please answer all the boxes below , thanks !!

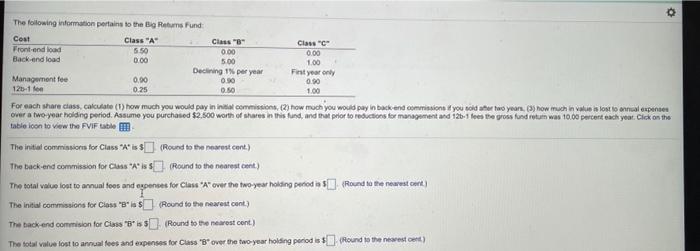

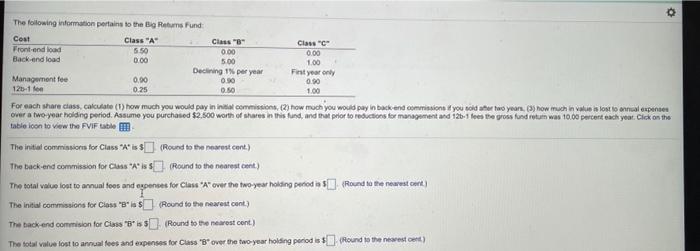

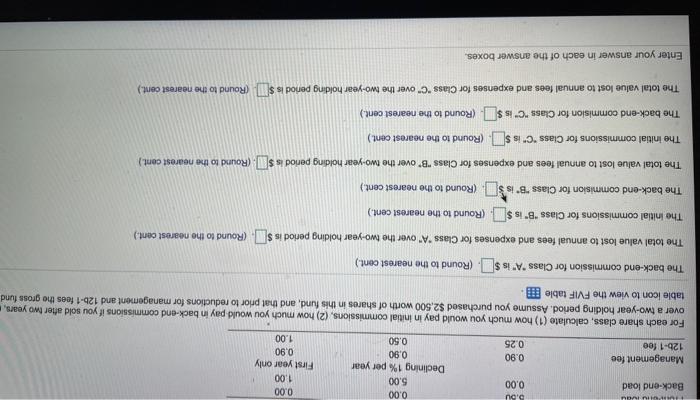

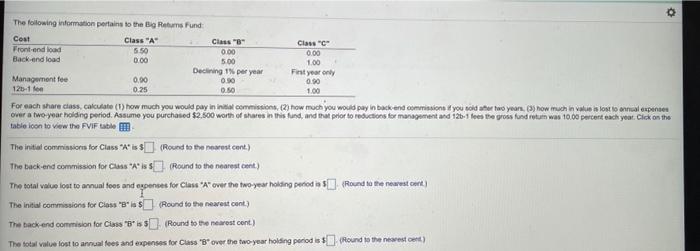

The following information portains to the Big Returns Fund Cost Class A Class" Clase C Front-end load 5.50 0.00 0.00 Back and load 5.00 1.00 Declining 1% per year First year only Managenont fee 0,90 0.30 0.90 120-1 for 0.25 0.50 1.00 For each share class, calculate (1) how much you would pay incommissions, (2) how much you would pay in backend comissions you told her two years (3) how much in value is lost to annual expenses over a two year holding period. Assume you purchased $2,500 worth of shares in this fund, and that prior to reductions for management and 12b-1 foes the gross fond return was 10.00 percent each year. Click on the table loon to view the FVIF ablem The initial commissions for Class ***s$ (Roond to the nearest cont.) The back-end commission for Class "A" is Round to the nearest cont) The total value foot to annual toes and expenses for Class "A" over the two-year holding perodias (Round to the newest cond) The initial commissions for Clows (Round to the nearest cont.) The back end comision for Class b' is $. (Round to the nearest cont) The total value lost to annual toes and expenses for Class over the two-year holding periode $) Round to the nearest cent) Sau Back-end load 0.00 0.00 0.00 5.00 Declining 1% per year 0.90 0.50 Management fee 125-1 fee 0.00 1.00 First year only 0.90 1.00 0.90 0.25 For each share class, calculate (1) how much you would pay in initial commissions, (2) how much you would pay in back-end commissions if you sold after two years, over a two-year holding period. Assume you purchased $2,500 worth of shares in this fund, and that prior to reductions for management and 125-1 fees the gross fund table icon to view the FVIF table ! The back-end commission for Class "A" is $. (Round to the nearest cont.) The total value lost to annual fees and expenses for Class "A" over the two-year holding period is $ (Round to the nearest cent.) The initial commissions for Class "B" is $ (Round to the nearest cent.) The back-end commision for Class "Bis $ (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "B* over the two-year holding period is $1(Round to the nearest cont.) The initial commissions for Class "C" is $ (Round to the nearest cent) The back-end commision for Class "C" is $. (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "C" over the two-year holding period is $0 (Round to the nearest cent.) Enter your answer in each of the answer boxes. The following information portains to the Big Returns Fund Cost Class A Class" Clase C Front-end load 5.50 0.00 0.00 Back and load 5.00 1.00 Declining 1% per year First year only Managenont fee 0,90 0.30 0.90 120-1 for 0.25 0.50 1.00 For each share class, calculate (1) how much you would pay incommissions, (2) how much you would pay in backend comissions you told her two years (3) how much in value is lost to annual expenses over a two year holding period. Assume you purchased $2,500 worth of shares in this fund, and that prior to reductions for management and 12b-1 foes the gross fond return was 10.00 percent each year. Click on the table loon to view the FVIF ablem The initial commissions for Class ***s$ (Roond to the nearest cont.) The back-end commission for Class "A" is Round to the nearest cont) The total value foot to annual toes and expenses for Class "A" over the two-year holding perodias (Round to the newest cond) The initial commissions for Clows (Round to the nearest cont.) The back end comision for Class b' is $. (Round to the nearest cont) The total value lost to annual toes and expenses for Class over the two-year holding periode $) Round to the nearest cent) Sau Back-end load 0.00 0.00 0.00 5.00 Declining 1% per year 0.90 0.50 Management fee 125-1 fee 0.00 1.00 First year only 0.90 1.00 0.90 0.25 For each share class, calculate (1) how much you would pay in initial commissions, (2) how much you would pay in back-end commissions if you sold after two years, over a two-year holding period. Assume you purchased $2,500 worth of shares in this fund, and that prior to reductions for management and 125-1 fees the gross fund table icon to view the FVIF table ! The back-end commission for Class "A" is $. (Round to the nearest cont.) The total value lost to annual fees and expenses for Class "A" over the two-year holding period is $ (Round to the nearest cent.) The initial commissions for Class "B" is $ (Round to the nearest cent.) The back-end commision for Class "Bis $ (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "B* over the two-year holding period is $1(Round to the nearest cont.) The initial commissions for Class "C" is $ (Round to the nearest cent) The back-end commision for Class "C" is $. (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "C" over the two-year holding period is $0 (Round to the nearest cent.) Enter your answer in each of the answer boxes