Answered step by step

Verified Expert Solution

Question

1 Approved Answer

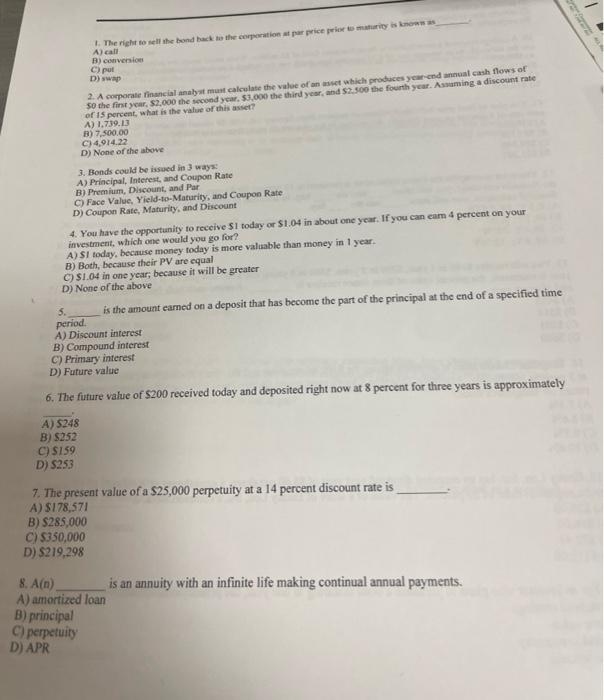

Please answer all, thank you :) 1. The rieht to sell the bond back ao the corporation at par price prior ts mutuarity is knowis

Please answer all, thank you :)

1. The rieht to sell the bond back ao the corporation at par price prior ts mutuarity is knowis as A) call: A) convcrision! (*) put D) swap 2. A corporate finmeial analyst muat calculate the value of an aset which probuces year-cod annual cash flows of 50 the fint ycar, $2,000 the secend ycar, 53,000 the thiru yesr; and $7.900 the fourth ycar. Asuaming a discount rate of 15 percent, what is the value of this asset? 4) 1,739.13 B) 7,500.00 C) 4,914.22 D) None of the above. 3. Bonds could be issued ait 3 ways: A) Principal. Interest, and Coupon Fate B) Premium, Discount, and Par C) Face Value, Y ield-1o-Maturity, and Coupon Rate D) Coupon Rate, Miafurity, and Discount 4. You have the opportanity to receive $1 today or $1.04 in about one year. If you can cam 4 perceat on your investruent, which one would you go for? A) 51 today; because money roday is more valuable than money in 1 year. B) Both, because their PV are equal C) 51.04 in one year; becauce it will be greater D) None of the above 5. is the amount eamed on a deposit that has become the part of the principal at the end of a specified time period. A) Discount interest B) Compound interest. C) Primary interest D) Future value 6. The future value of $200 received today and deposited right now at 8 percent for three years is approximately A) 5248 B) $252 C) 5159 . D) 5253 7. The present value of a $25,000 perpetuity at a 14 percent discount rate is A) $178,571 B) $285,000 C) 5350,000 D) 5219,298 8. A(n) is an annuity with an infinite life making continual annual payments. A) amortized loan B) principal C) perpetuity D) APR 1. The rieht to sell the bond back ao the corporation at par price prior ts mutuarity is knowis as A) call: A) convcrision! (*) put D) swap 2. A corporate finmeial analyst muat calculate the value of an aset which probuces year-cod annual cash flows of 50 the fint ycar, $2,000 the secend ycar, 53,000 the thiru yesr; and $7.900 the fourth ycar. Asuaming a discount rate of 15 percent, what is the value of this asset? 4) 1,739.13 B) 7,500.00 C) 4,914.22 D) None of the above. 3. Bonds could be issued ait 3 ways: A) Principal. Interest, and Coupon Fate B) Premium, Discount, and Par C) Face Value, Y ield-1o-Maturity, and Coupon Rate D) Coupon Rate, Miafurity, and Discount 4. You have the opportanity to receive $1 today or $1.04 in about one year. If you can cam 4 perceat on your investruent, which one would you go for? A) 51 today; because money roday is more valuable than money in 1 year. B) Both, because their PV are equal C) 51.04 in one year; becauce it will be greater D) None of the above 5. is the amount eamed on a deposit that has become the part of the principal at the end of a specified time period. A) Discount interest B) Compound interest. C) Primary interest D) Future value 6. The future value of $200 received today and deposited right now at 8 percent for three years is approximately A) 5248 B) $252 C) 5159 . D) 5253 7. The present value of a $25,000 perpetuity at a 14 percent discount rate is A) $178,571 B) $285,000 C) 5350,000 D) 5219,298 8. A(n) is an annuity with an infinite life making continual annual payments. A) amortized loan B) principal C) perpetuity D) APR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started