Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all thanks What is the present value of the following end-of-year cash flows if the discount rate is 8 percent? Cash flows: Year

please answer all thanks

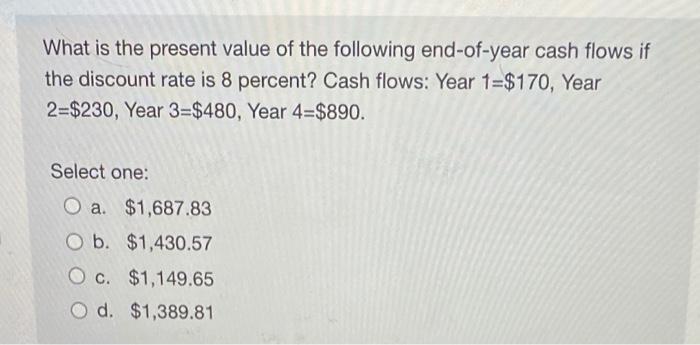

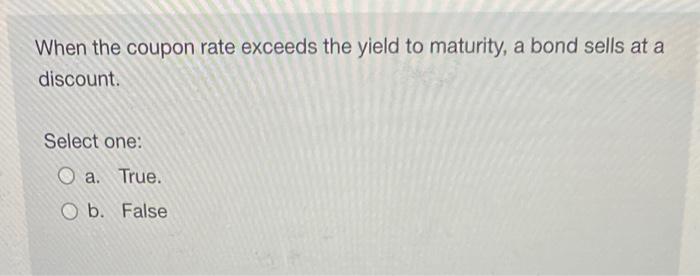

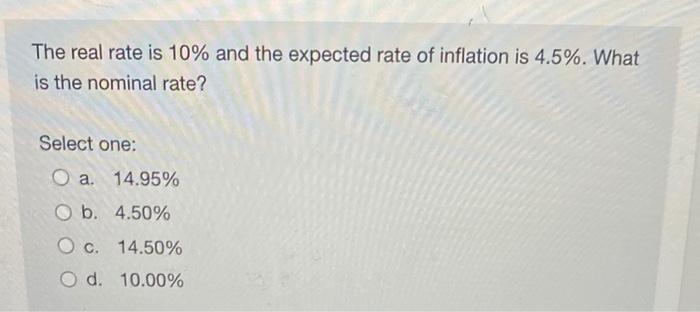

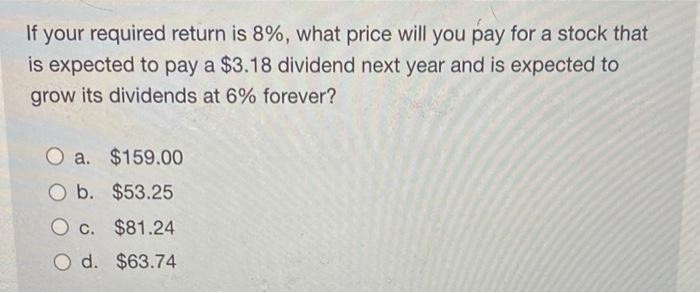

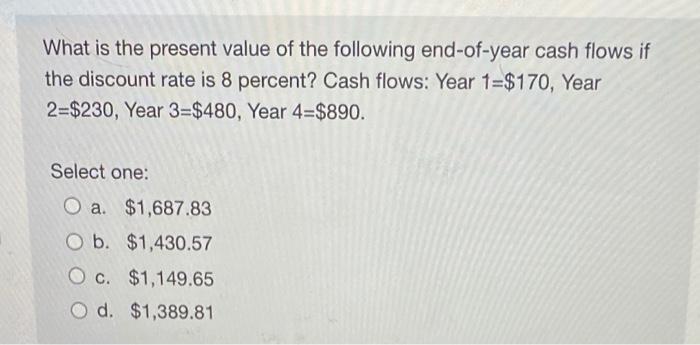

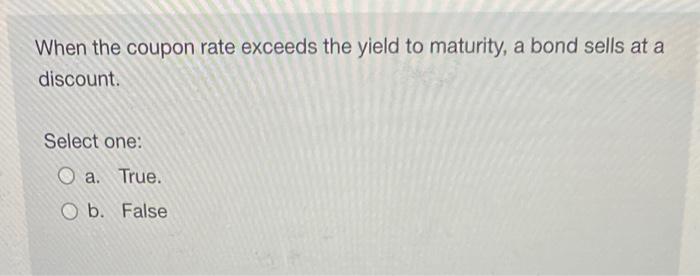

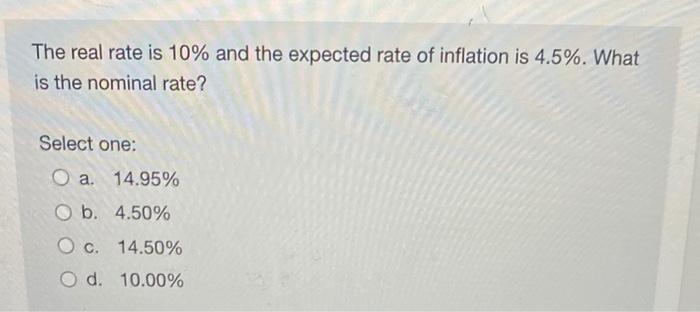

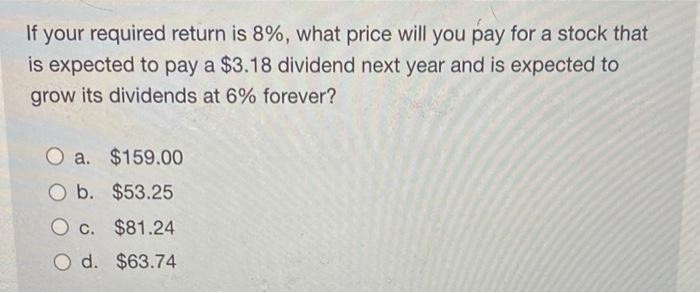

What is the present value of the following end-of-year cash flows if the discount rate is 8 percent? Cash flows: Year 1=$170, Year 2=$230, Year 3=$480, Year 4=$890. Select one: O a $1,687.83 O b. $1,430.57 O c. $1,149.65 O d. $1,389.81 When the coupon rate exceeds the yield to maturity, a bond sells at a discount. Select one: O a. True. O b. False The real rate is 10% and the expected rate of inflation is 4.5%. What is the nominal rate? Select one: O a. 14.95% O b. 4.50% O c. 14.50% O d. 10.00% If your required return is 8%, what price will you pay for a stock that is expected to pay a $3.18 dividend next year and is expected to grow its dividends at 6% forever? O a. $159.00 b. $53.25 O c. $81.24 d. $63.74

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started