Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLease answer all the question thank you! QUESTION 12 MSFT currently trades at $105. It pays $0.5 dividend at the end of each quarter. Assume

PLease answer all the question thank you!

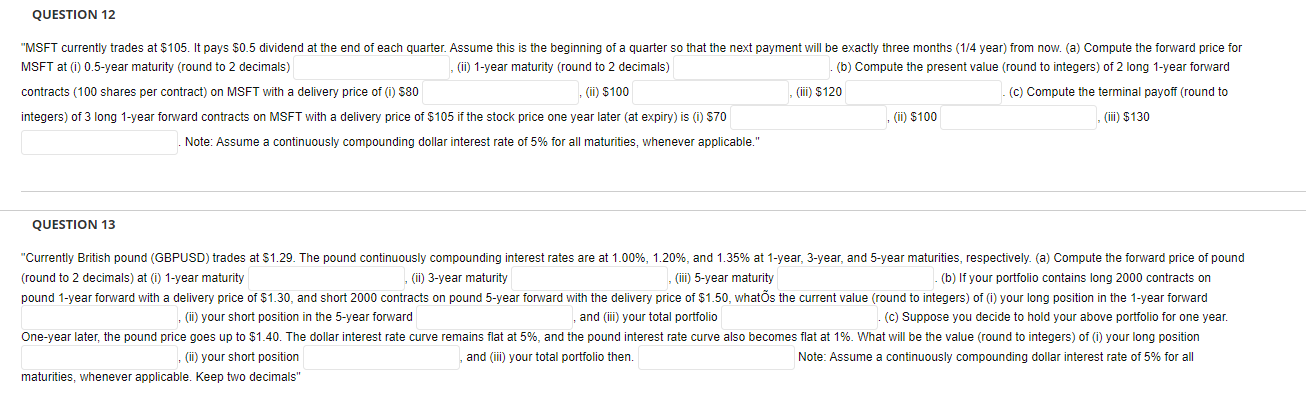

QUESTION 12 "MSFT currently trades at $105. It pays $0.5 dividend at the end of each quarter. Assume this is the beginning of a quarter so that the next payment will be exactly three months (1/4 year) from now. (a) Compute the forward price for MSFT at (0) 0.5-year maturity (round to 2 decimals) (ii) 1-year maturity (round to 2 decimals) (b) Compute the present value (round to integers) of 2 long 1-year forward contracts (100 shares per contract) on MSFT with a delivery price of (0) $80 (ii) $100 (iii) $120 (c) Compute the terminal payoff (round to integers) of 3 long 1-year forward contracts on MSFT with a delivery price of $105 if the stock price one year later (at expiry) is (0) S70 (ii) $100 (iii) $130 Note: Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable." QUESTION 13 "Currently British pound (GBPUSD) trades at $1.29. The pound continuously compounding interest rates are at 1.00%, 1.20%, and 1.35% at 1-year, 3-year, and 5-year maturities, respectively. (a) Compute the forward price of pound (round to 2 decimals) at (0) 1-year maturity (ii) 3-year maturity (iii) 5-year maturity (b) If your portfolio contains long 2000 contracts on pound 1-year forward with a delivery price of $1.30, and short 2000 contracts on pound 5-year forward with the delivery price of $1.50, whats the current value (round to integers) of (1) your long position in the 1-year forward (ii) your short position in the 5-year forward and (iii) your total portfolio (c) Suppose you decide to hold your above portfolio for one year. One-year later, the pound price goes up to $1.40. The dollar interest rate curve remains flat at 5%, and the pound interest rate curve also becomes flat at 1%. What will be the value (round to integers) of your long position (ii) your short position and (iii) your total portfolio then. Note: Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable. Keep two decimals" QUESTION 12 "MSFT currently trades at $105. It pays $0.5 dividend at the end of each quarter. Assume this is the beginning of a quarter so that the next payment will be exactly three months (1/4 year) from now. (a) Compute the forward price for MSFT at (0) 0.5-year maturity (round to 2 decimals) (ii) 1-year maturity (round to 2 decimals) (b) Compute the present value (round to integers) of 2 long 1-year forward contracts (100 shares per contract) on MSFT with a delivery price of (0) $80 (ii) $100 (iii) $120 (c) Compute the terminal payoff (round to integers) of 3 long 1-year forward contracts on MSFT with a delivery price of $105 if the stock price one year later (at expiry) is (0) S70 (ii) $100 (iii) $130 Note: Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable." QUESTION 13 "Currently British pound (GBPUSD) trades at $1.29. The pound continuously compounding interest rates are at 1.00%, 1.20%, and 1.35% at 1-year, 3-year, and 5-year maturities, respectively. (a) Compute the forward price of pound (round to 2 decimals) at (0) 1-year maturity (ii) 3-year maturity (iii) 5-year maturity (b) If your portfolio contains long 2000 contracts on pound 1-year forward with a delivery price of $1.30, and short 2000 contracts on pound 5-year forward with the delivery price of $1.50, whats the current value (round to integers) of (1) your long position in the 1-year forward (ii) your short position in the 5-year forward and (iii) your total portfolio (c) Suppose you decide to hold your above portfolio for one year. One-year later, the pound price goes up to $1.40. The dollar interest rate curve remains flat at 5%, and the pound interest rate curve also becomes flat at 1%. What will be the value (round to integers) of your long position (ii) your short position and (iii) your total portfolio then. Note: Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable. Keep two decimalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started