Answered step by step

Verified Expert Solution

Question

1 Approved Answer

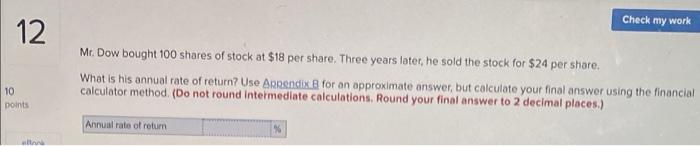

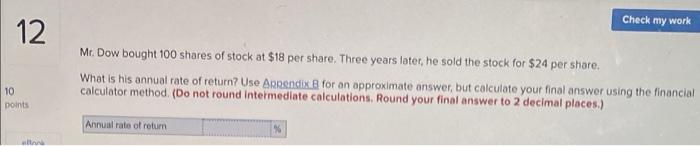

please answer all the questions 12 10 points allank Check my work Mr. Dow bought 100 shares of stock at $18 per share. Three years

please answer all the questions

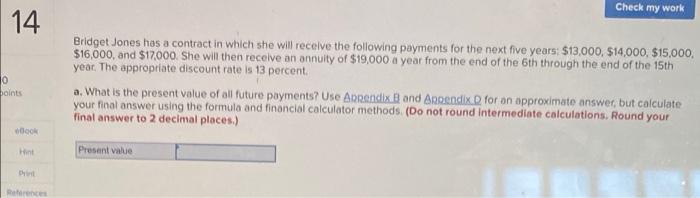

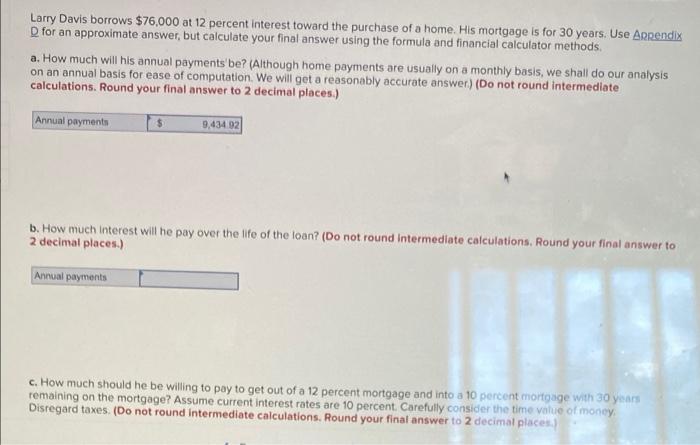

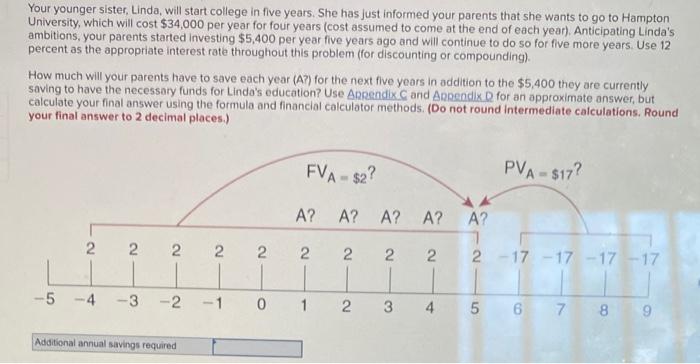

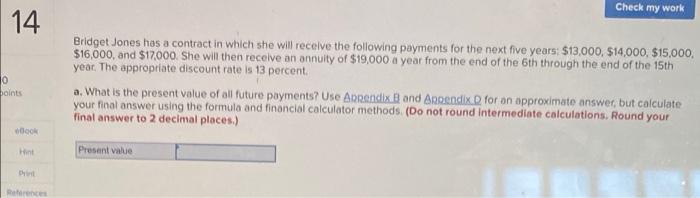

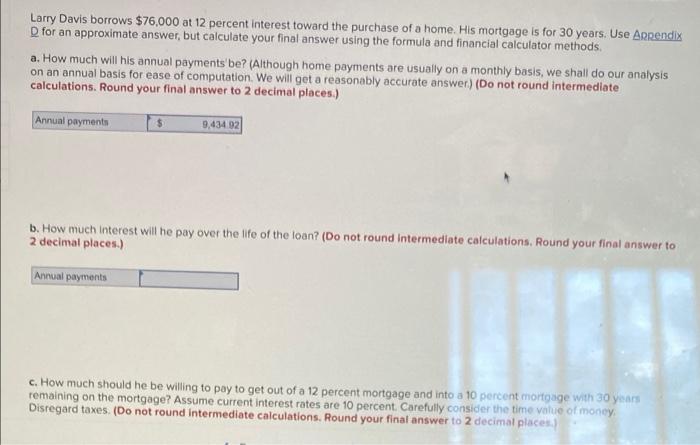

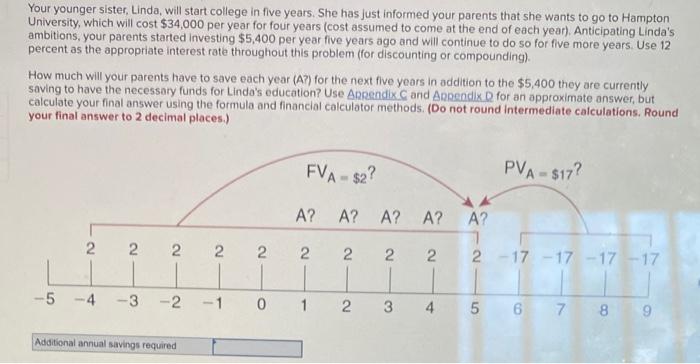

12 10 points allank Check my work Mr. Dow bought 100 shares of stock at $18 per share. Three years later, he sold the stock for $24 per share. What is his annual rate of return? Use Appendix B for an approximate answer, but calculate your final answer using the financial calculator method. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual rate of return Check my work Bridget Jones has a contract in which she will receive the following payments for the next five years: $13,000, $14,000, $15,000, $16,000, and $17,000. She will then receive an annuity of $19,000 a year from the end of the 6th through the end of the 15th year. The appropriate discount rate is 13 percent. a. What is the present value of all future payments? Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) eBook Present value Hint Print References 14 0 points Larry Davis borrows $76,000 at 12 percent interest toward the purchase of a home. His mortgage is for 30 years. Use Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. How much will his annual payments' be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual payments $ 9,434 92 b. How much interest will he pay over the life of the loan? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Annual payments c. How much should he be willing to pay to get out of a 12 percent mortgage and into a 10 percent mortgage with 30 years remaining on the mortgage? Assume current interest rates are 10 percent. Carefully consider the time value of money. Disregard taxes. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Your younger sister, Linda, will start college in five years. She has just informed your parents that she wants to go to Hampton University, which will cost $34,000 per year for four years (cost assumed to come at the end of each year). Anticipating Linda's ambitions, your parents started investing $5,400 per year five years ago and will continue to do so for five more years. Use 12 percent as the appropriate interest rate throughout this problem (for discounting or compounding). How much will your parents have to save each year (A?) for the next five years in addition to the $5,400 they are currently saving to have the necessary funds for Linda's education? Use Appendix C and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) FVA - $2? PVA-$17? A? A? A? A? A? 7 2 2 2 2 2 2 2 2 2 2-17-17-17-17 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 Additional annual savings required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started