Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the question asap Sweet Golden Inc produces three products X(16,000 units), Y(8,000 units), Z(9,000 units). Each product can be sold at splitoff

Please answer all the question asap

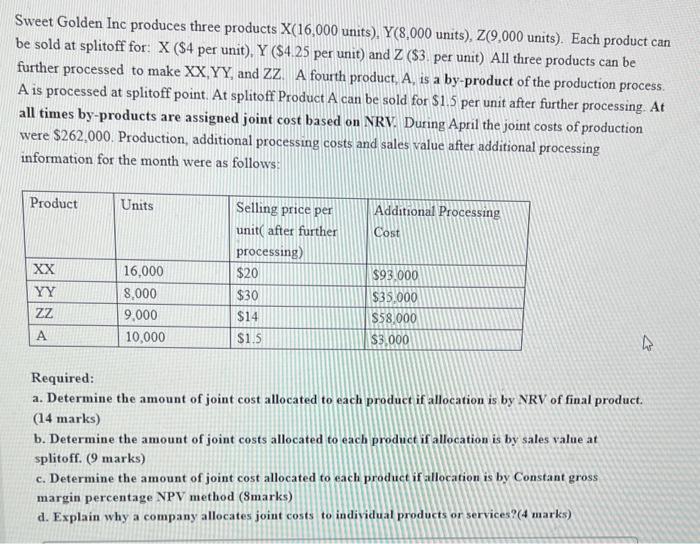

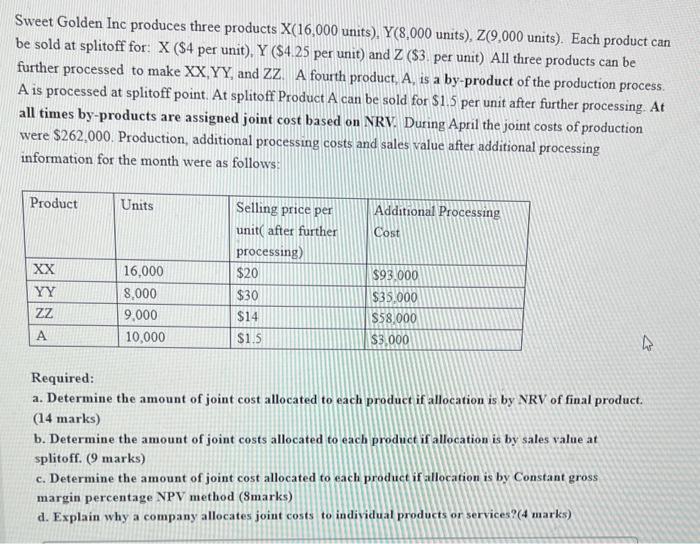

Sweet Golden Inc produces three products X(16,000 units), Y(8,000 units), Z(9,000 units). Each product can be sold at splitoff for: X ( $4 per unit), Y ( $4.25 per unit) and Z ( $3. per unit) All three products can be further processed to make XX,YY, and ZZ. A fourth product, A, is a by-product of the production process. A is processed at splitoff point. At splitoff ProductA can be sold for $1.5 per unit after further processing. At all times by-products are assigned joint cost based on NRV. During April the joint costs of production were $262,000. Production, additional processing costs and sales value after additional processing information for the month were as follows: Required: a. Determine the amount of joint cost allocated to each product if allocation is by NRV of final product. (14 marks) b. Determine the amount of joint costs allocated to each product if allocation is by sales value at splitoff. ( 9 marks) c. Determine the amount of joint cost allocated to each product if allocation is by Constant gross margin percentage NPV method (Smarks) d. Explain why a company allocates joint costs to individual products or services? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started