Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the incorrect questions thx Skysong enters into an agreement with Traveler plc to lease a car on December 31, 2021. The following

please answer all the incorrect questions thx

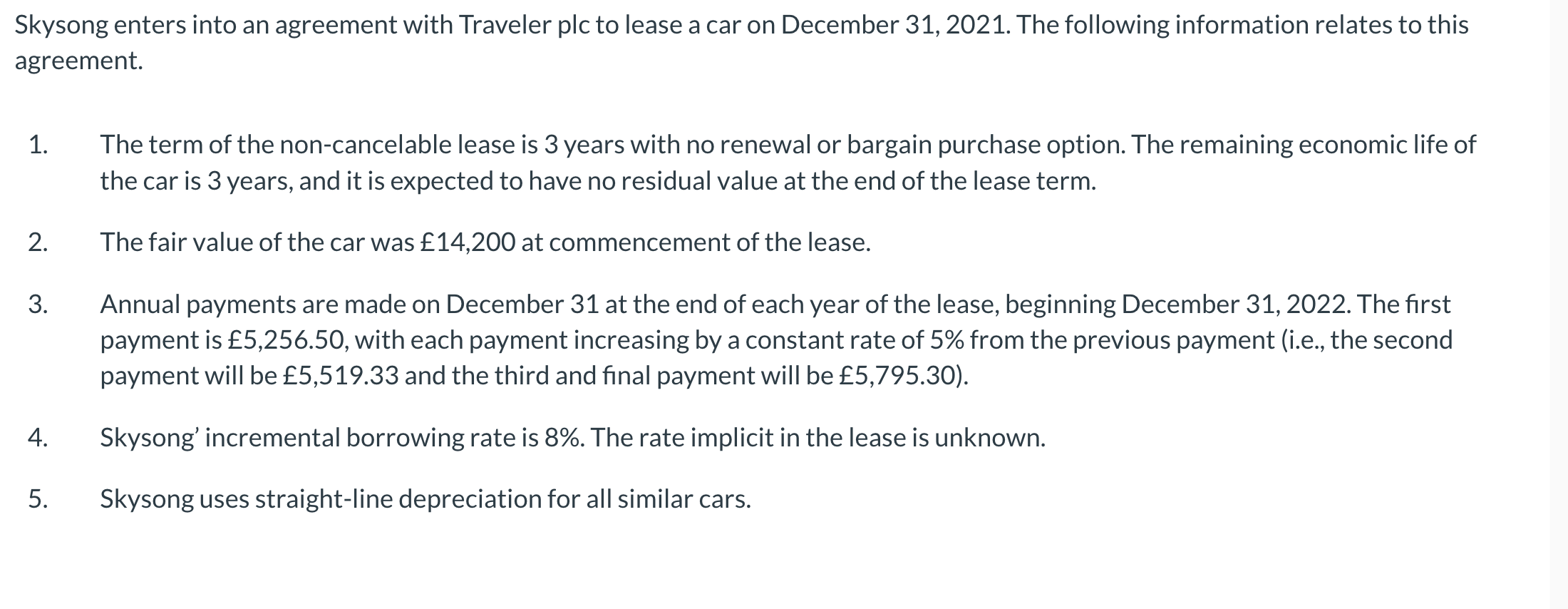

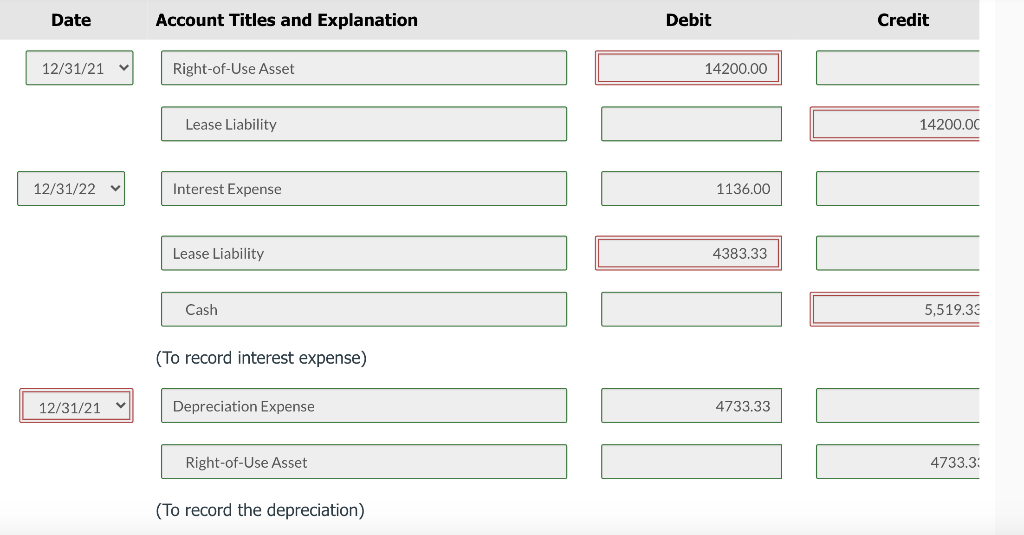

Skysong enters into an agreement with Traveler plc to lease a car on December 31, 2021. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no renewal or bargain purchase option. The remaining economic life of the car is 3 years, and it is expected to have no residual value at the end of the lease term. 2. The fair value of the car was 14,200 at commencement of the lease. 3 . Annual payments are made on December 31 at the end of each year of the lease, beginning December 31, 2022. The first payment is 5,256.50, with each payment increasing by a constant rate of 5% from the previous payment (i.e., the second payment will be 5,519.33 and the third and final payment will be 5,795.30). 4. Skysong'incremental borrowing rate is 8%. The rate implicit in the lease is unknown. 5. Skysong uses straight-line depreciation for all similar cars. Date Account Titles and Explanation Debit Credit 12/31/21 Right-of-Use Asset 14200.00 Lease Liability 14200.00 12/31/22 Interest Expense 1136.00 Lease Liability 4383.33 Cash 5,519.33 (To record interest expense) 12/31/21 Depreciation Expense 4733.33 Right-of-Use Asset 4733.3: (To record the depreciation) 12/31/23 Interest Expense 785.33 Lease Liability 5009.97 Cash 5,795.30 (To record interest expense) 12/31/23 Depreciation Expense 4733.33 Right-of-Use Asset 4733.33 (To record the depreciation)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started