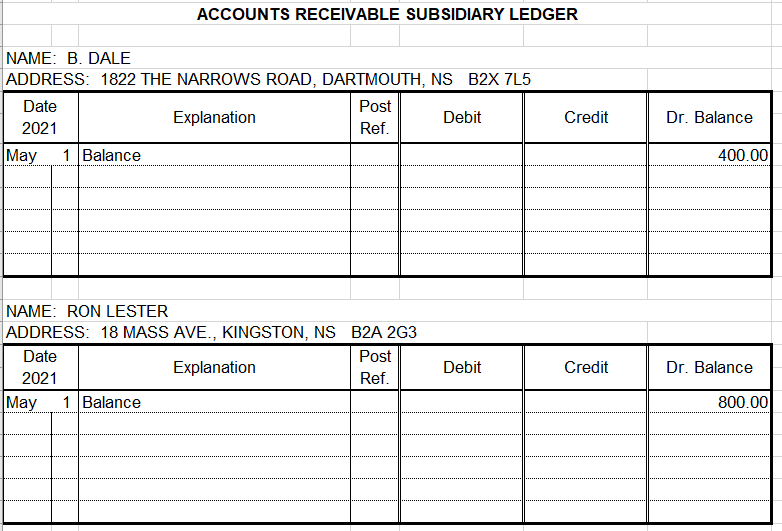

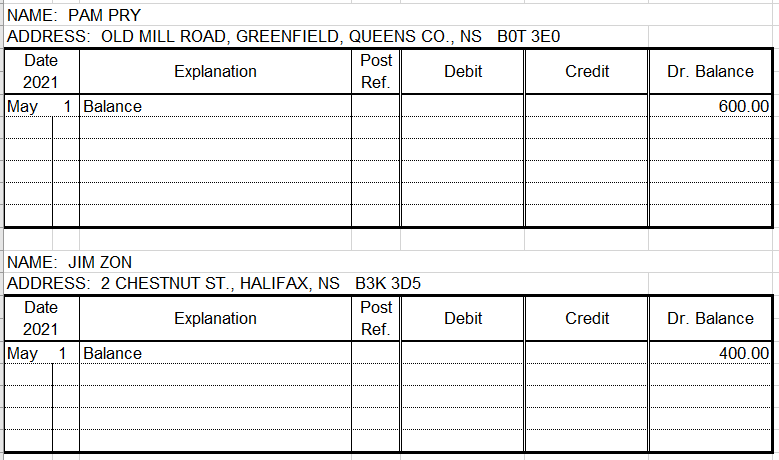

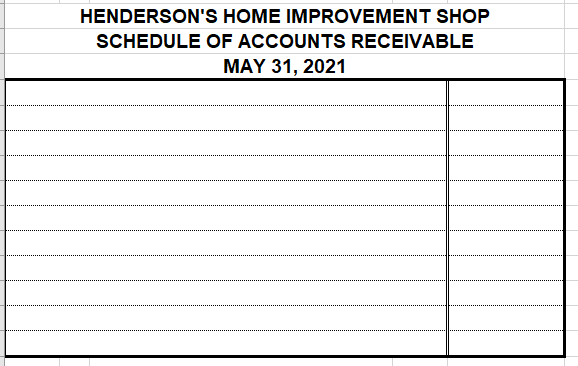

P6-3B. Kylie Henderson owns Henderson's Home Improvement Shop in London. (In your working papers, balances as of May 1 are provided for the accounts receivable and general ledger accounts. The following transactions occurred in May: 2021 May 1 Kylie Henderson invested an additional $12,000 in the home improvement store 4 Sold $900 worth of merchandise on account to B. Dale, sales invoice No. 160, terms 1/10, n/30. Cost of inventory was $675. 4 Sold $500 worth of merchandise on account to Ron Lester, sales invoice No. 161, terms 1/10, n/30. Cost of inventory was $375. 8 Sold $200 worth of merchandise on account to Jim Zon, sales invoice No. 162, terms 1/10, n/30. Cost of inventory was $150. 11 Received cash from B. Dale in payment of May 4 transaction, sales invoice No. 160, less discount. 21 Sold $3,000 worth of merchandise on account to Pam Pry, sales invoice No. 163, terms 1/10, n/30. Cost of inventory was $2,250. 22 Received cash payment from Ron Lester in payment of May 4 transaction, sales invoice No. 161. 22 Collected cash sales, $3,000. Cost of inventory was $2,250. 25 Issued credit memorandum No. 31 to Pam Pry for $2,000 worth of merchandise returned from May 21 sales on account. Cost of inventory was $1,500. 25 Collected cash sales, $7,000. Cost of inventory was $5,250. 28 Received cash from Pam Pry in payment of May 21 sales invoice No. 163. (Don't forget about the credit memo and discount.) 28 Sold home improvement rack equipment for $300 cash. (Beware.) 29 Sold merchandise, priced at $4,000, on account to Ron Lester, sales invoice No. 164, terms 1/10, n/30. Cost of inventory is $3,000. 31 Issued credit memorandum No. 32 to Ron Lester for $700 worth of defects from May 29 transaction, sales invoice No. 164. The merchandise was not returned to inventory. Comprehensive problem: recording transactions in sales, cash receipts, and general journals; recording in accounts receivable subsidiary ledger; preparing a schedule of accounts receivable (70 min) Check Figure Schedule of Accounts Receivable $5,700.00 Required a. Journalize the transactions. b. Record in the accounts receivable subsidiary ledger. c. Prepare a schedule of accounts receivable as of May 31. HENDERSON'S HOME IMPROVEMENT SHOP SALES JOURNAL Date PAGE 5 Cost of Goods Sold Dr. Inventory Cr. Invoice No. Post Ref. Customer's Name Accounts Receivable Dr. Sales Cr. HENDERSON'S HOME IMPROVEMENT SHOP CASH RECEIPTS JOURNAL PAGE 2 Date: Cash Dr. Accounts Receivable Sales Cr. Sales Cost of Discounts Goods Sold Dr. Inventory Cr. Description of Receipt Post Ref. Sundry Account Cr. Cr. Dr. HENDERSON'S HOME IMPROVEMENT SHOP GENERAL JOURNAL PAGE 1 Date Account Titles and Description Post Ref. Dr. Cr. ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER NAME: B. DALE ADDRESS: 1822 THE NARROWS ROAD, DARTMOUTH, NS B2X 7L5 Date Post Explanation Debit 2021 Ref. May 1 Balance Credit Dr. Balance 400.00 NAME: RON LESTER ADDRESS: 18 MASS AVE., KINGSTON, NS B2A 263 Date Post Explanation 2021 Ref. May 1 Balance Debit Credit Dr. Balance 800.00 NAME: PAM PRY ADDRESS: OLD MILL ROAD, GREENFIELD, QUEENS CO., NS BOT 3E0 Date Post Explanation Debit Credit 2021 Ref. May 1 Balance Dr. Balance 600.00 NAME: JIM ZON ADDRESS: 2 CHESTNUT ST., HALIFAX, NS B3K 3D5 Date Post Explanation 2021 Ref. May 1 Balance Debit Credit Dr. Balance 400.00 HENDERSON'S HOME IMPROVEMENT SHOP SCHEDULE OF ACCOUNTS RECEIVABLE MAY 31, 2021