Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer all the question Thanks. Question 2 Sata Ltd is a shoe manufacturer who has an operating profit of $25 per pair on selling

Please Answer all the question Thanks.

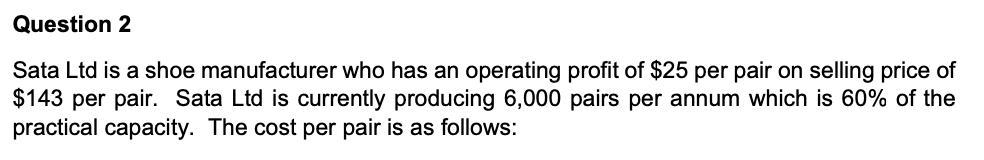

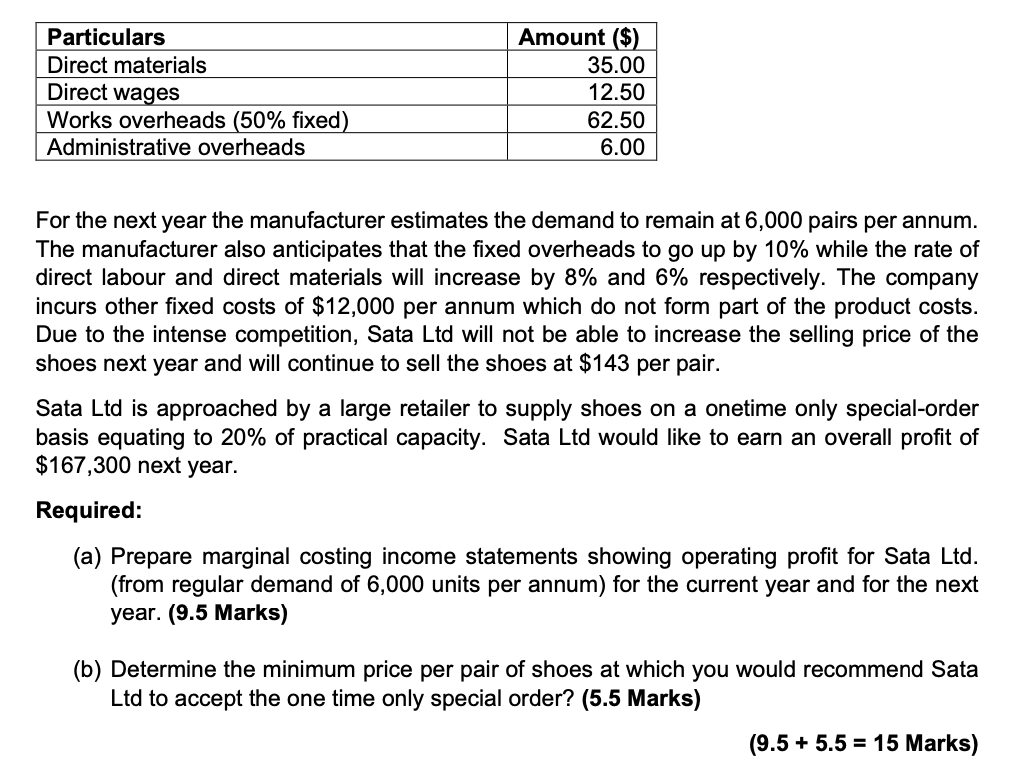

Question 2 Sata Ltd is a shoe manufacturer who has an operating profit of $25 per pair on selling price of $143 per pair. Sata Ltd is currently producing 6,000 pairs per annum which is 60% of the practical capacity. The cost per pair is as follows: Particulars Direct materials Direct wages Works overheads (50% fixed) Administrative overheads Amount ($) 35.00 12.50 62.50 6.00 For the next year the manufacturer estimates the demand to remain at 6,000 pairs per annum. The manufacturer also anticipates that the fixed overheads to go up by 10% while the rate of direct labour and direct materials will increase by 8% and 6% respectively. The company incurs other fixed costs of $12,000 per annum which do not form part of the product costs. Due to the intense competition, Sata Ltd will not be able to increase the selling price of the shoes next year and will continue to sell the shoes at $143 per pair. Sata Ltd is approached by a large retailer to supply shoes on a onetime only special-order basis equating to 20% of practical capacity. Sata Ltd would like to earn an overall profit of $167,300 next year. Required: (a) Prepare marginal costing income statements showing operating profit for Sata Ltd. (from regular demand of 6,000 units per annum) for the current year and for the next year. (9.5 Marks) (b) Determine the minimum price per pair of shoes at which you would recommend Sata Ltd to accept the one time only special order? (5.5 Marks) (9.5 +5.5 = 15 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started