Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the question. Thanks! QUESTION - 4 (20 + 5 = 25 marks) Wesfarmers Ltd Consolidated statements of operations For the year ended

Please answer all the question. Thanks!

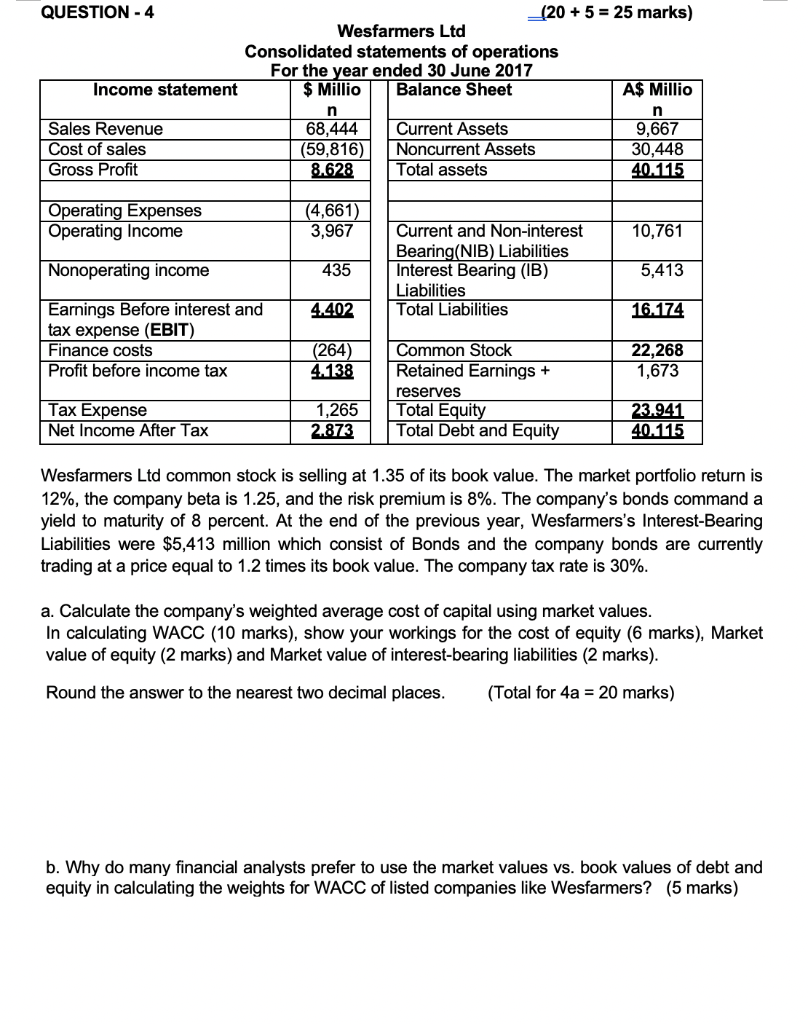

QUESTION - 4 (20 + 5 = 25 marks) Wesfarmers Ltd Consolidated statements of operations For the year ended 30 June 2017 Income statement $ Millio Balance Sheet A$ Millio n n Sales Revenue 68,444 Current Assets 9,667 Cost of sales (59,816) Noncurrent Assets 30,448 Gross Profit 8.628 Total assets 40.115 Operating Expenses Operating Income (4,661) 3,967 10,761 Nonoperating income 435 Current and Non-interest Bearing(NIB) Liabilities Interest Bearing (IB) Liabilities Total Liabilities 5,413 4.402 16.174 Earnings Before interest and tax expense (EBIT) Finance costs Profit before income tax (264) 4.138 22,268 1,673 Common Stock Retained Earnings + reserves Total Equity Total Debt and Equity Tax Expense Net Income After Tax 1,265 2.873 23.941 40.115 Wesfarmers Ltd common stock is selling at 1.35 of its book value. The market portfolio return is 12%, the company beta is 1.25, and the risk premium is 8%. The company's bonds command a yield to maturity of 8 percent. At the end of the previous year, Wesfarmers's Interest-Bearing Liabilities were $5,413 million which consist of Bonds and the company bonds are currently trading at a price equal to 1.2 times its book value. The company tax rate is 30%. a. Calculate the company's weighted average cost of capital using market values. In calculating WACC (10 marks), show your workings for the cost of equity (6 marks), Market value of equity (2 marks) and Market value of interest-bearing liabilities (2 marks). Round the answer to the nearest two decimal places. (Total for 4a = 20 marks) b. Why do many financial analysts prefer to use the market values vs. book values of debt and equity in calculating the weights for WACC of listed companies like WesfarmersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started