Answered step by step

Verified Expert Solution

Question

1 Approved Answer

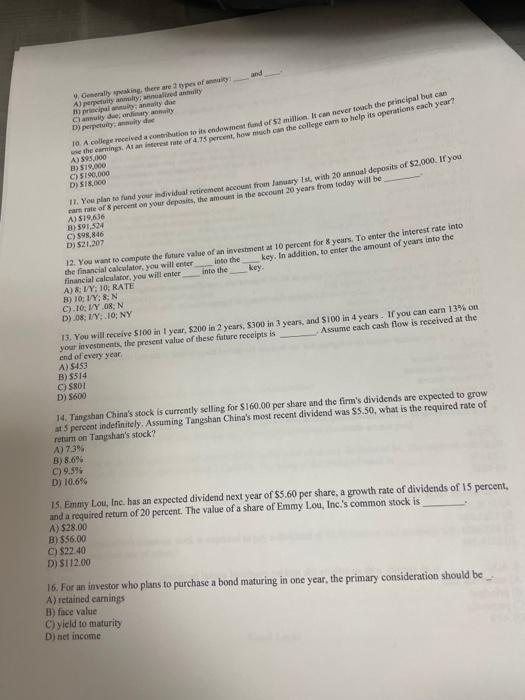

Please answer all, thank you :) 13) prificipal wimugr; annaity dat Cl annuily see, andiain anhaily D) perpetuily, annuiry diec de the earnings. At an

Please answer all, thank you :)

13) prificipal wimugr; annaity dat Cl annuily see, andiain anhaily D) perpetuily, annuiry diec de the earnings. At an itecrest nate of 4.75 pereent, how much cal the A) 595.000 B) 519,000 (C) $190,000 D) 518,000 17. Yoe plan te fund your individual retirement account from fasyary. 13t, with 20 annoal deposits of $2.000. If y ca eart rate of 8 pereent on your deposits, the amount in the account 20 years from today will be A) 519,636 B) 591,524 C) 598,846 D) 521.207 12. Yeu want wo compuse the future value of an inveament at 10 percent for 8 years. To enter the interest rate into the financial calcalator, you will enter into the key. In addition, to enter the ameant of years into the financial calcularof, you will enter _ into the keoy. A) 8:MY;10:RATE B) 10;1Y;8,N C) 10;MY08;N D) .08;1Y;.10;NY 13. You will receive $100 in I year, $200 in 2 years, $300 in 3 years, and $100 in 4 years . If you cas earn 13% on your invesments, the presect value of these future receipts is . Assume each cash flow is received at the end of every year, A) 5453 B) 5514 C) 5801 D) 5600 I4. Thinghan China's stock is currently selling for $160.00 per slure and the firn's dividends are expected to grow at 5 peresat indefinitely. Assuming Tangshan China's most recent dividend was $5.50, what is the required rate of refurm on Tangshan's stock? (4) 7.3% B) 8.6s C) 9.582 D) 10.6% 15. Emnyy Lou, Inc. has an expected dividend next year of $5.60 per share, a growth rate of dividends of 15 percent, and a required retum of 20 percent. The value of a share of Emmy Lou, Inc's common stock is A) 528.00 B) 556.00 () 322.40 D) 5112,00 16. For an imvestor who plans to purchase a bond maturing in one year, the primary consideration should be: A) retained camings B) face valie C)yicld to maturity D) nef income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started