please answer all the part very clearly to ger a thumbs up!

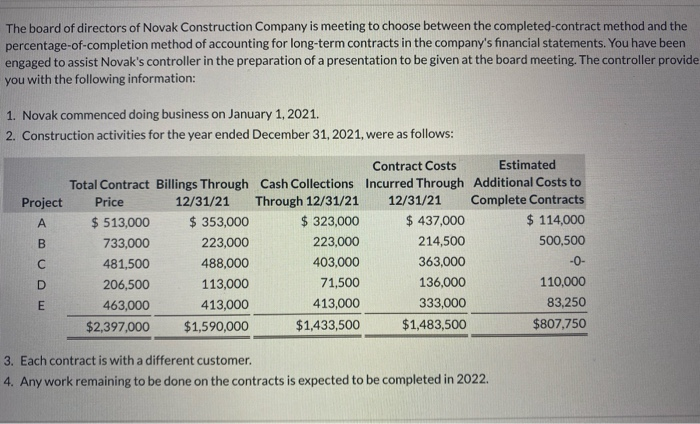

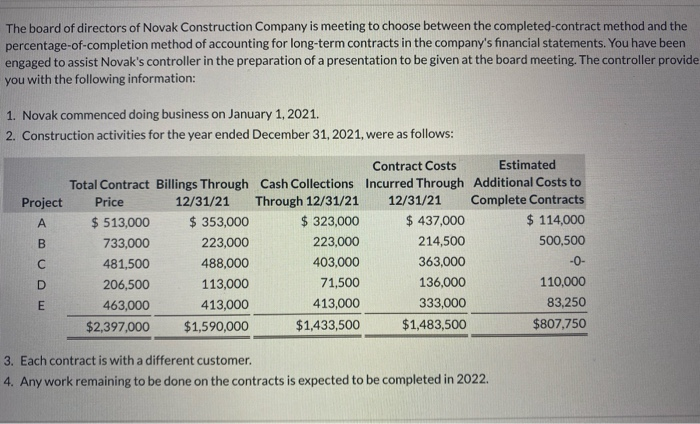

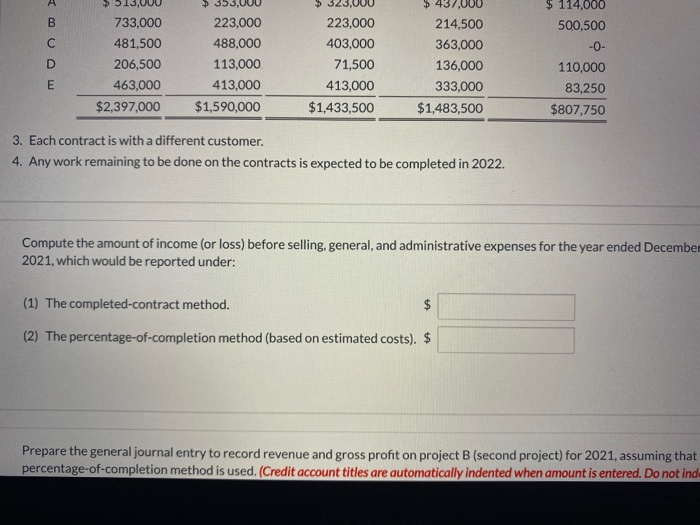

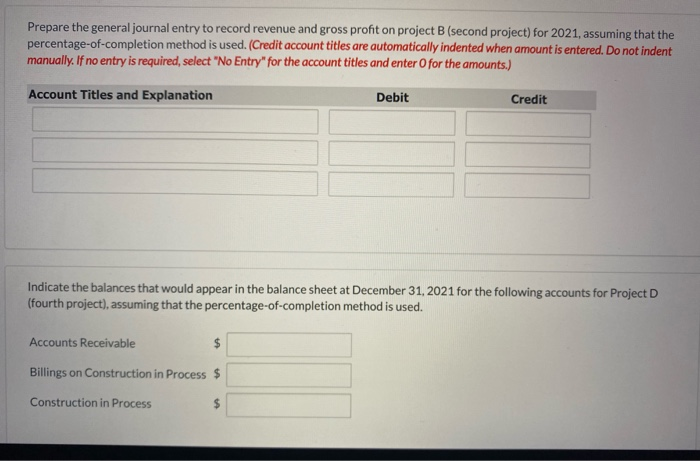

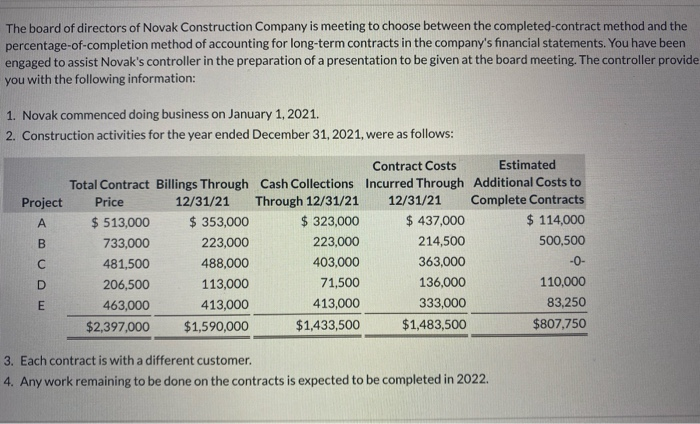

The board of directors of Novak Construction Company is meeting to choose between the completed-contract method and the percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been engaged to assist Novak's controller in the preparation of a presentation to be given at the board meeting. The controller provide you with the following information: 1. Novak commenced doing business on January 1, 2021. 2. Construction activities for the year ended December 31, 2021, were as follows: Project B Contract Costs Estimated Total Contract Billings Through Cash Collections Incurred Through Additional Costs to Price 12/31/21 Through 12/31/21 12/31/21 Complete Contracts $ 513,000 $ 353,000 $ 323,000 $ 437,000 $ 114,000 733,000 223,000 223,000 214,500 500,500 481,500 488,000 403,000 363,000 -O- 206,500 113,000 71,500 136,000 110,000 463,000 413,000 413,000 333,000 83,250 $2,397,000 $1,590,000 $1,433,500 $1,483,500 $807,750 D E 3. Each contract is with a different customer. 4. Any work remaining to be done on the contracts is expected to be completed in 2022. $ 114,000 B 500,500 -O- 3,000 223,000 488,000 113,000 413,000 $1,590,000 733,000 481,500 206,500 463,000 $2,397,000 D $ 437,000 214,500 363,000 136,000 333,000 $1,483,500 223,000 403,000 71,500 413,000 $1,433,500 E 110,000 83,250 $807,750 3. Each contract is with a different customer. 4. Any work remaining to be done on the contracts is expected to be completed in 2022. Compute the amount of income (or loss) before selling, general, and administrative expenses for the year ended December 2021, which would be reported under: (1) The completed-contract method. $ (2) The percentage-of-completion method (based on estimated costs). $ Prepare the general journal entry to record revenue and gross profit on project B (second project) for 2021, assuming that percentage-of-completion method is used. (Credit account titles are automatically indented when amount is entered. Do not ind Prepare the general journal entry to record revenue and gross profit on project B(second project) for 2021, assuming that the percentage-of-completion method is used. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Indicate the balances that would appear in the balance sheet at December 31, 2021 for the following accounts for Project D (fourth project), assuming that the percentage-of-completion method is used. Accounts Receivable $ Billings on Construction in Process $ Construction in Process $ How would the balances in the accounts discussed in part (c) change (if at all) for Project D (fourth project), if the completed- contract method is used? If the completed-contract method is used the account balances