Please answer all the following questions above including the additional questions. Questions are highlighted in bold.

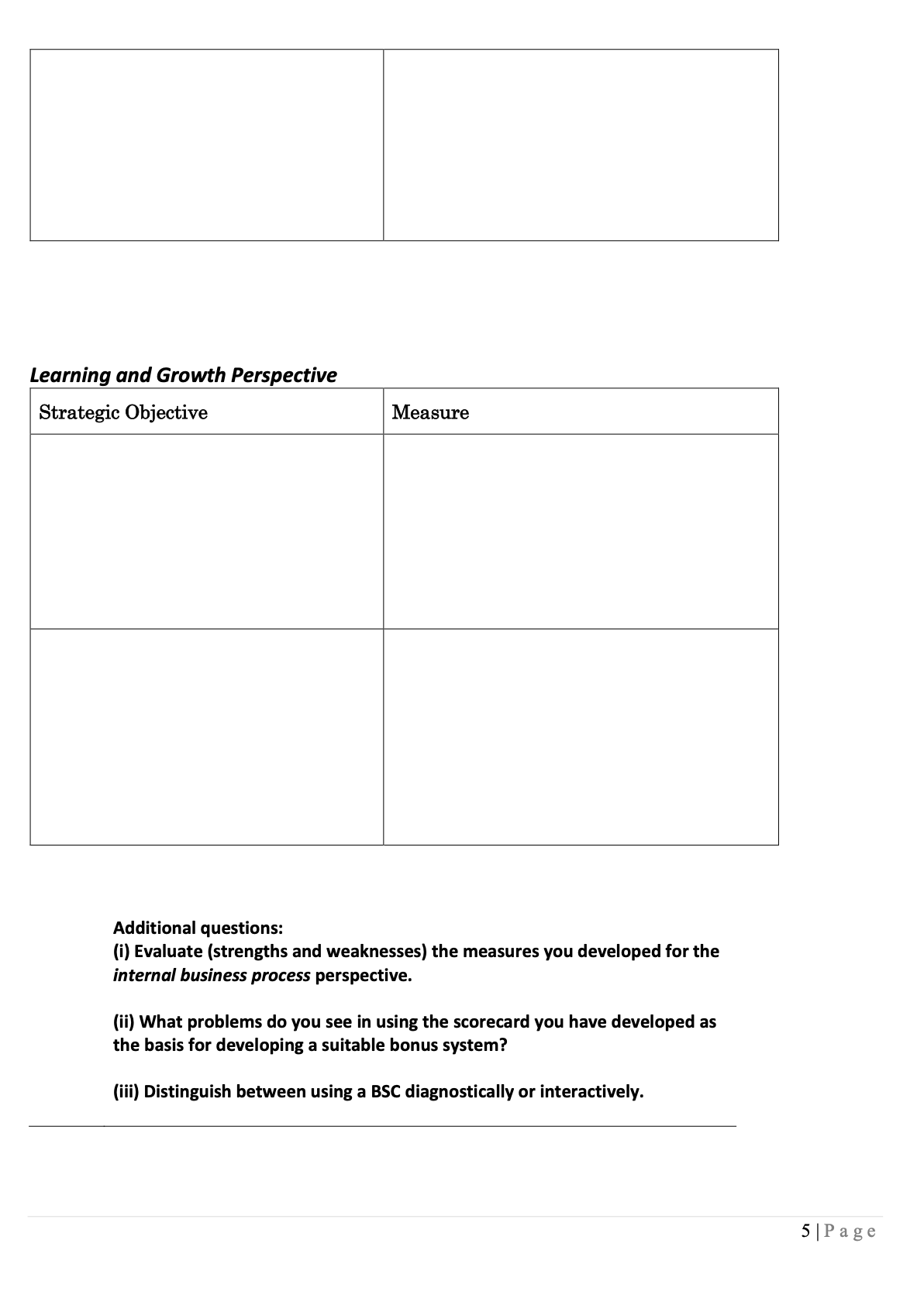

Question 1 Olivers case Olivers Ltd is a multi-divisional company with a focus in the wine, hospitality and entertainment industries. Olivers commenced in 1995 as a small wine company but over the years has expanded its operation and interests; predominantly through acquisitions. |t listed on the stock exchange in 2003. In the early days, the company had an informal culture and strong belief system. Stefan, the original founder of Olivers operated Olivers as a family company where he knew the names of all employees and spent hours in conversations with all of them about the business direction, wine issues and plans for the future. As the company has grown, this 'Oliver-family' way of doing business has been more difficult to maintain. At the time of listing Herb Barlow was appointed chief executive officer (CEO). Barlow's first task was to execute a re-organisation of the company into three distinct divisions: Wine; Hospitality and Entertainment. Each division was classified as an investment centre. Barlow appointed divisional managers who had been with the company for some time in the hope they would continue in the role for the longerterm. The internal structure within each division was left to each divisional manager. Invariably, most su b-u nits within investment centres were either profit centres or cost centres, though some were also classified as investment centres. The current organizational strategy is growth by acquisition with the objective of being the number one high quality company in the industry. This broad strategy is evident in each of the divisions through their key strategic planks which drive divisional activity. While there are some interdependencies between divisions, this is not a central feature of the company. Performance Measurement Since listing on the stock exchange, the focus of the performance measurement system has remained unchanged. Barlow is aware of the need to evaluate the current performance measurement and incentive structures and is planning a review within the next twelve months. Barlow has some ideas which he might pursue with individual divisions but for the moment, he figures he has enough on his plate. Divisional managers are currently evaluated on the basis of two key criteria. First, Barlow conducts an appraisal of each manager with reference to individualized objectives and measures with links to organisational objectives. Second, the incentive payment to divisional managers and the top 6 senior executives is based on a bonus pool calculated on the basis of organizational profit and distributed to divisional managers according to divisional ROI performance. Divisional managers are expected to achieve ROI targets, which are set in consultation with Barlow. ROI has been used this way for some years. Recently, Barlow has introduced an adjustment to the incentive payment to encourage new investments in line with the growth objectives of the company. Wine Division 1|Page The Wine Division (WD) is organised across six different business units. Most support functions are provided through a shared services function at headquarters, although there is some local support provided for accounting, information technology and marketing. The WD has a strategy of product differentiation and innovation through high quality premium wines and product development. The concept of high quality is promoted across all functions and activities from the vineyards to wine-making operations to customer- relations and post-sales support. A number of the subunits in the division are classified as investment centres by the divisional manager Alex Bardin. Ba rdin's reasoning is that if it is good enough for him to be evaluated on the basis of ROI it is good enough for each of the larger sub-u nits within the WD. The performance of the WD has traditionally been strong, averaging an ROI of 10% over recent years. However, a number of factors seem to be making good performance much more difficult to achieve. These include: 1) Supermarkets have been able to commission some winemakers to make generic label wines of reasonably high quality able to be sold at a relatively low retail price (around $10}, which is about half the price of competitor wines of similar {if slightly higher) quality. 2) A recent internal audit of the division's assets revealed that many were bordering on obsolete and were so old they were causing significant inefficiencies and restricting production. Upon further investigation this seemed common across the divisions. 3) Customer data that had usually been generated no longer seemed sufficient. The market seemed to be changing and the customer satisfaction data via surveys conducted by an external company seemed too general and basically, too late to be of much use. The WD had two broad sets of customers: retailers (wine shops) and end consumers. 4) There were a number of industry factors of concern. Over the last two years, prices for wine grapes have fallen dramatically for a number of varieties, resulting in some cases, in wine growers having to sell their grapes well below production costs. This is occurring at the same time as an oversupply of some grape varieties exists. Wine grape growers within the WD transfer internally about 70% of their production. The remaining 30% is sold either under contract to wine makers or on the open market. 5) It is becoming increasingly evident that innovation and people are critical in this industry. This had become more evident in the last six months as the WD had lost three key staff (including one winemaker) to competitors. Balanced scorecard pilot project: Wine Division (WD) Since joining Olivers, the new CFO Wallis has been busy raising new ideas to improve the performance measurement and control system. One of these has been the a pilot project of a balanced scorecard within the WD. Wallis held a number of introductory meetings with divisional manager Bardin as well as a number of other senior managers in the division. Following an initial presentation by an external consultant, Wallis made it clear how the project would proceed. Bardin would need to develop a number of key strategic planks (or levers) to guide the focus of BBC development (see Exhibit 1) within the WD; a series of meetings would follow with sub-unit managers with a view to developing a BSC at the level of the WD. Exhibit 1 Wine Division key priorities or strategic levers Grow revenue ahead of the market Increase market share across the product range Improve quality across all activities, functions and processes Maintain improvements in ROI each year Trade more effectively with customers (for example, wine shops) Develop the knowledge of all staff through training and knowledge sharing and ensure a safe working environment. n___..__ _ I__.l-.. :. :_.__.._a.:__ _...I _.._._I.._A .l-.._l__...___a. 2|Page Following a series of meetings within the WD, a number of common queries kept emerging. These are summarised below: 1. Is ROI a useful performance measure at sub-unit level within the division as well as at the divisional and organizational level, or is there something better. Why does it have to be the same ? At any rate, how do we know what's best at different levels of the company? Or, do we need to look at this another way? If we are going to have a BSC, what does that mean for our incentives? How do we best link a set of BSC measures to our bonuses? How is the BSC to be used? Obviously we can use it diagnostically, to provide feedback against pre- set targets and see if we are on-track? But is there more? Bardin wondered what he had got himselfinto! 1. What are the key factors that determine the suitability of performance measures at any level of an organisation? Illustrate with reference to case facts of Olivers. 2. The CEO, Herb Barlow is becoming increasingly aware that innovation and people development is critical to the long-term success of Olivers. Can you explain to Herb, why it may be difficult to achieve this objective whilst ROI is held as the only measure with which to award a bonus to divisional managers? Make TWO suggestions for improving the performance measurement of divisional mangers and explain how they would result in an improvement to the current system. {a} You have been given the responsibility of assisting with the development of the first draft of measures for the balanced scorecard of the WD. Using the templates below state two strategic objectives and two measures linked to those objectives for EACH perspective. Show how each measure would be calculated. Financial Perspective Strategic Objective Measure 3|Page Customer Perspective Strategic Objective Measure in ternai Business Process Perspective Strategic Objective Measure 4|Page Learning and Growth Perspective Strategic Objective Measure Additional questions: (i) Evaluate (strengths and weaknesses) the measures you developed for the internal business process perspective. (ii) What problems do you see in using the scorecard you have developed as the basis for developing a suitable bonus system? (iii) Distinguish between using a BSC diagnostically or interactively. 5|Page